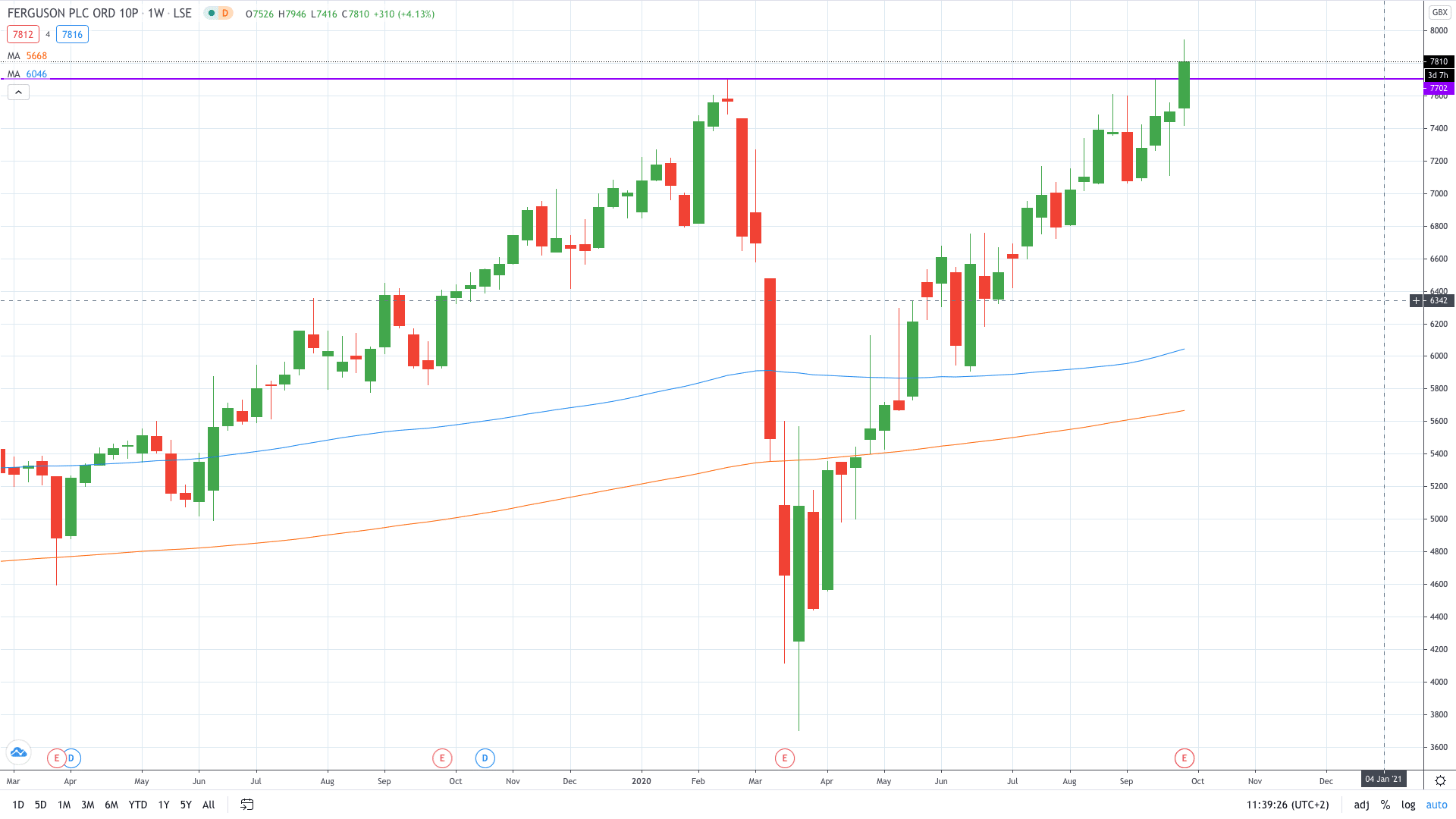

Shares of Ferguson (LON: FERG) soared 6% to print fresh record highs after the plumbing giant resumed dividend despite falling revenue.

Revenue fell 0.9% to $21.8 billion for the full-year ending 31 July, lower from $22 billion in the same period last year. Profit before tax dropped 4.8% to £1.26 billion, down from $1.3 billion in 2019.

Basic earnings per share fell 11.2% year-on-year to $4.28, from $4.81 in 2019.

Richard Hunter, head of markets at interactive investor, commented: “Ferguson has delivered an impressive performance for the year, particularly in light of the effects of the pandemic which have brought such difficulties elsewhere.

“Indeed, the most striking proof that the financial measures taken have been successful, as well as signposting confidence in future prospects is the full restoration of the dividend.”

Due to “excellent operating cash generation,” Ferguson said it will pay a final dividend of $2.08 as it reported “better than expected trading”. This is higher than a final dividend of $1.45 paid in 2019.

Ferguson share price jumped around 6% to trade at a new all-time high of 7946p.

PEOPLE WHO READ THIS ALSO VIEWED:

- Aston Martin share price up 15% in two days. Here’s why

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan