What Is Comparable Transaction Analysis?

Comparable transaction analysis is a way of analysing a company that is being considered for a merger or acquisition. The main objective of this analysis method is to look at similar or comparable m&a transactions.

Think of it as similar to someone purchasing a new laptop. Firstly the buyer has to analyse the computer they want to buy with others alike.

How To Do Comparable Transaction Analysis

Similar to Comparable Company Analysis, Comparable Transaction Analysis means finding previous transactions that are comparable for our company to conduct the analysis.

As an amateur investor, it is difficult to know where to start looking. This often takes a lot of time.

Professional investors use various sources to get a good list of comparable deals. Sources for Investors could be:

- Public Tender and Merger Proxy Statements: A document filed when a company conducts an acquisition. They often have to file a public report where they discuss the background of that specific deal. These documents generally include previous deals the acquirer has looked into. A Schedule TO and Schedule 14D-9 is filed in connection with the tender offer.

- 8-K: An 8-K must be filled by a public company when a significant event happens. Acquisition or disposals or anything of the likes is often considered material events, and subsequently, 8-K are filled. They include transaction details.

- SDC Database: Security Data Corporation database is probably the most extensive database which has 30- years of deal information. You can search within the database for industries, companies and timeframes.

- Bloomberg, Capital IQ or Factset: These are additional databases that all have historical transactions.

- Research Notes: If by chance, you have access to research reports within an industry, the reports for companies/industries normally include details on previous deals.

- Google Search: Surprisingly, an excellent method to find information about deals and subsequent multiples is through Google. Usually, when a deal gets announced, the deal value gets announced.

In the end, this is a long process that can result in no exact numbers. As always, the best approach is to start at the SEC website as this an official regulator website where companies have to file documentation.

Comparable Company Analysis vs Comparable Transaction Analysis

Comparable Transaction Analysis has plenty of similarities with Comparable Company Analysis. However, there are also differences.

- Timing: It is important to note when the transaction occurred in comparable transaction analysis. For example, transactions that were a long time ago may not be relevant for analysing our company in today's market.

- Size: If the two deal sizes are far apart in valuation, they may not be a viable comparison.

- Capital Structure: If capital structure characteristics differ from our target company, then we will put less weighting to that deal when conducting our analysis.

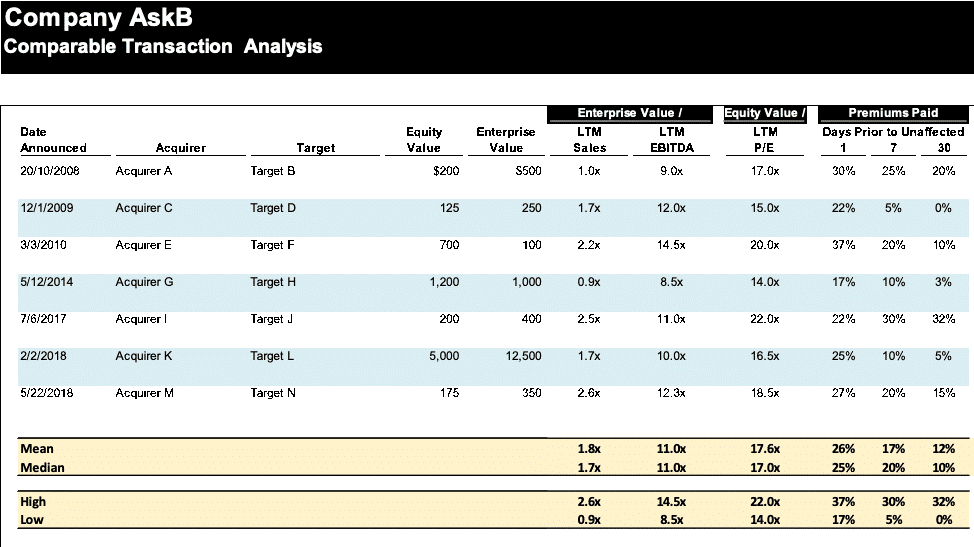

- Looking at Previous Transactions: Comparable transactions don’t look at what listed companies are trading at, it looks at what previous transactions have been conducted at. These include Enterprise Value / Sales, Enterprise Value / EBITDA and P/E.

If you look at various deal announcements, almost always the acquirer pays a premium relative to where the share price was previously trading before the announcement.

As a yardstick, this premium tends to be around 30% above where the stock was trading. Sometimes it could be even higher if the target company is in a super “hot” sector.

Just like Comparable Company Analysis, there are several steps to go through to conduct a Deal Comp.

Comparable Transaction Analysis Example

So, let's take a look at an example of comparable transaction analysis.

The comparable transaction analysis example looks relatively similar to Comparable Company Analysis.

For our example, with AskB, we are going to use all the comps to get a better understanding.

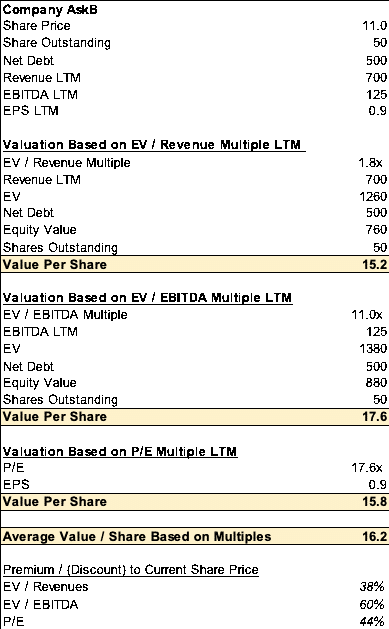

In this example, AskB is currently trading at $11/share. Using the mean of the various previous acquisition multiples gives us a suitable parameter for what AskB could be worth in a take-over. Here the average gives $16.2 a share (almost 50% premium).

One thing this analysis shows is that the premium is higher if one uses EBITDA multiple instead of either Sales or P/E multiple.

We can assess what part of its cycle AskB is at and what multiple would be the most relevant one. We previously went through when to use various multiples in our Comparable Company Analysis article. The same analysis and logic apply to Comparable Transaction Multiple Analysis.

Advantages & Disadvantages

The positive aspects of a “Deal Comp” are:

- All valuations are based on public information.

- The appraisals are based on what someone actually paid for businesses. This information is useful in giving guidance on what a buyer is willing to pay for targets in general.

- The analysis also provides a good understanding of what multiples are paid for different industries at different market times.

- The analysis gives a good indication of what types of transactions are trending, who are the most frequent buyers and what they are looking for.

- Finally, it provides a sense of overall market demand for different types of assets.

The negative aspects of this valuation methodology are:

- The public information available can be scarce and sometimes misleading.

- Previous transactions might have happened in a different market environment which taints the valuation.

- Also, past transactions may not be a good comparison as there might be deal dynamics that don’t apply to the current situation.

- Finally, variables such as potential synergies, intangibles (such as patents), or other situational factors might taint the transaction multiples as a comparable.

Conclusion

Comparable Transaction Analysis serves its best purpose in situations where there is an active m&a market in the space one for the company being analysed.

Again, just like our DCF analysis and Comparable Company Analysis , the valuation approach here is as much art as it is science.

Different industries focus on different multiples and result in different premiums paid. The comparable transaction might not be perfect, and the output results depend on the companies we compare.

The Comparable Transaction Analysis valuation method should be used with other valuation methods to get an excellent holistic assessment of a company.

People Also Read:

- IG Trading Platform: The Way Forward for Traders?

- Admiral Markets Review

- Pepperstone Broker Review