The first step involves clients completing a questionnaire, which establishes their investment objectives. Then Wealthify and Nutmeg match that profile to investment strategies that use algorithmic trading models to enter into trades in the market. Given the growing popularity of the two platforms, it’s worth digging into the detail to find out which one is best for you. This article will compare Nutmeg Vs Wealthify, exploring:

- What are Nutmeg and Wealthify?

- Nutmeg and Wealthify – Getting started

- Nutmeg vs Wealthify – Pricing

- Nutmeg vs Wealthify – Products

- Nutmeg vs Wealthify – Performance

- Are Nutmeg and Wealthify safe?

- Final thoughts

What are Nutmeg and Wealthify?

Nutmeg started out in 2011 and Wealthify in 2014. Their online investment platforms use algorithmic programs to monitor prices and try to buy into the market at the right time. The instruments they take positions in are ETFs (Exchange Traded Funds), which are baskets of asset groups that trade in real-time.

Source: Nutmeg

The ‘secret sauce’ of both firms is the use of cutting-edge technology to make investment decisions. Returns on capital are obviously a priority, but another selling point for both platforms is that, by using computers to trade, they benefit from cost savings, which can be passed on to clients in the shape of lower fees.

Being tech-orientated, the user interfaces of each platform are particularly user-friendly and have a fresh and attractive aesthetic.

Systematic trading has been around for decades. The fact that the process allows computers, rather than humans, to take control of other people’s money meant that uptake was at first gradual.

Institutional investors such as pension funds and family offices have made significant returns from investments in systematic funds. Those investors had the knowledge and manpower to carry out due diligence on the tech-based investment managers. As computer-based trading has become more of the ‘norm’ the approach is becoming more readily available to retail investors.

Both providers are regulated by the FCA (Financial Conduct Authority) and offer similar products, which are pitched towards those looking for medium and long-term returns.

Wealthify vs Nutmeg – Getting Started

Onboarding

In line with regulatory requirements, both platforms ask potential new customers to complete a questionnaire and supply proof of ID. The questions are the first part of the process of the firm building a better picture of your aim. They also help them meet their KYC (Know Your Client) protocols, which are part of their regulatory duty of care.

Source: Nutmeg

Questions range from ‘expected retirement age’ to ‘size of investment’ and if you’ll be making ‘regular payments. The format and exact questions asked differ from firm to firm.

At Wealthify, there is a magic number at the end of the process when the site generates a projected value for your investment. This is only an estimate, but is a useful part of the process allowing you to revisit your risk return settings.

Onboarding should take less than 10 minutes to complete. The intention is that new users are matched up to products that suit them.

One important note, and a positive feature of the Wealthify service, is that it takes a professional approach to the situation and reserves the right to turn down applications. If it thinks an applicant ought not invest in the markets, for example due to excessive personal debt, it makes that point known.

Minimum Account Balance

The minimum initial investment at Wealthify is £1. This is one of the lowest entry levels in the sector.

Nutmeg also does a good job of supporting those with smaller balances. The minimum requirement to open an account there can be as little as £100 or £500 depending on the product.

Some other robo-advisor platforms require new clients to make initial deposits of several thousand pounds.

Nutmeg vs Wealthify – Pricing

The good news is that Nutmeg and Wealthify both provide simple and transparent pricing schedules. There is fierce price competition in the sector and this is causing all the participants to offer headline-grabbing terms and conditions.

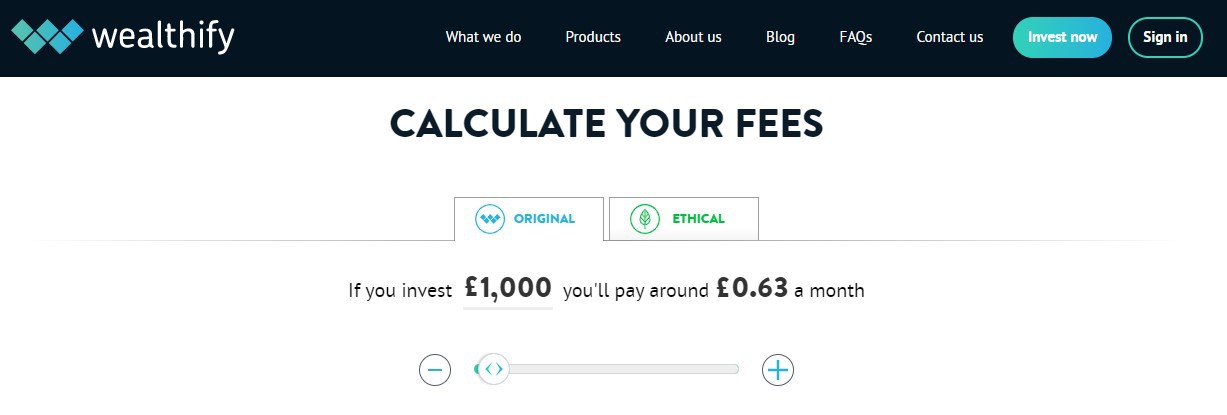

Source: Wealthify

Both firms are focussing on developing market share and appear to have taken on board that potential users want straight-talking as much as they do low-pricing. The devil is in the detail but there is little chance of getting caught out at a later date due to missing something in the small print.

Wealthify has traditionally been seen as the more cost-effective platform. It overhauled its pricing schedule in December of 2019 with the intention of simplifying its tiering. Wealthify now charges 0.6% on all portfolios meaning it offers the cheapest fees in the market on portfolios with less than £20,000 invested.

The downside of applying on standard rate is that those with accounts that are larger in size soon find Nutmeg’s rates might be more appealing. If you have £100,001 or more to invest then the 0.35% fee at Nutmeg represents a considerable saving on Wealthify’s 0.6%.

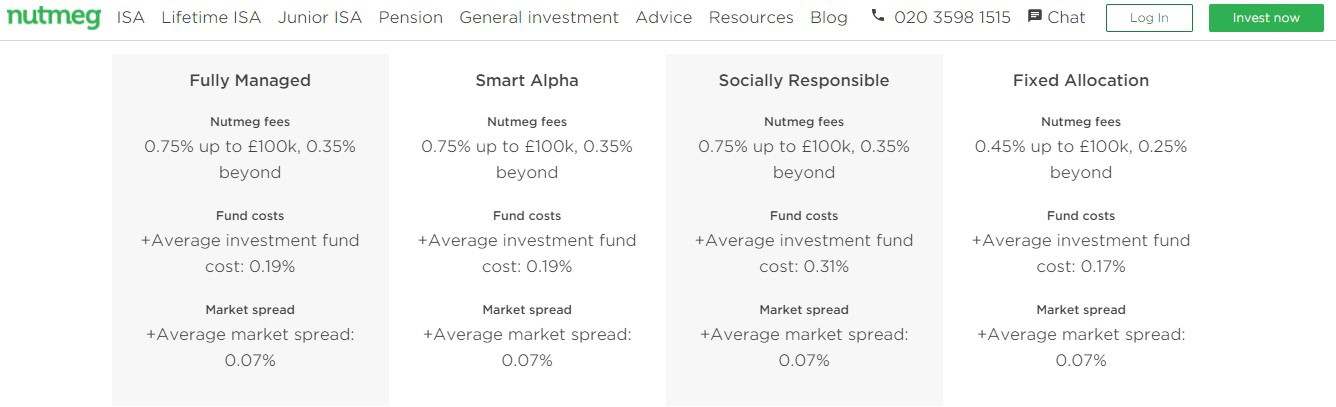

Source: Nutmeg

Both platforms feel their pricing gives them a competitive edge. The decision regarding which one is best for you will largely come down to the amount you are looking to allocate. Credit should be given to both of them for offering clarity on T&Cs, which enable users to make an informed decision.

Promotions

If you are considering investing with either platform, do run a browser search of promotional offers. It’s highly likely that you might find vouchers which give you ‘12-months fee free’.

Nutmeg vs Wealthify – Products

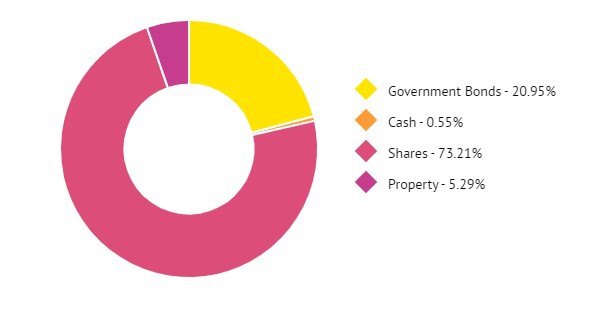

At both firms, your cash will be invested in underlying instruments like ETFs. These exchange-traded funds mean your cash will be spread over a sector rather than placed in one individual firm. There are risk-management benefits associated with this approach, not least the ability to avoid single-stock risk.

Source: Wealthify

Nutmeg and Wealthify both offer a service pitched more towards investing than trading. As a result, they both offer investment products in tax efficient ‘wrappers’.

- ISA

- Pension

- Junior ISA

- General Investment Account

Nutmeg also offers a Lifetime ISA and a range of services relating to wills, life insurance and mortgages.

Nutmeg breaks its investment strategies down into four categories:

- Fully Managed

- Smart Alpha

- Socially Responsible

- Fixed Allocation

Wealthify offers five strategies, each one with a different risk-return rating:

- Cautious

- Tentative

- Confident

- Ambitious

- Adventurous

Source: Wealthify

There is a second layer of decision making, which includes the option to flag your account to do actions like investing ethically. The whole process though is well-designed and particularly user-friendly.

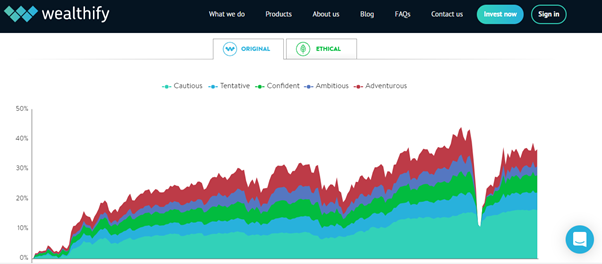

Nutmeg vs Wealthify – Performance

Both platforms try to generate healthy returns for investors and tie that in with low trading costs. It is possible to set your account to follow a higher risk return profile, but the choice is yours. Neither firm has ‘star traders’ so the returns are largely in line with the broader market rather the result of a moment of individual genius.

While it’s hard to run a direct comparison, the returns on their funds do suggest that both Nutmeg and Wealthify deserve to be considered as candidates for managing your investment.

Source: Wealthify

Source: Nutmeg

At each stage of the investment process the emphasis is on long-term returns in line with your personal approach to risk. Neither site overpromises and there is little sense that you’re being sold something too good to be true.

Are Nutmeg and Wealthify safe?

Nutmeg started out in 2011 and Wealthify in 2014. The feeling that they are tech-start-ups extends beyond their vibrant aesthetics and informal approach. The hard reality is that despite their sky-high valuations and increasing client base, neither make a profit.

If you’re placing money with a third party, the primary risk you face is that it disappears completely. Here is more information to help you evaluate that risk.

Regulators

The good news is that both firms are regulated by the FCA.

Source: FSCS

Source: FSCS

UK clients also come under the umbrella of the FSCS scheme, which offers government backed protection on up to £85,000 of client funds in cases of insolvency.

Reputation

The growth in their client base means both firms now have significant critical mass and the feel of being businesses that are becoming viable concerns. They are both customer-facing and negative reviews can damage a firm’s reputation, so they’re keen to achieve high rankings in terms of customer satisfaction.

Backers

Nutmeg is privately owned. This means there is less transparency of reporting than if it was listed on a stock exchange.

Source: Wealthify

Wealthify was bought out by Aviva in 2018. The insurance giant took the decision to try to match up Wealthify with its own existing client base in an effort to find a profitable win-win.

Nutmeg has also sought additional financial support. In 2019 investment giant Goldman Sachs bought a stake in Nutmeg which and valued the robo-advisor at £245m.

The robo-advisor sector is one of small profit margins and building the customer base requires considerable amounts of investment. These buy-outs are not necessarily cause for alarm, but are something to keep in mind in terms of know who you are investing with.

Final thoughts

Both Nutmeg and Wealthify offer an interesting and refreshing approach to investment. The difference between the two firms is not as great as the one between them and the ‘traditional’ fund management operators.

When put head to head, Wealthify edges it in terms of costs for those with less to invest. Nutmeg, on the other hand, has a wider range of products on offer

Investors aren’t necessarily required to choose between the two. They both have minimum investment conditions that make them stand out from the other robo-advisors. As onboarding only takes minutes to do, there could be some benefit from trying both out to see which one matches your personal preference.

They offer a range of new ideas, as well as tried and tested ones and a low-cost way to make your money work a little bit harder.