When choosing a broker, one of the most important factors to consider is whether it is regulated. If you open an account with a broker that operates under license from the Dubai Financial Services Authority (DFSA), you’re heading in the right direction for safer trading. A harsh reality experienced by all too many traders is that the sector, unfortunately, attracts scams and scammers. One of the most common risks is wiring funds to a broker that promises incredible returns but doesn’t even return your funds.

Making a paper profit and not being able to claw back your funds is a painful experience, which is where regulators such as the DFSA step in. The DFSA is the independent regulator of financial services conducted in or from the Dubai International Financial Centre (DIFC). Its mandate covers asset management, securities, collective investment funds, banking, trust and custody services, Islamic finance, commodities futures trading, an international equities exchange and an international commodities derivatives exchange. Founded in 2004, it has built a reputation as being an internationally-recognised regulator, overseeing the financial markets to ensure business is carried out in a strong and fair manner.

#1FXTM

What We Liked:

What We Liked:

- Leverage of up to 1:2000 available to traders

- Swap-free / Islamic trading accounts

- Competitive pricing — spreads starting from 0 pips and no commissions on selected ECN accounts.

- $10 minimum opening balance (Cent account).

- Multilingual customer support available 24/5 via phone, email, and Live Chat

- Three high-quality and easy to use trading platforms available

- Professional grade trade execution

- Winner of the World Finance, Best Trading Experience award, 2020.

- Low admin costs

- Lots of additional extras, including Trading Signals and FXTM Pivot Point Strategy

FXTM offers an extremely popular trading platform that is packed full of neat and innovative features specifically designed to make trading easy. Thanks to this approach, the broker continues to pick up industry awards and new clients.

It gives its users everything they need to trade, but it’s laid out in a easy to access way, which makes the platform ideal for beginners. A lot of the features are unique to FXTM and visiting the platform to try out its service is highly recommended.

Source: FXTM

Some of the upgrades such as the Cent Account appear no-brainers and raises the question why other brokers don’t offer them as well. With a low minimum deposit of $10, the Cent Account allows traders to take the step up from trading in a demo account and into live trading without the risk of burning through their entire cash pile.

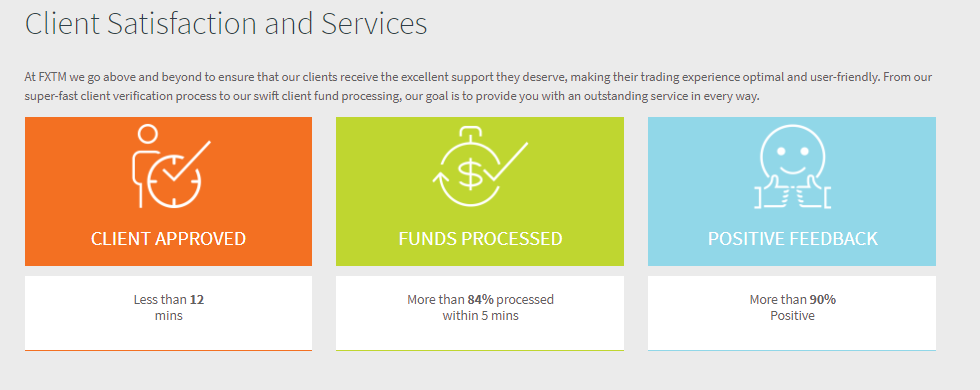

The firm is also one of the best in the sector in terms of the information it provides clients about the operational efficiency of the site. Transparent reporting is a sign of a confident broker and one that is aware that it is doing a good job of supporting its clients.

Broker Fees

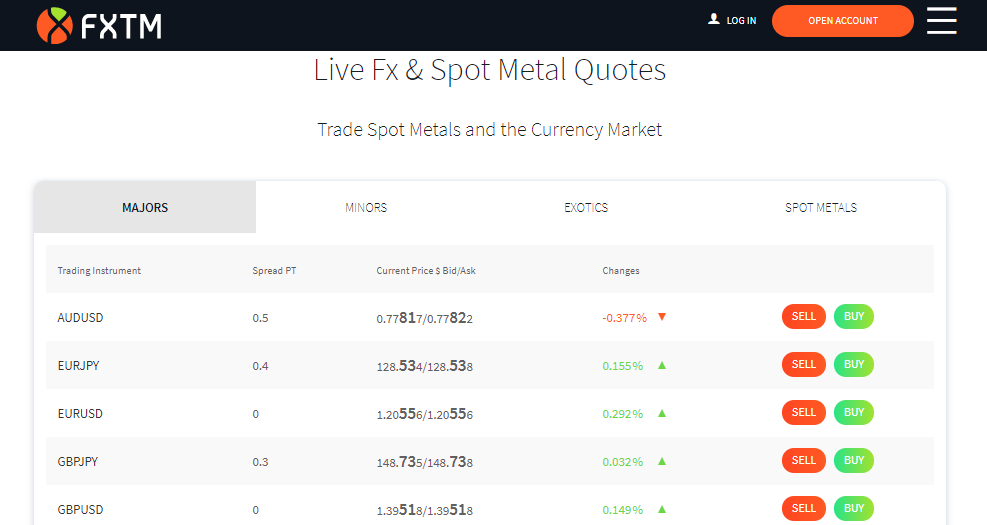

FXTM offers three types of account types, Standard, Stock CFDs and Cent, so that clients can find a best fit. The T&Cs vary across the accounts, but all are very competitive.

- EURUSD as low as 0.1pips

- EURUSDStandard spread: 1.9 pips

- EURUSD Average RAW spread: Standard spread 0.6 pips

- GBPUSD Average RAW spread: Standard spread 0.5 pips

- Commissions USD: $2

Source: FXTM

Trading Limit

Leverage terms are flexible and can even be adjusted on a trade-by-trade basis. FXTM clients that open accounts are covered by the Mauritius regulator FSC and can access leverage up to 1:300.

- FXTM provides access to a range of asset groups: 120 currency pairs + 36 commodities + 58 indices + 7 cryptocurrencies + 77 ETFs and 4 bonds.

- The minimum initial deposit requirement at FXTM is $10 for the Cent account and $100 for the Standard, Stock and FXTM copy trading accounts.

- Maximum number of orders: 100.

Source: FXTM

Features

- A trusted broker with a refreshing approach to innovation.

- The Cent account is a great introduction level account with a $10 minimum balance requirement.

#2Pepperstone

What We Liked

What We Liked

- Offers access to the global markets.

- Forex specialist that also supports markets in crypto, indices and commodities.

- Great demo account, which is free to use and doesn’t expire.

- No hidden costs, no deposit fee, no withdrawal fee, no inactivity fee.

- Well-designed trading architecture ensures low-cost and super-fast trade execution.

- A range of online learning materials presented in webinars and video format.

- Ideal for beginners and intermediate and advanced traders.

- Islamic accounts.

- Award-winning customer service.

Pepperstone Financial Services (DIFC) Limited is authorised and regulated by DFSA.

DFSA Reference Number: F004356.

Address: Unit PL-CT-00-15-OF-2A, Level 15, Currency Tower 2, DIFC, PO 482087, Dubai, UAE

#3AvaTrade

What We Liked

What We Liked

- A global broker with a reputation for integrity and fairness.

- Good for novices but powerful enough for intermediate-level and professional traders.

- Operating since 2006, but still has an appetite to continue innovating to improve client services.

- Islamic account, which is Shariah-compliant.

- High-quality multi-lingual customer service available 24/5.

- Free demo account.

- MetaTrader MT4 and MT5, but also offers the proprietary platforms, AvaTradeGo, AvaSocial and, AvaOptions.

- Competitive spreads and leverage.

- More than 1,250 markets. You can trade indices, commodities, shares, forex, cryptocurrency, bonds, vanilla options, and exchange-traded funds (ETFs).

- A 4.8 / 5.0 rating on Trustpilot.

- Great mobile app — ideal for those trading on the go.

- Winner of the Best Forex Trading App award at the 2020 Global Forex Awards.

AvaTrade is one of the best-regulated brokers in the market and operates globally under license from Tier-1 authorities, including FRSA (Abu Dhabi), FSCA (South Africa), the FSA in Japan and the Central Bank of Ireland.

The firm gained full regulatory approval and Financial Services Permission Number 190018 on 6th February 2020. This means it is authorised to arrange deals in investments and for dealing in investments as principal.

Its headquarters are at 2424, 24th Floor, Al Sila Tower, Abu Dhabi Global Market Square, Al Maryah Island, Abu Dhabi, United Arab Emirates.

#4HYCM

What We Liked

What We Liked

- Ideal for beginners.

- A trusted broker that has been operating since 1977.

- 24/5 customer support and a dedicated account manager.

- Islamic Accounts that are Shariah-compliant.

- Great variety of accounts to choose from. Fixed or variable spreads — you decide.

- Competitive pricing and no trading commissions on the Fixed and Classic accounts.

- Trade orientated research materials such as the ‘Week Ahead’ webinar.

- Market-leading trading platforms with up to 51 trade indicators.

- Trade forex, stocks, indices and commodities.

HYCM is the trading name of Henyep Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Limited and Henyep Capital Markets (DIFC) Limited. The Henyep Capital Markets group is the holding company and its assets are a controlling equity interest in them.

Henyep Capital Markets (DIFC) Limited is regulated and authorised by the Dubai Financial Services Authority. Licence number 000048.

#5Swissquote

What We Liked

What We Liked

- Offers access to the international financial markets.

- Accounts supported in up to 22 different currencies.

- Supports trading and investing in the same account.

- 5,000 ETF markets and Mutual funds included in the offering.

- Smart Portfolios are an automated low-cost investing solution.

- Islamic accounts.

- No entry or exit fees.

- No minimum investment on stocks and ETFs.

- Low fund administration fees.

- Simple, transparent T&Cs.

- Multi-lingual customer support.

- Free high-quality independent research to help you find trading opportunities.

Swissquote MEA Ltd. is regulated by DFSA with DFSA Reference Number: F001438.

Address: Office No 3, Level 9, Currency House Building, Tower 2, DIFC, PO Box 121364, Dubai, UAE

#6IG

What We Liked

What We Liked

- Multi-asset broker offering more than 13,000 markets. Forex, crypto, shares, indices, commodities bonds, options and ETFs.

- Market-leading proprietary trading platform and option to use MT4 if you prefer.

- Research and analysis materials hard to beat in terms of quality and quantity.

- Islamic accounts.

- Great charting tools.

- Great mobile app with Reuters news flow included.

- Free demo account.

- Multi-lingual Customer support is available 24/7.

IG Limited is regulated by the DFSA with DFSA Reference Number: F001780.

Address: Units 2 & 3, Level 27, Al Fattan Currency House, Tower 2, DIFC, PO Box 506968, Dubai, UAE.

#7FxPro

What We Liked

What We Liked

- Founded in 2006, FxPro offers a range of global markets.

- A global broker offering MetaTrader, cTrader and proprietary (FxPro Edge) platforms.

- User-friendly website ideal for beginners.

- Free demo account.

- Ultra-fast execution with most orders filled <11ms.

- Trade forex, commodities, futures, metals, energies, shares and indices.

- Supports clients in more than 170 countries across the world.

- Islamic account.

- The winner of more than 80 industry awards.

- Great tools for those who want to get into automated trading.

FxPro Global Markets MENA Limited is regulated by DFSA with DFSA Reference Number: F003333.

Address: Unit 1010, Level 10, Index Tower, DIFC, PO Box 507126, Dubai, UAE

#8Amana Capital

What We Liked

What We Liked

- CFD and crypto trading on MT4 and MT5 platforms.

- Trading signals and training webinars to develop your skills.

- Spreads as low as 0.1 pips.

- 24/5 customer support.

- Free demo account.

- Founded 10 years ago.

- More than 360 markets to choose from.

- White label and affiliate schemes for those looking for non-trading income streams

- Islamic accounts.

Amanah Capital LLP is regulated by the DFSA with DFSA Reference Number: F003269.

Address: Office 10, Level 5, Building 3, DIFC Precinct, DIFC, PO Box 15, Dubai, UAE.

#9Axi

What We Liked

What We Liked

- Minimum opening deposit of less than $10.

- Multi-lingual customer service.

- Islamic accounts.

- Pro and Standard accounts to cater for newbies and the more experienced.

- Free demo account.

- ECN grade trade execution.

- Multiple payment options available and super-easy withdrawal processes.

- Educational courses available in 24 languages.

- Video tutorials on demand.

- Most Trusted Broker — UK Forex Awards 2018.

- Best Forex Broker Middle East — Forex-awards.com 2019.

- Best MT4 Forex Broker — atozmarkets.com, 2019.

AxiCorp Financial Services Pty Ltd is regulated by DFSA with DFSA Reference Number: F003742.

Address: Office 105, Level 1, Tower 2, Al Fattan Currency House, DIFC, PO Box 507299, Dubai, UAE.