AvaTrade is a globally-regulated broker that allows traders to trade over 250 instruments including Forex, cryptocurrencies, commodities, stock indices and more.

YOUR CAPITAL IS AT RISK.

In this guide, we’ll be taking a look at some of the AvaTrade fees you need to be aware of and how to avoid any unexpected charges.

The fees in AvaTrade is categorised to 2 types which are,

- Trading Fees : deposit fees , transaction fees , spread cost , currency conversion fees and overnight funding fees

- Non-Trading Fees : withdrawal fees and Inactivity fees

Before we get started, take a look at our other AvaTrade guides:

- Check how you can qualify for AvaTrade bonuses

- Find out how to open an AvaTrade demo account

- Find out more about AvaTrade's minimum deposit

If you’re ready, let’s get started otherwise head over to our expert AvaTrade review for a comprehensive look at this broker.

Table of contents

AvaTrade Fees

To begin with, let's take a look at the all-important fees in AvaTrade involved with trading, including:

- Deposit fees

- Transaction & commission fees

- Spread costs

- Currency conversion fees

- Overnight funding

Deposit Fees

AvaTrade does not charge any deposit fees. However, minimum deposit levels do apply. The minimum deposit for credit cards and e-payment methods is £100 (or similar if your account is in different currency) and £500 for wire/bank transfers.

Transaction & Commission Fees

Like many brokers today, AvaTrade does not charge any commission fees, which means that AvaTrade will not charge you for executing your buy or sell orders. Instead, it is compensated through the market bid/ask spread, i.e. the price difference between where you buy or sell an asset.

Spread Cost

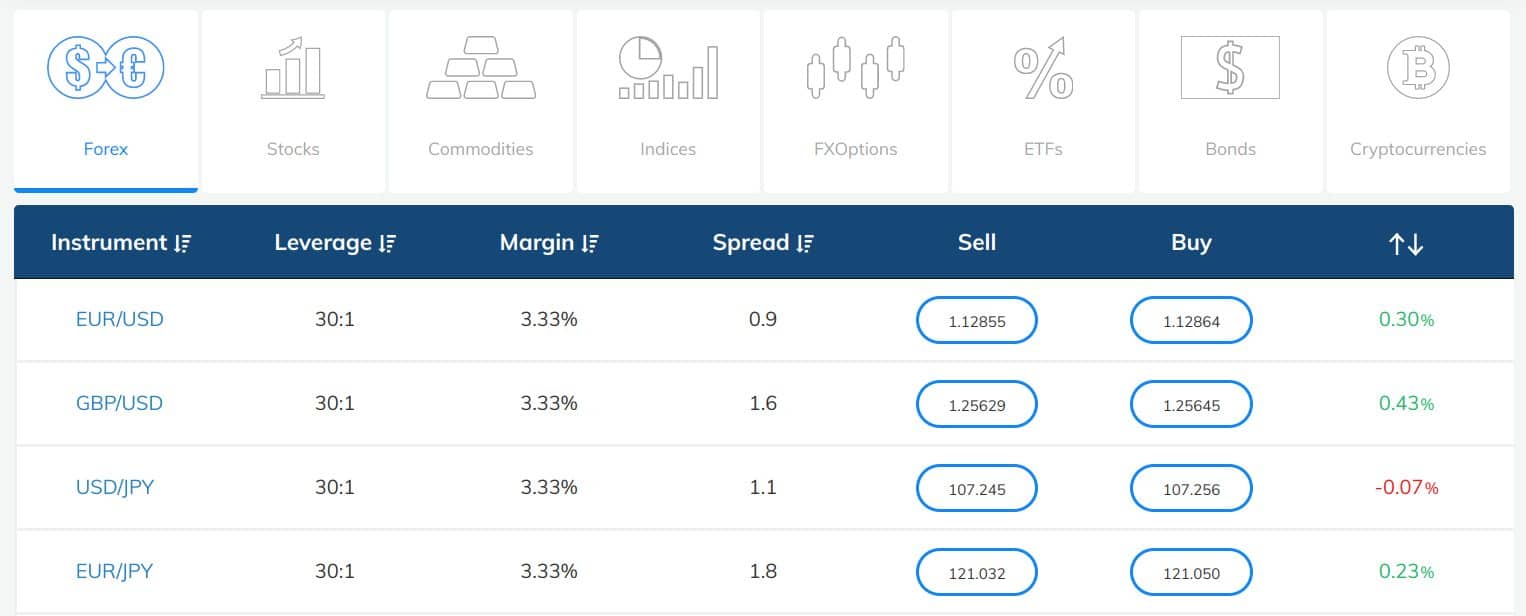

As we've already mentioned, AvaTrade makes its money off the cost of opening and closing a trade reflected in the spread. An example list of average spreads (along with margin and leverage requirements) is provided below:

Unfortunately, this information isn't readily available within the platform itself so you'll need to visit the AvaTrade website for full details.

It's always a good idea to shop around and compare brokers as some brokers will have ‘tighter' spreads than others, meaning more money in your pocket at the close of a trade.

Currency Conversion Fee

Compared with other brokers, AvaTrade doesn't support a large number of base currencies (5 in total). Therefore, your options for having other trading accounts in different base currencies are relatively restricted.

This relative lack of support for other currencies means that you'll be charged a currency conversion fee if you make a deposit that is in a different currency than the one on your account.

AvaTrade states that it is authorised to convert funds in your account at a rate of exchange determined by them on the basis of the then-prevailing money market rates.

Overnight Funding

Also known as an Overnight Premium, an Overnight Fee will be charged on any positions you hold overnight (22:00 GMT). If you hold a position over a weekend, you'll have to pay a 3-day ‘swap' charge that is charged on Wednesdays.

Brokers such as AvaTrade will levy this fee to cover the cost of leverage on open positions. Overnight fees and calculation methods vary by asset. Again, it's information that isn't available within the platform itself.

If you want to work out the overnight interest rate, you'll need to head over to the ‘Trading Info' section on the AvaTrade website for a detailed overview of the calculations.

Transparency around fees and spreads is something to bear in mind when comparing brokers. It's important for you to choose a broker that is open and honest about fees and minimises the friction between trades as much as possible.

Non-Trading Fees

Finally, let's take a quick look at some of the non-trading related fees to be aware of:

- Withdrawal fees

- Inactivity fees

Withdrawal Fees

Like most other brokers, AvaTrade does not charge a withdrawal fee. It's worth noting that your account must be fully verified before you can withdraw any funds. Also, you can only withdraw funds to the original payment method you used to fund your account.

It will take up to 1 business day to process your withdrawal request, plus some additional time to receive payment:

- Credit/Debit Cards (up to 5 business days)

- e-Wallets (up to 24 hours)

- Wire/Bank Transfers (up to 10 business days)

Inactivity Fee

If you don't log into your account for at least three months, AvaTrade will deduct an inactivity fee from your trading account. The currency unit of this fee depends on the currency base of your account:

- £50 (GBP account)

- $50 (USD account)

- €50 (EUR account)

After 12 consecutive months of inactivity, your account will be deducted an administration fee:

- £100 (GBP account)

- $100 (USD account)

- €100 (EUR account)

Low Cost Avatrade Alternatives

eToro: 68% of retail CFD accounts lose money

Take A LookPepperstone: FCA and ASIC regulated

Take A LookAdmirals (Admiral Markets): Impressive range of assets

Take A LookPlus500 | CFD provider: 79% of retail investor accounts lose money when trading CFDs with this provider

Take A LookIf you are looking for a reliable broker with low fees and fair conditions then this is who we recommend. All have been reviewed by our team and have been found to offer a low cost way to trade.

Conclusion

As traders, it is important to find out the fees and charges of the brokers before you start trading with them. The main chargeable fees that you need to be aware of while using AvaTrade are the deposit fees, transaction and commission fees, spread cost, currency conversion and overnight funding fee.

Additionally, AvaTrade charges withdrawal and inactivity fees for accounts that are inactive for at least three months.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here are our latest trending stories

- Compare the best CFD trading platforms

- Learn how to withdraw from AvaTrade