ATFX is an online forex and CFD broker founded in 2014 that has a global presence and supports customers in over 16 different languages. The company has its main offices in London and Limassol, Cyprus, although it also has offshore offices in Kingstown, St. Vincent, the Grenadines and Mauritius.

They use a no-dealing-desk (NDD) straight-through-processing (STP) model.

What can you trade?

Forex

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Good | 1:30 | Low |

When it comes to forex trading, they offer access to only 42 currency pairs, which is less than the majority of other platforms. They still provide you with the ability to trade all of the major pairs but offer a limited selection of minor and exotic currency pairs on their platform.

For U.K. residents the company offers zero-commission trading with competitive dealing spreads. Spreads are variable depending on quotes from the company’s liquidity suppliers

In regards to leverage, the FCA and EMSA only allow brokers in the U.K. and E.U. to offer up to 30:1 leverage for retail clients in their jurisdictions. If you trade through its offshore entities in St. Vincent and the Grenadines or Mauritius, however, then they can offer an increased maximum leverage of 200:1 for major and minor currency pairs, while the maximum amount of leverage for exotic currency pairs is 50:1.

The minimum lot size you can use when trading FX products is 0.01, and the maximum lot size is 20 lots.

The company also supports MetaTrader 4 (MT4), which is a popular trading platform among retail traders.

There is one unusual practice that the broker takes a one-minute trading break each day around midnight (GMT+2 or GMT+3 during Daylight Savings Time). While the impact of this may be minimal for the U.K. or European based day traders, it may not suit those who typically hold positions for the long-term or trade the Asia session. It could also impact trading robots overnight as they may fail to enter or exit positions at that time.

CFD

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Good | 1:30 | Low |

ATFX offers a limited selection of assets for CFD trading, some of which include 15 indices and more than 50 individual stocks.

In terms of its client coverage, they aim its CFD trading services at retail traders who use or are interested in using the MT4 platform.

The company provides a market analysis section on its website that offers educational seminars and investment research via reports that cover forex, precious metals, commodities and indices.

They also provide an economic calendar and free quarterly market outlook containing longer-term analysis that covers all of the markets ATFX offers.

The company also lets you trade CFDs using a third party or your automated trading software via MT4.

Social Trading

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Mid | 1:30 | High |

Social trading at the company is only available via their collaboration with the MT4 trading software and community. Once logged in to the MT4 platform, you will need to register for your social trading account by clicking on the ‘auto trading’ button.

You can then click on the signals tab in the toolbox window positioned at the bottom of the platform’s display to choose trading signals that you wish to follow.

Cryptocurrency

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £4 | Many | 1:2 | Mid |

The platform offers CFDs on several of the most popular cryptocurrencies. Some of the crypto assets you can currently trade at ATFX are:

- Bitcoin (BTC), with a minimum 40 pip spread.

- Ethereum (ETH), which has a minimum six pip spread

- Litecoin (LTC), with a five pip minimum spread

- Ripple (XRP), which has a minimum 0.05 pip spread

Although the selection is minimal, the spreads are quite good in relation to other cryptocurrency brokers. Their margin rate on cryptocurrency trades is 50%, which implies a 2:1 leverage ratio.

Spread Betting

| Min Deposit | App Support | Max Leverage | Trading Fees |

| £100 | Mid | 1:30 | Low |

Spread betting is tax-free for traders in the U.K. and Irelands and allows you to speculate on financial markets using margin. Furthermore, spreads for ATFX spread-betting accounts are generally competitive and start at 0.6 pips.

Traders are also given negative balance protection when trading on a spread-betting account. While hedging is allowed using the spread betting account, scalping is not permitted.

What did our traders think after reviewing the key criteria?

Fees

The company offers a decent range of trading account types that should suit most traders. Furthermore, all ATFX UK account types conform to FCA regulations, let traders enjoy free deposits and withdrawals, and allow access to their online trading course.

Only the professional account type does not qualify for negative balance protection, and all the accounts currently supported allow you to deal in sizes as small as 0.01 of a lot.

In addition to a free demo account, which uses virtual money so you can practice trading and test strategies, you can choose from the following list of account types:

- Micro Account: This account requires a $/€/£100 minimum deposit and has a minimum spread of 1 pip with no commission per trade. Leverage is as high as 30:1 for the U.K. and European accounts. The account has a maximum total deposit limit of $/€/£1,000.

- Standard Account: It requires a $/€/£500 minimum deposit and has a minimum spread of 1 pip with no commission per trade. Leverage is again as high as 30:1 for U.K. and E.U. accounts.

- Edge Account: Requires a $/€/£5,000 minimum deposit and has a minimum spread of 0.6 pips with no commission. Leverage is as high as 30:1 for U.K. and E.U. accounts.

- Premium Account: Requires a $/€/£10,000 minimum deposit and features raw spreads with a minimum of 0 pips and a $25 commission per side. Leverage is as high as 30:1 for U.K. and E.U. accounts.

- Professional Account: Requires a $/€/£5,000 minimum deposit and has a minimum spread of 0.01 pips with no commission. Leverage is as high as 400:1 for FCA regulated accounts. Traders must provide evidence to meet ESMA requirements for elective professionals.

The company does not offer an Islamic account.

Account Types

Offers a decent range of trading account types that should suit most traders. Furthermore, all ATFX UK account types conform to FCA regulations, let traders enjoy free deposits and withdrawals, and allow access to their online trading course.

Only the Professional account type does not qualify for negative balance protection, and all of the accounts currently supported allow you to deal in sizes as small as 0.01 of a lot.

In addition to a free demo account funded with virtual money that you can use to practice trading and test strategies, you can choose among the following list of live account types:

- Micro Account: Requires a $/€/£100 minimum deposit and has a minimum spread of 1 pip with no commission. Leverage is as high as 30:1 for FCA regulated accounts. Has a maximum total deposit limit of $/€/£1,000.

- Standard Account: Requires a $/€/£500 minimum deposit and has a minimum spread of 1 pip with no commission. Leverage is as high as 30:1 for FCA regulated accounts.

- Edge Account: Requires a $/€/£5,000 minimum deposit and has a minimum spread of 0.6 pips with no commission. Leverage is as high as 30:1 for FCA regulated accounts.

- Premium Account: Requires a $/€/£10,000 minimum deposit and features raw spreads with a minimum of 0 pips with a $25 commission per side. Leverage is as high as 30:1 for FCA regulated accounts.

- Professional Account: Requires a $/€/£5,000 minimum deposit and has a minimum spread of 0.01 pips with no commission. Leverage is as high as 400:1 for FCA regulated accounts. Traders must provide evidence to meet ESMA requirements for Elective Professionals.

Broker does not offer an Islamic account without overnight swaps, and that common account option was not listed among the available account types on the broker’s website when this review was written.

Platforms

The company supports the free MetaTrader 4 (MT4) trading platform developed by MetaQuotes. While MT4 remains the market standard for retail traders, the lack of selection is a disadvantage compared to the trading platform choices on offer with other brokers.

The straightforward yet sophisticated MT4 platform has a desktop, mobile and web-based application.

Usability

The website is simple and very easy to use, so you should have no trouble navigating it and finding the information you need.

A tab menu at the top of the page illustrates how the website is organised. It provides these options: About ATFX, Trading, Market Analysis, I.B. Partnership, Promotions, and Contact Us. These tabs provide a good sense of the organisation of the site, and their associated pull-down menus provide more detailed navigation information.

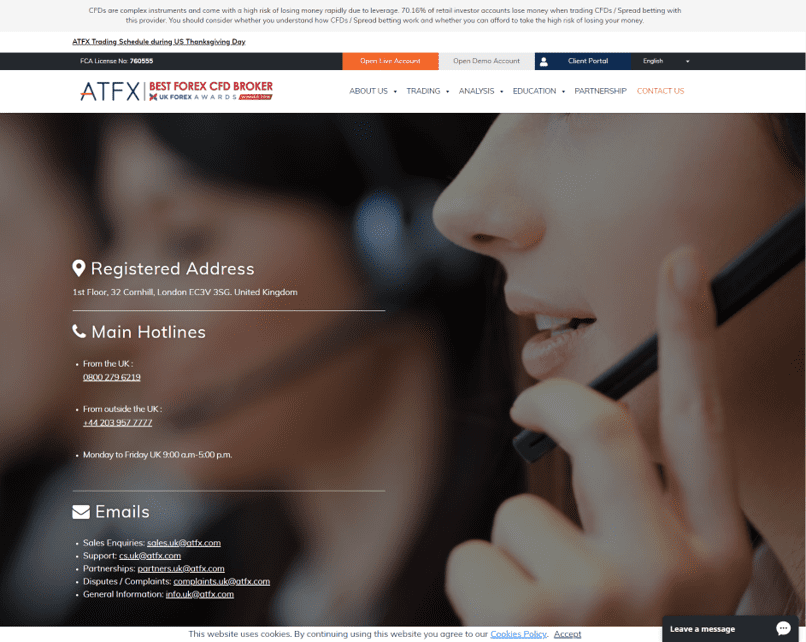

Customer Support

The company has received awards for its customer service that is focused on its 24/5 Live Chat service, although local phone numbers and email support are also available. The company’s website has a decent FAQ section to look up commonly-required information.

Although their website does not always use the correct English, it is generally understandable and has been translated into at least 16 languages.

Payment methods

ATFX is a global company that lets clients make deposits and withdrawals via several popular payment channels. These include the following:

- Credit and debit card payments: Card transactions are processed quickly, and you should see your deposit reflected in your account within 30 minutes.

- Bank wire transfers: You can send a wire transfer from any bank without transaction limits. Banks usually charge for such transactions, and processing a wire transfer can take two to five business days. The broker will then credit your account within one day of them receiving the funds from your bank.

- E-wallet payments: They support Neteller and Skrill, as well as SafeCharge that lets you use over 180 global and regional electronic payment methods, including PayPal.

There are no fees attached to deposits in pounds sterling, U.S. dollars and euros.

Non-UK traders will need to be aware that they may be charged a small fee for debit and credit card deposits.

As with most platforms, the company pays withdrawals into the same account from which they made the initial deposit.

Best offers

The company currently runs two promotions as follows:

- Welcome credit: They offer a $100 welcome credit that provides you with an additional $100 to your initial deposit when you open a live account. You will need to make a minimum deposit of $200 within 14 days of registration and trade six lots within the promotional period. At that point, you can withdraw your $100 welcome credit.

- Rebate Promotion: It rewards traders who participate in this promotion and trade during its active period to gain cashback. The offer has five levels that depend on the net amount deposited, which determines what cashback rebate you can access. Cash rewards start at $1/lot up to $100 total for a deposit up to $1,000. The top of the range is $5/lot up to $2,500 for a deposit above $10,000.

Also, the company offers expert market analysis and trade ideas. They make an online trading course available to all live account holders and provide an economic calendar on its website.

The company has several active social media accounts for both its global and U.K. regional offices. Its Facebook page presently has over 47,000 followers, and its U.K. YouTube channel has over 22,000 views.

Regulation and Deposit Protection

Their offices based in London and Cyprus are well regulated by the FCA and CySEC respectively. Those offices currently need to operate under the Markets in Financial Instruments Directive II, and so they must ensure that funds are segregated. Companies that adhere to those regulations must also restrict leverage ratios to 30:1 among clients who trade through their U.K. and E.U. offices.

Furthermore, U.K. traders are protected against broker defaults in amounts up to £85,000 per person under the Financial Services Compensation Scheme (FSCS), while accounts of E.U. traders are only protected up to €20,000 by Cyprus’ Investor Compensation Fund (ICF).

The company also maintains offices in offshore locations in Mauritius and St Vincent and the Grenadines. These entities are not as well regulated, although you can access higher leverage ratios when trading through them.

When it comes to data security, ATFX makes sure your data is secure with SSL encryption. They are obligated to protect customer data following GDPR and EDPA guidelines, so they cannot disclose client information to third parties and need to guard against data breaches adequately.

Awards

As they started in 2014, they have won relatively few awards to date despite receiving typically favourable reviews. Most notably, the company’s website currently highlights that it won the Best Forex CFD Broker award at the U.K. Forex Awards in 2018.

Additional awards ATFX has received to date include the Best Forex Customer Services award for 2017 at The Entrepreneur JFEX Awards in Jordan, and the Online Personal Wealth Awards prize for the “Best No-Dealing Desk Broker” in 2018.