Reducing the level of emotion involved in trading can help you navigate the markets more calmly and consistently. That includes not being forced out of positions at the wrong time, instead optimising your trade entry and exit points. This is where options come in. Although the individual excesses of some high-profile traders have resulted in derivatives picking up a bad reputation, the options market was initially created to help mitigate risk. If used appropriately, options can still play that role, so read on to learn how to use options to manage risk.

What Are Options & How Do They Work

Buying options allow you to buy or sell an asset at a future date. You're not obliged to exercise that trade and would only do so if the market had moved in a way that your trade had become profitable. Instead, you pay a premium for the right to book a trade, and if you end up letting your options expire, then your loss will be capped at the premium paid to buy the options in the first place.

If you buy Put options, then you can sell an asset at a future date, so if its price drops below the ‘strike price' of your options, you will make a profit equivalent to the difference between the exercise price (where you can sell) and the live market price.

Nasdaq 100 Index Options Market – Put Options Become Profitable Below The Strike Price

Source: IG

Call options work in the other direction. If the price goes higher than the exercise price of your Call options, then you'll make a profit. The remuneration packages of top executives of listed companies often include Call options as that aligns with the incentives of the management and the shareholders. If the management team improves the firm's prospects and the share price increases, everyone's a winner.

How Using Options Can Help You Manage Risk

The options market was developed to manage the demands of large institutional investment houses. Pension funds and their peer group often manage trillions of dollars worth of long positions, which, whilst being solid long-term propositions, are exposed to the risk of markets correcting, particularly in the short term.

Buying Put options effectively insures against the risk of markets crashing. Whilst the rest of the core portfolio will fall in value, the Puts will start to show a positive return. The strategy allows the big funds to concentrate on their day job of picking the best buy-and-hold stocks in the market, and by paying a premium for the options, they cover some of the downside risks.

How and Where to Buy Options

Online brokers have revolutionised the investment industry and opened up the options market to traders who were previously unable to gain access. If you trade using a firm from this list of trusted brokers, you'll be able to manage your portfolio using a cost-effective and user-friendly platform. They can be set up to use on desktop or handheld devices, so you're always in touch with the markets.

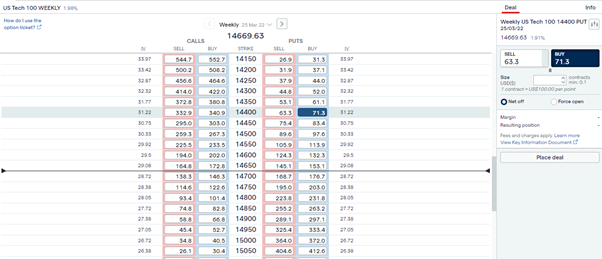

Nasdaq 100 Index Options Market – Put Options Become Profitable Below 14,400

Source: IG

Buying options at brokers such as IG is as simple as clicking a button or tapping a screen. The below screenshot from the IG platform shows the markets in Put and Call options for the Nasdaq 100 index. With the current market price at 14,667.25, it costs $71.3 to buy Put options with a strike price of 14,400. If the market doesn't fall below 14,400 by the expiry date, the options would expire as worthless. If the Nasdaq crashes and trades below 14,400, then your options would be ‘in the money' and generate a profit. The $71.3 premium will be a trading cost that hits the bottom line of your account regardless of whether your options strategy is profitable or loss-making.

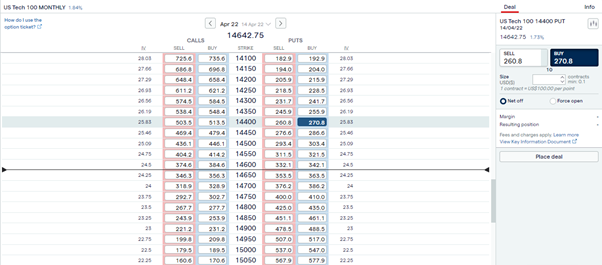

Nasdaq 100 Index Options Market – Buying and Selling Call & Put Options

Source: IG

The above market is for weekly options, so the expiry date of the contracts is the final trading session of the week. It is possible to trade options that are ‘longer-dated', including the end of the current or next month. The greater the time until the expiry date, the more time there is for market prices to move and bring options ‘into the money'. As a result, longer-dated options typically command higher premiums. Using the Nasdaq options market as an example again, the premium on 14,400 Put options for the following Friday is $270.8 instead of $71.3.

Nasdaq 100 Index Options Market – Buying and Selling Call & Put Options

Source: IG

How to Use Options to Hedge Your Portfolio

Put options are commonly used by those holding long positions in an asset who feel the market is set for a correction. A long position in Put options with a strike price lower than the current market price means you are set to profit from the options part of your strategy if the correction does come. If prices continue to rise, your loss will be the premium paid on the options.

This enables you to reduce the risk-return level on your portfolio without having to sell any of your core portfolio. The downside of selling in and out of your long positions is that doing so will involve transactional costs. There is also a risk of FOMO setting in if the correction doesn't materialise and prices continue to rise.

Good brokers offer options trading across a range of markets. Put options in the Nasdaq index would be ideal for someone looking to hedge a portfolio made up of tech stocks. If your portfolio is not necessarily tech-centric, then options in the S&P 500 index might be a better match.

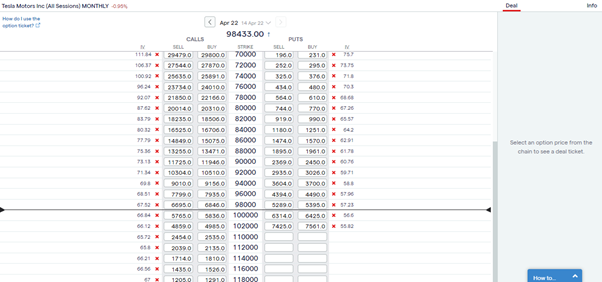

If you're long on oil, gold, or forex, then finding the right broker that offers a range of options markets will allow you to use options to hedge your downside risk. It's even possible to trade options markets in single stocks, which could be helpful if you've built up a sizeable position in one particular company. EV manufacturer Tesla is a popular stock to trade, but if you feel you're overweight in the stock, then the below dashboard of the options market in Tesla Inc might be where you want to head to trim your risk.

Tesla Inc Options Market – Buying and Selling Call & Put Options

Source: IG

How To Avoid The Risks Associated With Options Trading

Derivative instruments such as options do have to be treated with care. There are notorious instances such as the Baring's crisis of 1995, which demonstrate what can happen when the risks are scaled up. The details of the big news stories often reveal the problems were caused by options being used in a way that was not intended. Following the below guidelines can help you avoid falling into that trap.

What Are ‘Naked' Options Trades

Buying Put options remains a tried and trusted way of hedging downside market risk for those with existing portfolios. Those who trade options outright and take ‘naked' option positions use them to take a view on the market rather than hedge positions. Trading ‘naked' options requires volatility levels to pick up as the strike prices on options will be based on current volatility levels. If market sentiment doesn't change, it's possible to run up premium costs without ever seeing a profitable trade materialise.

Why It's Not a Good Idea to Sell Options

Buying Puts or Calls in any market limits your losses to the premium paid. Even if your options expire as worthless, your losses are capped. Selling options can be a different matter as you effectively become the market maker and are responsible for meeting the obligations associated with any exercised options you sell to other parties. Professional brokerage firms run behind-the-scenes trading programs to ensure they manage their risk, and retail traders might not have the experience or capacity to do the same.

Final Thoughts

Increased access to the options market can only be a good thing for retail investors, but there are specific rules to follow, the main one being only ever to buy options and not sell them. That opens the door to tapping into the benefits of purchasing Put options to hedge risk without selling off your core portfolio. Using that strategy, the maximum cost you can expect to pay on the option leg of the strategy is the premium paid to buy the options.

If you're new to the options market, starting by using a Demo account is a good idea. It offers a risk-free way of getting to grips with the cost-benefit analysis which goes into the calculation. You can simply put on trades and see how the different price moves and premium charges feed into your virtual P&L.

Another factor to consider is that broker selection will play an essential part in your efforts to manage risk using options. Put simply, some of the smaller brokers in the sector don't offer options trading. Navigating this list of well-regarded and high-quality brokers is the first step toward developing a more sophisticated approach to generating long-term gains using options to hedge your portfolio.