Key points:

- Color Star Tech is listed as being up 3,157% this morning but that's nominal

- An accurate real price change for CSCW is more like a 40% fall

- The difference between nominal and real prices can be large….

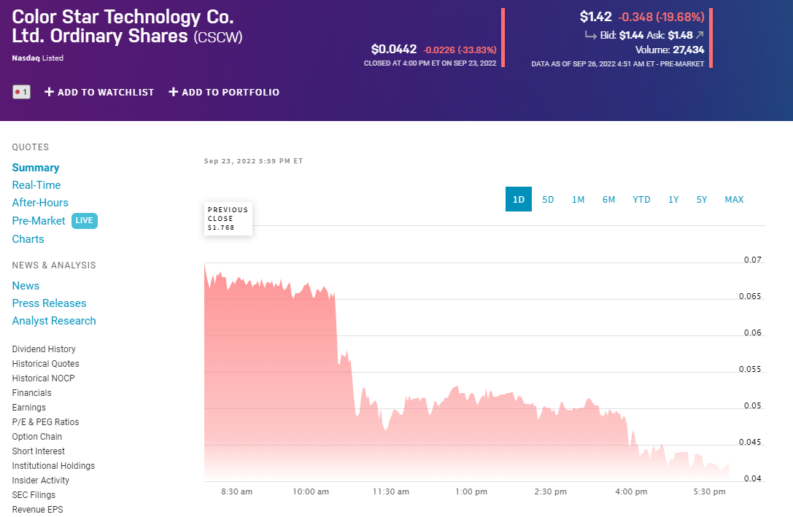

Color Star Technology (NASDAQ: CSCW) stock is up, at pixel time, 3,157% premarket. This is, in reality, more like a 40% fall in CSCW stock over the past 24 business hours. There's a considerable difference between those two numbers and that difference needs to be explained of course. The truth here being our old friend, that difference between nominal price changes and real ones. It is real price changes that make a difference to our wallets and they are therefore the ones we have to concentrate upon. Nominal ones are just changes in denomination – they're interesting because of whatever knock on effect they may have but only because of those subsequent effects.

Color Star Tech has been having a bad time of it, that's for sure. CSCW stock is down 95% over the past 12 months. The background is that Color Star provides online educational services. The description is in both China and the US but the focus of the business is China. Which is a problem, for the CCP decided, in its wisdom, that it didn't in fact want private sector companies competing with the public and state schooling system there. So, it's now allowable to provide online teaching in lieu of apprenticeships – as an example – but not in the equivalent of the K-12 space. Now, why the CCP wanted to do that is another matter but every business must deal with the trading environment as it is. And that obviously puts a crimp on a business trying to sell educational services. This has significantly affected other stocks in the same business line like New Oriental and Onesmart Education.

Also Read: 30 Global Stocks That Warrant Your Consideration

It's that 95% decline in the CSCW stock price that matters. For that takes the stock price well below NASDAQ's $1 minimum bid price. Without doing something about this the NASDAQ listing will be lost and relegation to the less liquid OTC markets looms. The solution to this is a reverse stock split, a consolidation to Brits. Simply declare that 40 old shares are now one new one – a 40 for 1 stock split as Color Star has just done.

In theory this should not change the real share price – the company is still worth the same amount, any stockholding is as well. It's just the number of pieces of paper that make it up which changes – a nominal, not real, price change.

The knock on effect – hopefully – will be that a NASDAQ listed corporation is worth more than an OTC one, so the real price will edge up a bit along with the nominal. Which is clearly what has not happened here. A 40 for 1 reverse split should mean a 4,000% rise in the CSCW stock price. At pixel it's a 3,157% – so, that's a fall. But we should probably also include the price moves of the last trading day as well. That was a 34% fall. Add all of that together and we've that nominal stock price change this morning of 3,157% as a rise, but that's much more like – not exactly so, but more like – a 40% drop in the real Color Star stock price. Starting Friday at $0.06 and $1.42 right now – but after the 40 to 1 reverse split.