Many are predicting this to be the year for small cap growth stocks, and the markets are certainly throwing up plenty of opportunities to buy the dips. The sector can generate significant returns even without finding the optimal trade entry points. However, by using fundamental and technical analysis to pick the right stock, and the right time to buy it, investors can gain exposure to the market that holds the promise of revealing the next big thing.

YOUR CAPITAL IS AT RISK

Filtering the stock market for firms which have a market capitalisation below $6bn and the potential to post future earnings which are above the market average still leaves a considerable pool of names to choose from. This review will consider the sectors in which those candidates operate, so that it’s possible to build a portfolio which offers returns, but also diversifies risk.

Best Small Cap Growth Stocks

- Best Small Cap Growth Stock in the Pharma Sector – Rocket Pharmaceuticals (NASDAQ:RCKT)

- Best Small Cap Growth Stock in the Cybersecurity Sector – Tenable Holdings Inc (NASDAQ:TENB)

- Best Small Cap Growth Stock in the Renewables Sector – Sunnova Energy International (NYSE:NOVA)

- Best Small Cap Growth Stock in the Energy Sector – Tellurian Inc (NYSEARCA:TELL)

Best Small Cap Growth Stock in the Pharma Sector – Rocket Pharmaceuticals (NASDAQ:RCKT)

- Market Cap: $1.73bn

- Dividends: N/A

US-based Rocket Pharmaceuticals is a Nasdaq-listed clinical-stage biopharmaceutical company that develops gene therapies for rare diseases.

The company has a strong pipeline of product candidates, with some of the drugs in its pipeline having already received orphan drug designation, while it recently got RMAT designation for its RP-L301 gene therapy for PKD.

Rocket Pharmaceuticals Share Price Chart

Source: IG

RCKT is well-positioned and has an experienced management team with a strong track record in the biotech industry.

Best Small Cap Growth Stock in the Cybersecurity Sector – Tenable Holdings Inc (NASDAQ:TENB)

- Market Cap: $4.42bn

- Dividends: N/A

The scanning software Nessus which has been developed by Maryland-based Tenable Holdings Inc is designed to help clients resist a wide range of online attacks. The software is capable of protecting networks and servers, but the kicker is that it can extend the protection to different areas of a firm’s operations.

Tenable Holdings, Inc – Share Price Chart

Source: IG

With the Internet of Things (IoT) demonstrating how corporations are just beginning to expand their networks into another area of the public domain, Tenable is in a good position to build market share thanks to it being able to keep up with the direction its clients want to go.

Despite some recent near-term challenges, we remain positive about the stock in the long term in part due to its healthy pipeline generation.

Best Small Cap Growth Stock in the Renewables Sector – Sunnova Energy International (NYSE:NOVA)

- Market Cap: $1.92bn

- Dividends: N/A

Sunnova installs and services solar cells on US homes, and currently operates a network of more than 309,000 customers across 42 states and territories. Part of the appeal of Sunnova is that it is classified as a utility stock, which means funds with a mandate that requires them to invest in that relatively pedestrian sector can take a position in a stock which offers greater growth potential.

Sunnova Energy International – Share Price Chart 2019 – 2022

Source: IG

Trading in the same direction as big institutional funds is rarely a bad idea. One note to make is that Sunnova does not pay a dividend. It’s not that type of utility stock and is much more about gaining exposure to the rollout of solar energy across the US.

Best Small Cap Growth Stock in the Energy Sector – Tellurian Inc (NYSEARCA:TELL)

- Market Cap: $714.8m

- Dividends: N/A

Tellurian is an energy firm focused on developing liquid natural gas (LNG). The Houston, Texas-based company is developing a portfolio of natural gas production, LNG marketing and trading, and infrastructure.

Tellurian has a number of projects in the works, including the Driftwood liquified natural gas production project. The company is also developing the Driftwood Pipeline, which is a 96-mile gas pipeline that will deliver an annual average of 4 bcf/d of natural gas

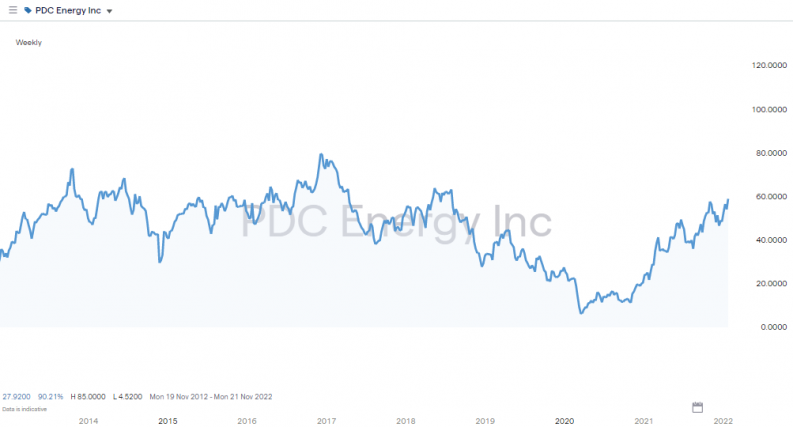

Tellurian Inc – Share Price Chart

Source: IG

Why Invest in Small Cap Growth Stocks Now?

Using fundamental analysis metrics, small-cap stocks appear undervalued in relation to a lot of other sectors. The Russell 2000 index, which contains a broad spread of US small-cap stocks, has been stagnant for a while, despite an initial push higher earlier in the year.

Russell 2000 Index Monthly Price Chart

Source: IG

The underperformance of the Russell 2000 surprised many, as small-cap growth stocks usually outperform during periods of economic recovery. The ending of lockdown restrictions due to COVID was expected to act as a catalyst for small-cap growth; however, this hasn’t materialised – yet.

A research note posted by Alliance Bernstein recently stated that small-cap stocks are trading at extremely depressed valuations. They wrote:

“Investors have discounted further potential hazards for small-caps, without regard to company fundamentals. So, we think firms that offer resilient business models will stand out and benefit the most along the road to recovery..”

Source: AllianceBernstein

What to Know Before Investing in Small Cap Growth Stocks?

Higher interest rates and inflationary pressures are still providing headwinds. Small-cap growth stocks are not immune to those global headwinds, and it could be argued they’re even more exposed to the risk of an economic slump.

The question is whether pullbacks in price are short-term blips and an opportunity to buy small-cap growth stocks with a view to them coming good in the long term. This can mean that investments in small-cap stocks may take some time to come good. Buy-and-hold investing can pay off, but capital can be tied up for some time, and that means it can’t be invested in other areas.

Single stock risk also needs to be considered. Major corporations such as Apple and Amazon are subject to intense scrutiny from institutional investors. The granular level of due diligence on those large firms offers some comfort to retail investors, and small-cap stocks might not have been subject to the same degree of analysis and investigation.

How to Buy Small Cap Growth Stocks

Carrying out research on small cap growth stocks is the first step to gaining exposure to the sector but making the right choice of broker is equally important.

1. Choose a Broker

This broker shortlist includes firms that can be trusted. They are all regulated and have been reviewed by the AskTraders team. Some have been trading for decades and over that time have expanded the markets they offer to ensure their clients can tap into some of the most exciting small cap growth stocks.

Tier-1 Regulators

- The U.S. Securities and Exchange Commission (SEC)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

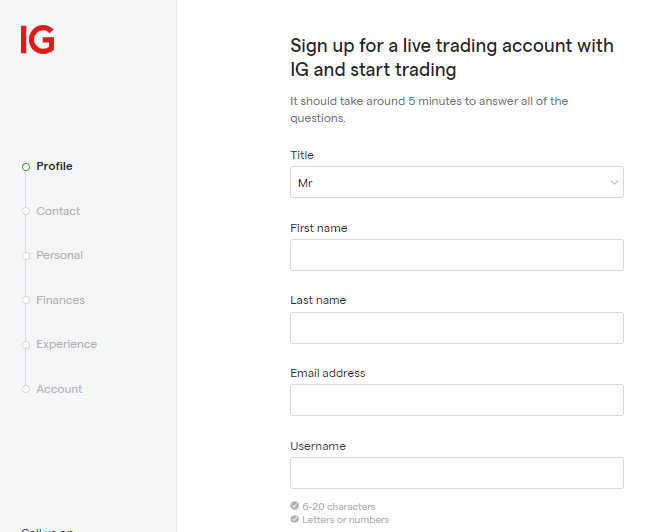

2. Open and Fund an Account

Opening an account with an online broker takes minutes and can be done using a handheld or desktop device.

Source: IG

Once the registration process has been completed, the next step is transferring funds to the new account. There are plenty of payment options, including debit and credit cards, bank transfers and e-payments.

It is worth checking the terms and conditions at brokers as some payment methods aren’t instant and others incur charges, including fees from third-parties. These aren’t typically of a size that they are a deal-breaker, but there’s little point in paying commissions which might be avoidable.

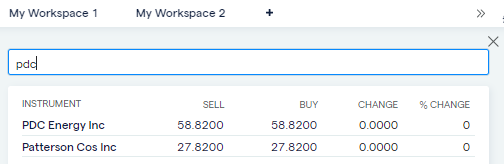

3. Open an Order Ticket and Set Your Position Size

The next step is to buy your target small cap growth stocks. This is done by navigating through the trading dashboard or using the ‘search’ function.

Source: IG

The process of buying is as simple as entering the quantity of shares you want to buy into the appropriate data field and clicking or tapping ‘buy’.

Source: IG

4. Set Your Stops and Limits

Stop Loss and Take Profit instructions are orders built into the trading platform system to help manage risk. They instruct a broker to automatically close out some, or all, of a position if the price reaches a certain level.

Investors with a longer investment time-horizon often decide not to use stop loss and take profit orders. This is because buy-and-hold positions can be closed out at a loss if there is a temporary crash. Take profit orders also cap the potential upside on a positions.

Alternative approaches to risk management include portfolio diversification and allocating small amounts of capital to different firms to limit single stock risk.

5. Make Your Purchase

At the point of trade execution, funds in your account will be converted into a stock position. This will be shown in the portfolio area of the broker platform and its value will be determined by the live price feed from the market.

Best Broker for Trading Stocks Online

Whether you're a new trader building an extensive portfolio of high-growth small cap stocks or just curious about the sector, these trading platforms are perfect for beginners. They are all fully regulated and provide a user-friendly, safe and secure trading environment. The support services include educational materials on how to trade, stock market research and price update messages, which all adds up to you having everything needed to help you get started and make your first trade.