Interactive Investor offers a range of ways to gain exposure to the financial markets. The service ranges from self-managed pensions through to straightforward trading. The firm has grown significantly since being founded in 1995 and now supports more than 300,000 clients.

Its pedigree as a solid and reliable investment platform is blended with a fee structure that is at first at least appealing due to its transparent nature. Compared to some (of the more expensive) platforms in the sector, its fees can at first glance look in-line with its peer group.

Scratch the surface though and you begin to see a different story. There are other brokers now offering a like-for-like service with improved trading terms. This has brought to light the very real risk that Interactive Investor clients could be unnecessarily over-paying for the service they receive.

This review looks at the structure and competitiveness of Interactive Investor fees. There are enough risks associated with investing to make it worthwhile, ensuring you’re not giving away money that you don’t need to.

To establish whether Interactive Investor gets the balance right, this review will look at:

- How and why do brokers charge fees

- Transparency — How to understand broker fees

- Interactive Investor — Trade execution fees

- Interactive Investor — Financing fees

- Interactive Investor — Administration fees

- The Bottom Line

How and why do brokers charge fees

With so many brokers now in operation, the approach to fees covers a broad spectrum.

At one end are low-cost providers, which offer little more than tight trading spreads. These are great in terms of access to the markets, but are not likely to tick the boxes of investors looking for nice add-ons like research, investment ideas and top-quality trading platforms.

Being regulated costs money. Completing reports and monitoring compliance helps protect clients but takes considerable effort. The list of client support features, which are nice to have, includes professional customer support, research libraries and risk management tools.

A further risk associated with ‘price-only’ brokers is that the headline rate can tempt some to forget to check if the broker is safe.

The worst-case scenario is that an unscrupulous broker offers terms that are just too good to be true and turns out to be unregulated. This puts your entire cash pile at risk.

For many, it’s a case of finding the middle ground — understanding that well-run brokers need to make money, but ensuring the profits they make are not at your expense.

Transparency — How to understand broker fees

One very important aspect of broker fee schedules is how transparent they are.

It can be a very simple measure of where a broker positions itself in the market. The trend is that firms that feel they have an advantage willingly share price information. After all, it’s to their advantage if clients can easily access information on the T&Cs.

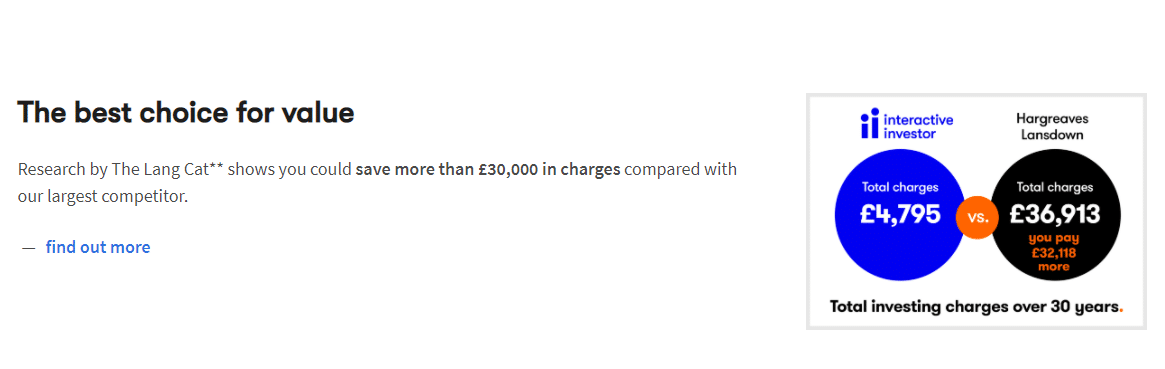

Interactive Investor scores quite well in this category. It applies a flat fee pricing policy across its products and is able to run thought-provoking price comparisons with their major competitors such as Hargreaves Lansdown.

It’s to its credit that Interactive Investor provides a clear and detailed breakdown of fees.

The major issue is that while the fees may compare well to Hargreaves Lansdown, they don’t to other brokers in the sector.

In truth, Hargreaves Lansdown is an easy target in terms of price comparisons. A batch of second-generation disruptor firms, which have entered the space, now offer a comparable service and are far more competitive on price.

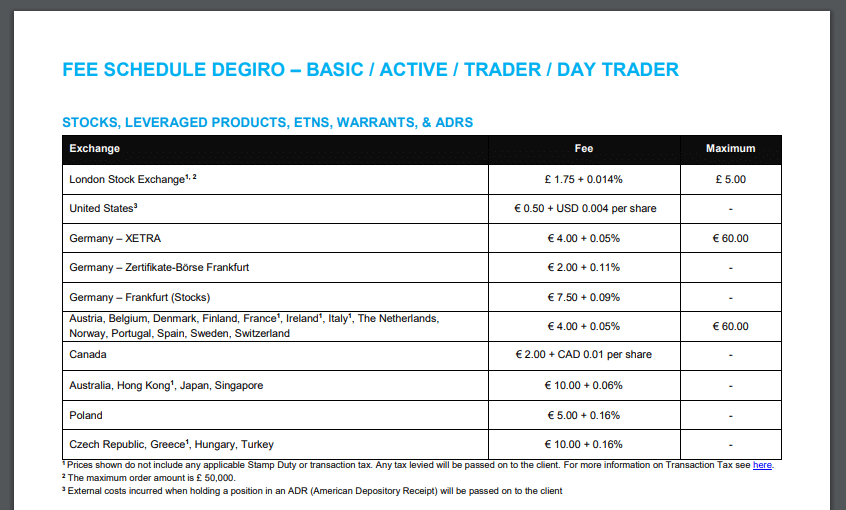

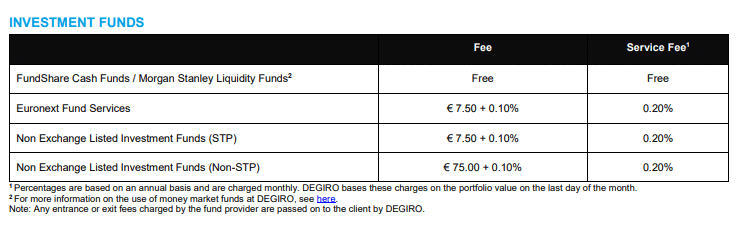

The broker, Degiro, also offers a very transparent pricing schedule, its UK fees can be found on one easy to read document. The difference is that by taking advantage of being a newer entrant, this means its structure includes operating efficiencies and cost savings, which is then passed on to its clients.

The Interactive Investor flat-fee charge starts at £9.99 per month and includes one free trade. This is easy enough to understand, but hard to justify when compared to Degiro’s ‘Maximum £5.00 fee’ for trading stocks on the LSE.

The transparency at Degiro carries over to its Investment Funds products. Its FundShare product charges no fees or service fees. It’s very hard for more traditional platforms like Interactive Investors to compete on price with something that is free.

The clarity on fees provided by both brokers helps traders during their break-even analysis and strategy development. They also point to the need to shop around and make sure trading profits aren’t unnecessarily eaten away by frictional costs.

Interactive Investor — Trade execution fees

Trade execution fees are the headline price point in the industry. These come under close scrutiny as they are the fees charged to buy or sell a particular instrument such as an equity.

The comparison with Degiro points to Interactive Investor offering transparent but far from spectacular pricing. In terms of trade execution fees, that trend continues.

It is possible to trade a very high number of markets at Interactive Investor. There are more than 40,000 UK and global stocks to choose from, across 17 different stock exchanges.

If you’re looking to trade an obscure market, then it may be for you. In more mainstream markets, its execution commissions are some way off the pace.

The broker IG offers its clients in excess of 16,000 markets to trade, trades in US equities are commission-free. Plus500 offers its millions of clients the choice of over 1,000 different stocks from a wide range of global markets and also offers zero commissions on execution.

Interactive Investor financing fees

Post-trade reporting at brokers requires they provide portfolio reports, pricing updates and comply with a range of regulatory reporting requirements.

Brokers, therefore, also charge fees for the ongoing holding of any positions you might trade.

These charges are often overlooked. Part of the reason for this is they are typically charged according to the number of days you hold the position. As this number might not be known at the time of the trade, it’s easier to focus on the up-front execution costs that are crystalised at the time.

Running a comparison of Interactive Investors fees to other brokers reveals this can be a costly mistake.

It costs £9.99 per month to hold an Interactive Investor account and this is a big number. It looks even bigger when you consider that another broker, eToro, offers zero commissions on some equity trades and also applies no charges for holding that position with them.

eToro is regulated by tier-1 authorities and has a track record that has encouraged millions of traders to make it their first-choice broker. eToro makes its money on the difference between bid-offer spread, or buy and sell prices, in markets it offers.

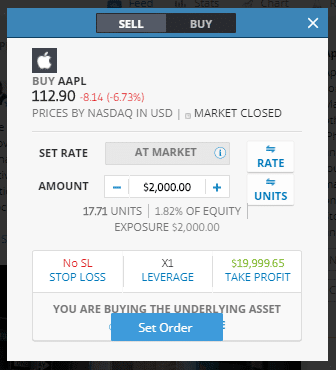

This makes the eToro pricing very easy to analyse. It also begins to look very appealing when you consider trades such as the below purchase of $2,000 of Apple Inc stock incurs zero financing fees and no monthly admin fees.

Interactive Investor administration fees

Account administration fees can be a considerable drag on trading performance. This makes Interactive Investor’s £9.99 per month fee, just to hold an account, hard to look past.

This represents a drag on your trading returns, particularly if you only have a small amount to invest. In comparison, the eToro account can be opened with a cash deposit as low as $200, meaning trading in small size is much more cost-effective there.

There are also extra costs to factor in at Interactive Investors. If you require services such as share certificates or paper statements, you can expect to pay more on top of the base rate fee of £9.99.

Nearly all of the new-wave of online brokers have abandoned charging monthly management fees, but one thing to keep an eye out for is inactivity fees. These are applied to encourage good account management by investors — even dormant accounts have to be properly managed by a broker.

Inactivity fees can, of course, be avoided. One approach is to put trades on to satisfy the specific T&Cs. Another option is using one of the brokers that doesn’t charge them.

- IG does apply an inactivity fee and it is $12 per month after two years of inactivity

- eToro does apply an inactivity fee and it is $10 per month after one-year inactivity

- Pepperstone does not charge any account keeping or inactivity fees.

The bottom line

There is an important difference between a broker that is ‘cheap’ and one that offers ‘value’.

When choosing a broker, do remain wary of the overly ‘cheap’ ones and consider the security of funds. Factor in regulatory licenses and other features such as the quality of client support.

Interactive Investor scores highly in terms of being a well-regulated and established broker, but its fees are some way off those of many of its competitors. Firms such as IG, Pepperstone, eToro, Plus500 and Degiro are also well-regulated, they just manage to offer better terms.

‘Market Risk’ is one thing. It’s an unavoidable part of trading.

Fee management, however, is a risk-free way to improve your trading bottom line.

This means it is important to consider the pricing terms of brokers. Unfortunately for Interactive Investor, a lot of such reviews would place them quite a long way down the list of preferred brokers.