The need for wallets comes down to the fact that cryptos such as Bitcoin are revolutionising the financial markets. Wallets are part of their technological DNA and getting on board with the new processes means some things have to be done slightly differently.

The crypto frameworks operate using blockchain technology, which means all the participants in the Bitcoin market have accounts in the same (Bitcoin) computer system. Your wallet is part of that system and what you use to receive and send coins. The size of each individual’s Bitcoin holding will be shared publicly and, that way, all members of the system can see where they stand. This cuts down on the risk of anyone scamming the system and claiming they own more than they do.

What Types of Bitcoin Wallet Are There?

- Desktop BTC Wallets

- Mobile BTC Wallets

- Hardware BTC wallets

- Paper BTC wallet

- Bitcoin Exchange (Web-Based Wallet)

Desktop BTC Wallets

Desktop Bitcoin wallets are stand-alone devices that store your Bitcoin, which you hook up to an internet-connected device when you want to trade coins.

In technical terms, a desktop wallet is an address from which you can send and receive Bitcoins. They are protected by the fact that the owner holds details of the private key that is used to access it. Having the option of disconnecting your desktop wallet from the internet and keeping them in ‘cold storage’ minimises the risk that your device can be hacked into.

How Secure Are Desktop Wallets for BTC?

Safety rating: 9/10

In an ideal world, storing BTC on your desktop shouldn’t be an issue, but there are factors to consider that mean it is not an ideal way to store coins, particularly in large size.

For starters, you need to be completely sure that the software you download is legitimate. There is also a slim chance your wallet could become corrupted or malfunction. Backup protocols can provide some protection against you losing track of your account if this happens, but some other wallet types avoid this risk completely.

Different desktop wallet software packages offer varying degrees of security add-ons. Look for one that includes two-factor verification and multi-signature protocols.

Typical Cost of Use:

- One-time payment: Variable. Some software providers offer the service for free. Others charge.

- On-going costs: normal exchange costs apply and you may be locked in to using the exchange that sold you the hardware device.

Security should be your priority, and to a large extent, you get what you pay for. There are some providers of desktop wallets such as Armory that offer safety checks and don’t charge a fee. Another popular choice is Electrum, which charges a fee of 0.2mBTC for sending Bitcoins.

Main Advantage

- Using your own device to store Bitcoin is a logical first step as you have complete control over your wallet. It taps into the intuitive sentiment that, as you own your device and have it physically near to you, your trading will be secure.

Main Disadvantage

- Holding Bitcoin in a desktop wallet means that, most of the time, you are standing on the sidelines of the Bitcoin blockchain framework. The limited access, or lack of Full Node coverage, means you don’t have access to all the information all of the time.

At the same time, you will still have to occasionally access the online BTC market to buy and send coins to your desktop wallet. Some desktop wallets are, by default, hooked up to a particular exchange, which might not be your preferred choice.

Mobile BTC Wallets

Those balancing day-to-day commitments with trading the crypto markets will be drawn to the convenience of mobile bitcoin wallets. It’s possible to set up your wallet and buy or send Bitcoin using a range of mobile trading wallets that are compatible with Android and iOS operating systems.

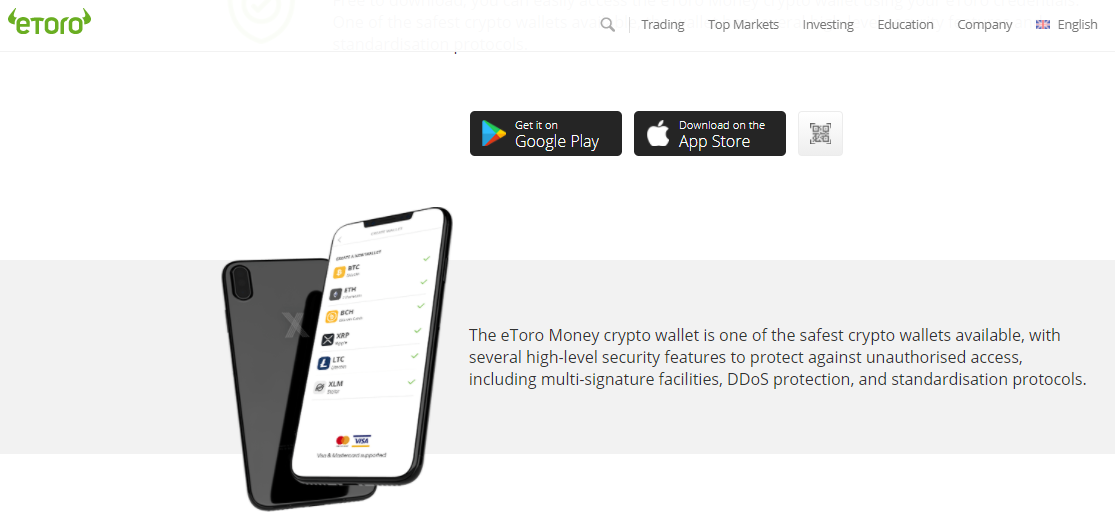

As phones don’t have the processing power of desktop machines, using a mobile device involves using your phone to access an account on a crypto platform, such as eToro, which is regarded as one of the best Android wallets.

Source: eToro

How Secure Are Mobile BTC Wallets?

Security rating: 8/10

When it comes to mobile BTC wallets, coins are not stored on your actual phone. This gets around the risk of your handset being lost or stolen. If you make the right choice, you can take advantage of the apps that offer mobile wallets, which are packed full of security features.

The eToro Money crypto wallet, for example, comes with DDoS protection, multi-signature functionality and other default security protocols.

Typical Cost of Use?

- One-off costs: It’s possible to find trusted providers that provide the service for free.

- On-going costs: Mobile wallet providers will outline their specific pricing terms. There can be blockchain fees associated with the service and these will be independent of the mobile wallet provider.

Main Advantage

- Ease of use. Not only are they easy to access, but they also come packed full of user-friendly functionality. The eToro Money mobile wallet supports more than 120 cryptocurrencies and also allows you to convert more than 500 crypto pairs to other assets. It has an unlosable private key in case you need to recover your account and provides users with a completely private on-chain address.

Main Disadvantage

- Small mobile devices are easy to lose. It’s important to ensure you make full use of available security features to protect your account in the event you misplace your handset.

Hardware BTC wallets

Source: 123RF.com

A hardware wallet is a bitcoin wallet that stores your private keys in a secure hardware device. They’re relatively new entrants into the sector but relatively secure because they can hold your coins off the main Bitcoin network in ‘cold storage’.

There is, of course, a trade-off associated with keeping your coins offline – while hardware wallets keep track of your holding and transactions, they cannot confirm if you have received coins. That requires connecting to a web interface, usually that of the manufacturer of the device.

Setting one up is as simple as downloading a wallet from a trusted provider. All the information relating to your Bitcoin holdings will be stored on the hard drive of your (Windows, Mac, Linux) machine with any transactions reported to the Bitcoin system when you access the internet to trade.

If you select a service provider that does provide Full Node coverage, then keeping track will take up a lot of space on your hard drive and take up a lot of internet bandwidth as well.

How Secure Are Hardware BTC Wallets?

Security rating: 9/10

To date, there have been no known incidents of Bitcoin being stolen from hardware wallets. Nothing is bullet-proof and there are still a range of risks and protocols to follow to minimise them.

The risks could include a malware attack where authentic recipient codes are switched by an attacker, but multi-factor verification can be used to address this threat. There is also the risk that the device is corrupted or compromised during the production or installation processes.

Typical Cost of Use?

- One-time payment: entry-level devices from £50

- On-going costs: normal exchange costs apply and you may be locked in to using the exchange that sold you the hardware device.

Main Advantage

- Holding BTC in cold storage limits the number of portals hackers can use to access your account. They're popular with BTC investors who adopt a buy-and-hold style strategy and don't want to frequently trade in and out of positions.

Main Disadvantage

- As with desktop wallets, the main disadvantage is that the hardware malfunctions or, possibly, more likely, your device is stolen or lost. Software engineer James Howells famously put his hardware drive in the rubbish and has since spent years trying to persuade his local council to allow him to search for the wallet, which is estimated to now have a value in excess of $375m.

Paper BTC wallet

Source: 123RF.com

As the name suggests, paper bitcoin wallets involve keeping track of your holding using a slip of paper. This approach, which was popular during the infancy of the crypto revolution, is now far less widely used due to the many potential downsides associated with it.

How Secure Are Paper Wallets for Desktop?

Safety rating: 3/10

Paper wallets involve storing your private key and bitcoin address in physical form, most usually a printout. Security can become an issue right from the first stage of the process with users sometimes complaining the print out containing the important information was unclear or faded over time. At the same time, printers can be equipped with internal memory storage, meaning someone who can access your printer can check the log and obtain the vital information.

Paper wallets also promote address reuse, which impacts the reliability of the BTC protocols. Exporting the paper wallet contents to an online wallet is not a smooth process either, as a subsequent part-sale of your holding can mean it’s hard to reconcile your updated holding.

More bad news is that most paper wallets are generated by browser-based wallets, which have their own security issues meaning paper wallets offer the worst of both worlds.

Typical Cost of Use?

- One-off costs: Low. Just paper and printer ink.

- On-going costs: No costs associated with storage but standard transaction costs apply when you visit an exchange to sell.

Main Advantage

- There are few advantages associated with paper wallets.

Main Disadvantage

- Paper wallets are particularly weak in terms of security and ease of use.

They might, at first glance, appear to involve a tried-and-tested approach, but paper wallets miss out on the advantages associated with embracing the hi-tech approach taken by wallet providers such as Prime XBT and Cryptology.

Source: Prime XBT

Bitcoin Exchange (Web-Based Wallet)

Source: 123RF.com

Using an exchange opens up the opportunity to develop your Bitcoin holding into a multiple cryptocurrency crypto wallet. Choosing an exchange should still prioritise security, but long as you use a safe exchange, the potential for accessing different crypto markets is almost endless.

How Secure Are Bitcoin Exchanges?

Safety rating: 9/10

Bitcoin exchanges are not regulated by financial regulators or governments and, for the main part, don’t provide enough insurance or security to be used for the storage of currency in the same way as a bank. You ultimately have to place a lot of faith in exchanges perceiving the reputational risk of them transgressing to be too high and damaging to their business model.

You also have to hand over the private keys to your wallet, so are trusting a third party with your holding. Even if they are not a scam, you are relying on their security systems being strong enough to repel hackers from penetrating their systems.

Typical Cost of Use?

- One-off costs: Medium. Depositing funds in an online account can incur charges. Bitcoin exchanges are more cost-effective for frequent traders rather than buy-and-hold investors.

- On-going costs: Transaction costs can be charged as a flat fee, $3 approx. Or as a percentage commission 1.49% of value, approx. With exchanges often charging the fee which is the greater of the two.

Main Advantage

- The process of onboarding with a BTC exchange is quite straightforward and once on, it offers 24/7 access to the markets. Most exchanges also offer a variety of crypto markets.

Main Disadvantage

- It’s hard to get away from the fact that exchanges are unregulated. They also tend to have pricing terms skewed in favour of more active traders.

It is possible to buy Bitcoin outright using a regulated broker such as eToro.

Best Bitcoin Wallet in the UK

- Ledger Nano X — The best overall

- Primexbt — The most secure wallet

- Stormgain — Cheapest secure wallet for larger amounts

- eToro Money — Best mobile wallet

- Cryotology — The best for a variety of cryptocurrencies

- Bitpanda — The best exchange for keeping BTC

Ledger Nano X — The Best Overall

Crowdsourcing information is always a good idea and the new Ledger Nano X desktop wallet consistently ranks highly in industry and user reviews.

Security

9.5 / 10

Price

£109

Advantages

- Second generation desktop wallet builds on the success of predecessor, Ledger Nano S.

- Tried-and-tested French manufacturer.

- Use Bluetooth to connect to your smartphone or tablet.

Disadvantages

- The Bluetooth functionality is a big plus point, but user testing suggests it could be improved upon in terms of connection quality.

- Price.

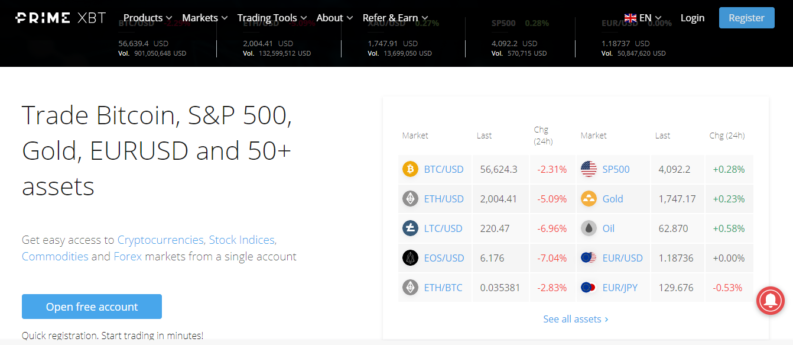

Prime XBT — The most secure wallet

Security

9.5 / 10

Price

No charge

Advantages

- 24/7 support.

- Regulated by FSA in Seychelles.

- A strong foothold in the market ensures competitive pricing.

- Trade on leverage.

Disadvantages

- Trading on leverage can lead to financing charges.

Stormgain — Cheapest secure wallet for larger amounts

Security

9 / 10

Price

Zero deposit fees

Advantages

- Great security features including private keys being held by the account holder, not the exchange.

- Buy Bitcoin using credit and debit cards.

- Based in London and a member of the Blockchain Association.

Disadvantages

- Crypto holdings can’t be converted back into fiat currency.

eToro Money — Best mobile wallet

Security

9 / 10

Price

Free to download

Advantages

- Backed by a platform with millions of users.

- User-friendly functionality.

- Packed full of innovative security features.

Disadvantages

- The app is not available on desktop devices.

- Relatively limited number of cryptocurrencies to choose from.

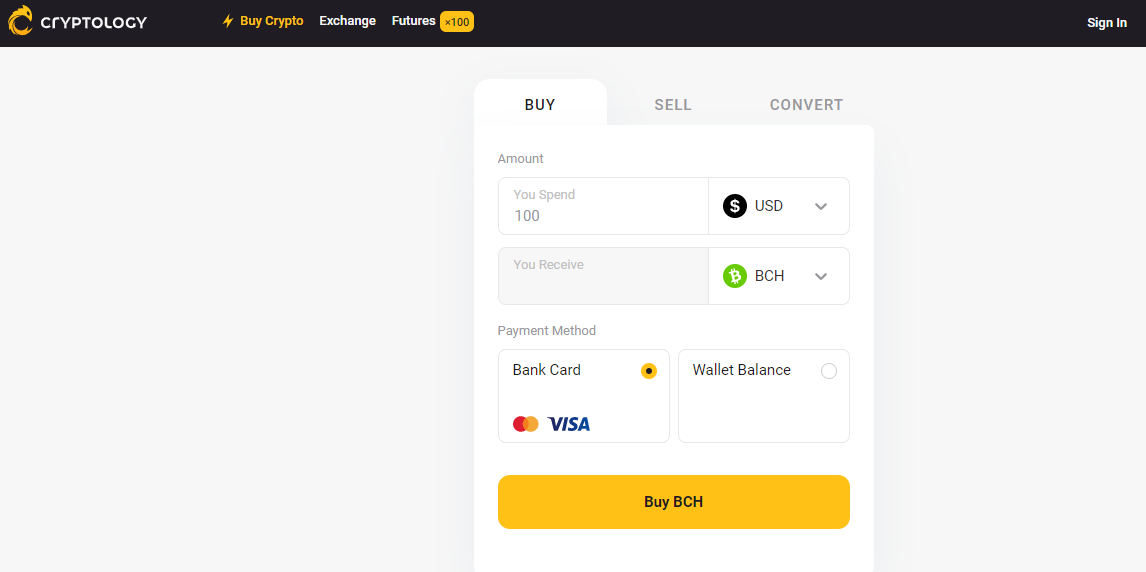

Cryptology — the best for a variety of cryptocurrencies

Security

8.5 / 10

Price

Free to download

Advantages

- The exchange covers all the major markets, but in addition, allows you to buy coins or trade crypto futures.

- Ideal for beginners.

- Great trading dashboard to support more active trading profiles.

Disadvantages

- Slow response times from customer service.

- Reports from users of account verification problems.

Bitpanda — the best exchange for keeping BTC

Security

9 / 10

Price

Deposits using bank transfer are free of charge but using other processing agents can incur charges.

Advantages

- Europe-based and a major player in the market.

- A wide variety of payment options, not just credit and debit card.

Disadvantages

- Customer service responds to each individual query and this can sometimes delay response times.

How to Buy Bitcoin

Bitcoin has come a long way in a short time and is now bought and sold in a very similar manner to other assets such as stocks, forex and commodities. The core principle of the transaction involves exchanging fiat currency for Bitcoin, and the different wallets are just the means of supporting that process.

Conclusion

A wallet is essentially a software-based means of storing your Bitcoin. At a granular level, it’s very much like any other online bank account, which only you have access to. Personal information such as your name isn’t shared publicly, but the wallet does report to the blockchain network what your holding is.

There are a variety of types of wallet and each one has its relative pros and cons. Which one you choose ultimately comes down to personal preference and which type best suits your way of doing things.

If curiosity is the driver of you wanting to ‘buy a little bit of Bitcoin’, then the operational risks of the different wallets may not be too great a consideration. If you’re looking to scale up to have one of the biggest Bitcoin wallets in town, then giving the subject some thought would be advised.