Key points:

- Forza X1, FRZA, is nothing to do with Forza Innovation, FORZ

- FRZA is a would be maker of electric boats

- It's very early days which is why the price is so volatile following the IPO

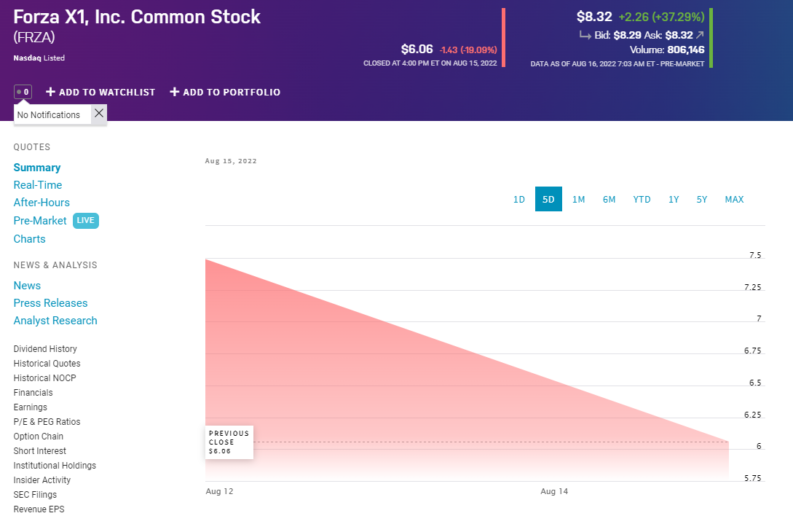

Forza X1 (NASDAQ: FRZA) stock is still highly volatile following the IPO. The stock launched at $5.00 in the IPO itself and immediately soared to near $15, which is its highest so far. After that Friday and Monday were a continual downhill slope – not something a boat maker is used to – but we've a 42% rise premarket this morning. Given the extreme recency of the IPO itself there's nothing really to go on as a valuation exercise other than those issuance documents. So any estimations of where the price is going to go next have to be based upon crowd theory.

One thing we can say though is that this is something of a change for the market itself. This FRZA IPO is a straight IPO, that craze – fad or fashion perhaps – for SPAC deals doesn't come into it. It's possible to think of technical reasons why this might be so, for example the IPO only raised $15 million. That might be a smaller deal than a SPAC would be set up for. Or it could be that the SPAC craze just has had its day. That was always going to be likely anyway, that the new twist on an old technique of a shell company would revert back to being something interesting to use occasionally rather than some major part of the market.

It's also worth pointing out that Forza X1 is just nothing at all to do with Forza Innovations (OTCPK: FORZ) so don't go trading the other stock by mistake. This has happened, people getting confused with stock names and tickers, and we don't want it to happen to us.

Also Read: How To Invest During A Recession

It's also worth noting that it's nothing to do with Italy. This is a Florida based developer of all electric boats. These are pleasure craft, not commercial, and they intend to sell direct to consumer. Given that the IPO money is to be used to buy manufacturing space and so on they're pretty early in the cycle to get this going too. So it's again difficult to price the corporation. We're being asked to buy into an idea more than anything else.

As ideas go electric pleasure craft have their merits. There's definitely at least something of a market for them – there were early adopters of EVs after all, long before true economic viability was proven. It's also possible to think that selling direct to consumers preserves margin but comes with significant capital costs – as Tesla themselves have shown, selling without dealers. It can indeed work but it is also expensive to do so.

As to the short term of the FRZA price that's the usual combination here so close to an IPO. Firstly, there's how much of that stock was securely placed with long term holders, how much is with traders looking for their turn? Then there's whatever we think the long term value might be, discounted back through time. Finally, there's that pondering what other traders are going to think about that same information set. We can predict continued volatility, but which way, well, that's the test.