The GameStop (NYSE:GME) situation was largely US-based, but the ability of groups of individuals to co-ordinate their approach and overrun a particular market is now a global phenomenon. It no doubt poses a threat to the financial status quo and could be a game-changer in terms of how the markets operate and regulators regulate.

However, one minor detail relating to how the GameStop situation came about has been largely overlooked — the nature of the fundamental analysis used to justify the long position in the retailer.

This review of the analysis and the trade history sheds light on how it could actually have far wider reaching consequences for the markets. The ability of a crowd of online traders to target a position is a significant development, but so too is how potentially life-changing GameStop stock analysis is freely available if you know where to look.

A Breakdown of u/deepf**kingvalue ’s Fundamental Analysis of GameStop

The GameStop long position can be traced back to one passionate and knowledgeable individual carrying out fundamental analysis on a company and proving Wall Street wrong.

According to the WallStreetBets (WSB) thread on Reddit, the seed of the idea of going long in GameStop was planted back in July 2020. At that time, Reddit user and trader u/deepf**kingvalue made a call on the unloved games retailer, which, six months later, would go on to represent a seminal moment in financial market history.

Source: YouTube

After carrying out in-depth fundamental analysis on GameStop, u/deepf**kingvalue concluded that the stock was massively undervalued. In the Summer of 2020, u/deepf**kingvalue made his first video on Roaring Kitty, his newly set up YouTube channel in which he declared he was looking to buy GME at $4.

We’ll look into what fundamental analysis u/deepf**kingvalue carried out to come to that decision, but the approach he took is worth noting.

How to Carry Out Fundamental Analysis on a Stock

In the video where he outlined his strategy idea, u/deepf**kingvalue demonstrated he’d adopted a methodology, which would ultimately pay off, big time.

- He acknowledged his weaknesses “Some people won’t even tune into the stream right now when they hear that I’m bullish on GameStop”.

- The amount of research he had carried out was evident when he said: “I could talk about it for weeks”. The video ‘summary’ itself is more than one hour long.

- Opening the floor to critical engagement, he said: “I’m also hoping you can catch some of my blind spots… poke some holes in my thesis and share them with me”.

- His analysis appeared to be based on the stock, not his own ego “I’ve been wrong plenty of times in the past”.

(Sources: YouTube)

Compare this to the approach of in-house analysts at institutional investors where things operate differently.

- Salaries and bonuses are allocated according to each analyst’s stock-picking track record.

- This increases the risk of individuals and departments becoming siloed.

- Analysts are expected to “fight for their position”, not invite criticism.

What Did U/deepf**kingvalue See That Wall Street Missed?

By going over the pros and cons of GameStop’s core business, u/deepf**kingvalue concluded the firm’s market capitalisation, and therefore the stock price was being misjudged by the market. U/deepf**kingvalue went long because a stock price reflects the buying and selling pressure of traders today, not a company’s prospects for future growth.

Background

GameStop had been losing money for years.

- Its +5,000 bricks-and-mortar stores were a drag on performance and left the firm struggling to compete with online retailers.

- Failed projects such as a move into selling smartphones smacked of desperation.

- Its expansion into other markets in Europe, Australia and New Zealand offered investors the same bad business model, just in different locations.

- Bid-offer spreads. GameStop offered an exchange service where customers could trade in their old games. To make this viable, the firm had to offer bid-offer spreads so wide it generated its own memes.

- Poor operational systems.

- The COVID pandemic exacerbated all of the above.

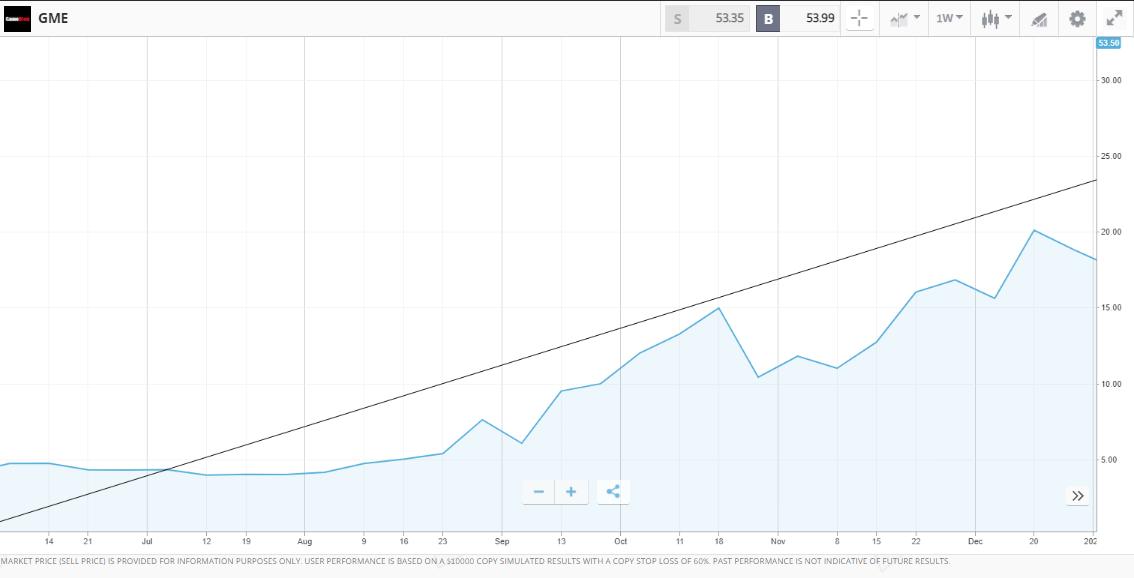

GME Price History

Over a period of three years, GME had lost 83% of its value. The below chart is similar to the one that u/deepf**kingvalue would have seen in July 2020 and showed nothing other than bearish price moves.

GME Weekly Price Chart – 2017 – 2020

*68% of retail CFD accounts lose money

Why Did u/deepf**kingvalue Decide to go Long in GME?

The analysis by u/deepf**kingvalue was extensive. He even studied the dynamics of the relationships between the different managers of the firm. Below are some of the reasons he saw that GME’s value should have been higher than what the market was showing.

- One reason was that GME was being tipped as ‘the Amazon of video games’. The firm’s earnings report showed it had finally managed to successfully tap into the online market with digital sales up 300%.

- New Board of Directors and new management team.

- Cutting costs and improving internal review procedures.

- Improving working capital management — making better decisions on buying and selling stores.

- Sales of the corporate jet for $9m and sale-leasebacks of premises to strengthen the firm’s balance sheet.

- Liquidity improvements — refinancing of loans and extension of maturity dates.

- Closing stores in areas where George Floyd memorials were taking place as a sign of solidarity.

- Q1 financial reports showed that revenues held up even during the pandemic lockdown. Quarterly revenue of $1bn prove the firm is still relevant.

- New console cycles in the pipeline — these always generate extra business.

- The market capitalisation of $260m was lower than the ‘fair value’ valuation of $400m.

- Free Cash Flow projections of $100m.

- Cash position of +$500m and a market cap of $260m.

- 42 million registered members — monetisation of that database currently not being fully optimised

- Game Informer magazine has around 6 million subscribers and is in the top 5 of US subscriptions services. The balance sheet didn’t accurately demonstrate its value as the service could be ramped up or even sold off. Time Magazine, with far fewer readers, was sold for $190m in 2018.

- He disagreed with the way that leases were accounted for on the balance sheet.

- Discounted downside potential “If you think that GameStop is going bankrupt you need to show your work. Its highly, highly, highly unlikely to happen”.

How u/deepf**kingvalue ’s Fundamental Analysis Strategy in GME Played Out

Fundamental analysis relies on catalysts. To put it another way, you can be right that a firm is undervalued, but if the market price doesn’t react to that situation, that opinion won’t convert into profits. Studying the history of u/deepf**kingvalue ’s trade details how it paid off for him.

In his July analysis of the management shake-up, he said: “Not to say they’re going to hit it out of the park, that’s not the point. The point is it’s changed”.

Groundswell of Buying Pressure

Gradually more and more investors asked the same questions that u/deepf**kingvalue had. Any review of GME and why its stock was climbing higher would quickly come across the ‘Amazon of gaming’ idea. The potential was huge and would generate FOMO across the US share dealing platforms.

Serious Backers

Ryan Cohen, CEO of chewy.com and high-profile tech entrepreneur, bought a 10% stake in GameStop in September 2020 and increased it to 13% in December.

By December, GameStop was printing prices above the $20 mark and u/deepf**kingvalue ’s position was worth five times what it was when he bought in.

*68% of retail CFD accounts lose money

A cycle developed where positive news coverage led to increased buying, which led to more positive news. The situation had now changed from the one u/deepf**kingvalue had described in July.

“Not enough people are talking about this stuff. The stock price has gone nowhere for 12 months, but the fundamental events which are unfolding are like, objectively positive. They’ve been incrementally improving and the price is still flat, which is surprising to me”.

Source: YouTube

GME – The Role of Hedge Funds

A five-fold return in the space of months proved u/deepf**kingvalue right. Already sitting on substantial profits, he held his nerve and then the situation took a dramatic turn.

Hedge funds that had also been monitoring the GME situation had come to an opposite conclusion. Their analysts did think GME would go bust and a degree of short-selling would allow them to profit on that. By borrowing stock and selling it, they looked to buy it back at a later date at a lower price.

Until July 2020, that strategy had paid off as the GME stock price tumbled. Running into Q4, the pressure was on the hedge funds to close out their shorts and bank some profits, or hold the position with the view that GME would eventually go bust.

The niggling factor at the back of a short-seller’s mind is that losses are infinite. U/deepf**kingvalue’s maximum loss was the cash he deposited in the stocks, reported to be $750k. For the funds, there was no cap on the downside. That factor plays a large role in what happened next — the GME short-squeeze.

What is Over-shorting?

In mid-January, the short interest in GME was 140%. Funds were seeing the Q4 price rise as a chance to double up on their shorts and adding to positions. The bad news for the funds was that u/deepf**kingvalue and other members of the WSB Reddit group noticed — that 140% number and that GME was over-shorted. There were more short positions than stock available to buy and the funds were vulnerable.

If the price rose and hedge funds looked to cover their shorts, they’d have to take part in a game of musical chairs. The loser would be left standing and facing dire financial consequences.

As the buzz about the story spread online, more and more small traders piled into long positions and took advantage of the hedge funds having overextended themselves. As the price rose, the short-squeeze took hold. Funds that bailed out of their shorts only added to buying pressure.

GME – The Role Played by Call Options

Buyers took advantage of the options market and bought out of the money call options, which given the unprecedented price moves, very soon became in the money call options. The brokers who had made the market in the options had to be in a position to deliver stock to the option owner –– which meant they also had to go out into the market and buy GME, whatever the price.

It’s reported that in 2019 u/deepf**kingvalue himself bought call options, the right to buy GameStop stock on a particular day (15th January 2021) at $8 a share. He wasn’t the only one.

*68% of retail CFD accounts lose money

How the GME Trade Ended

The populist uprising was finally quelled when Wall Street, ‘in the interests of retail investors’ banned all purchases of GameStop stock. They still allowed shares to be sold, which drove prices down and allowed the hedges to bail out of their positions.

Regulators made comments about online collusion being an issue, which needed to be addressed. The Reddit community and many within the establishment countered by saying the collusion between hedge funds was a longer-standing issue.

Even establishment insiders called foul. In a tweet, Democratic congresswoman Alexandria Ocasio-Cortez highlighted that lawmakers need to know more about broker Robinhood’s decision to “block retail investors from purchasing stock while hedge funds are freely able to trade the stock as they see fit” (Source: Twitter).

Summing Up

U/deepf**kingvalue ’s long position famously clashed with billion-dollar hedge funds who, as he was buying, were shorting the stock. The funds had also carried out their own analysis. Well-paid analysts and portfolio managers, who were likely to have access to superior research materials, sold short while a relatively under-resourced Reddit user went long.

The WSB-Reddit chat group can be a volatile space, but it seized on u/deepf**kingvalue ’s idea because the fundamental analysis was so strong.

The short-squeeze in GME ended up costing the hedge funds more than $5bn and could bring in regulatory changes relating to how markets operate. It is though, the divergence of that opinion regarding the ‘amateur’ and ‘professional’ valuations that could ultimately maximise the embarrassment of the hedge funds.

After being given access to more and better data, the ‘smartest guys in the room’ bet on red, while a Reddit user operating out of his spare room bet on black.

His fundamental analysis led him to buy GME at $4, and by 28th January 2021, the price of the stock was $483.