There are some sectors that attract greater attention from investors as the economy slows, and there are also some to avoid until the economy picks up again which means it is possible to continue to invest during a recession. But trading stocks during a recession involves considering how to trade, as well as what to trade.

What Is A Recession?

A recession is a period of reduced economic and industrial activity in which an economy’s gross domestic product (GDP) contracts for two consecutive quarters. That GDP number registers output from the manufacturing and service sectors of the economy, so one or other of them can be responsible for dragging the aggregate number down to a negative.

Analysts use other metrics to measure the health of the economy – these need to be considered as they can provide a more accurate means of filtering trading opportunities during a recession. Real income, inflation, employment levels, industrial production, and wholesale-retail sales all become hot topics.

A Historical Perspective On Recessions

Recessions can be short-lived or long-term in nature. For those with a pessimistic view, it’s worth noting there is no standard definition of when a recession becomes a depression. The downturn between December 2007 and June 2009 is widely referred to as the ‘Great Recession’ even though it was the longest contraction since the Great Depression of 1929-38.

Given that the GDP numbers are released every financial quarter, one can be recorded relatively quickly – in the space of three months and one day. That can be far faster than governments or central banks can introduce policies to try to avoid or rectify the downturn. The difficulties the global economy has faced in 2022 raise the prospect of the next recession being long-lasting, which makes developing ways to trade it even more important.

Stock Markets During A Recession

A contracting economy is typically associated with a fall in stock market prices due to the revenues of firms taking a hit. Not all sectors will be impacted to the same extent. Utility companies, healthcare companies and those dealing in consumer staples can expect to outperform firms from the travel, consumer durable, leisure, and industrials sector.

Historical data also points to stock price volatility picking up during a recession, which without effective risk management being applied, can result in forced selling. A process of rotation from high-risk to low-risk stocks might be identifiable due to investors recalibrating the risk profile of their portfolio to ensure any price moves remain within a comfort zone.

Stock market performance might be loosely correlated to the health of the ‘real’ economy, but there can be moments when the two diverge. Stock prices, for example, tend to rally before a recession is over. This occurred during the Great Recession when central banks pumped trillions of dollars into the financial system. With cheap cash in abundance, investors bought into stocks despite there being an understanding that the additional lending would need time to work its magic and restore the fortunes of the companies involved.

Stocks That Perform Well During A Recession

Successful trading during a recession starts with carrying out research. Here are some of the sectors to consider buying and other quirks relating to a recession-based market that need to be factored in.

Defensive Stocks – Firms that produce products with inelastic demand tend to outperform during a recession. Energy companies, supermarkets, and pharmaceutical firms all sell products that consumers are likely to still budget for – regardless of changes to their personal income.

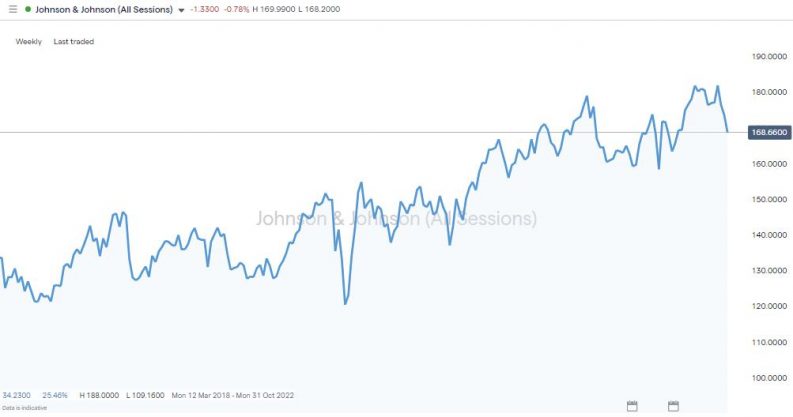

None can promise to be completely immune to a squeeze on household incomes, but the share price of firms such as Johnson & Johnson have historically held up while those of other companies have fallen in value.

Johnson & Johnson – Daily Price Chart – 2018 – 2022

Source: IG

Orsted AS offers an added element thanks to the firm’s status as one of the best renewable energy stocks to buy. Remember that trading through a recession doesn’t require all other long-term growth trends to be dismissed.

Orsted SA – Weekly Price Chart – 2016 – 2022

Source: IG

Value Stocks – Buying undervalued stocks can be a profitable trade regardless of what is happening in the wider economy. It involves identifying targets where for some reason or another, the market price doesn’t reflect fair value. This can come down to crucial information not being widely known or a stock price overshooting to the downside on the back of bad news, like a recession.

One of the key metrics to look for is the price-to-earnings ratio, the P/E ratio. This gives a one-figure answer to the question of whether a share price is low in comparison to the earnings a firm generates.

The Telecommunications Equipment sector has an average P/E ratio of 32.32, but Verizon Inc has a P/E ratio of only 9.55. At the time of writing, it also pays out a dividend yield of 5.28%, which means investors can benefit from passive income returns as well as the prospect of capital gains.

Verizon Communications Inc – Weekly Price Chart – 2018 – 2022

Source: IG

Cash-Rich Stocks – This type of firm can be found in any sector. The key here is to identify firms such as UK blue-chip stock Shell PLC, which has a track record of keeping an element of cash back.

In Shell’s case, the prudent cash management is done so that it can ride out the peaks and troughs of the global price in oil. While the oil market has been printing new all-time highs since the start of 2022, the spare cash on Shell’s balance sheet will come in handy when navigating a course through an economic slump.

The funds Shell has to hand could even provide the firm with a competitive advantage and allow it to gain market share off rivals. The firm has been angling for ways to position itself as a big player in the renewable energy sector. Smaller start-ups might have stronger green credentials than Shell, which still generates most of its revenue from carbon-based products. But money talks and a recession could even provide an opportunity for Shell to snap up clean energy rivals through mergers and acquisitions.

Shell PLC – Fundamentals

Source: IG

Shell also has a market capitalisation of £150bn. Critical mass can be important during an economic downturn.

Stocks That Perform Badly During A Recession

Several sectors underperform during a recession due to consumers cutting back on expenditure they would normally make in a more buoyant economy. These may be ones that investors rotate out of or even sell short to make a profit out of future share price weakness.

Cyclical stocks – Those companies that see their share price rise and fall with the economic cycle. These include clothing companies, luxury goods manufacturers, and leisure brands. If you buy a cyclical stock at the bottom of the market and later sell at the top, there is potential for impressively high returns, but timing that move is difficult. It’s always best to trade in the same direction as ‘the trend’, so cyclical stocks are best avoided during a recession.

A sub-set of the cyclical stock sector, which are particularly prone to an economic slowdown, are those companies that sell products and services that are big-ticket items. Long-haul airlines and automobile manufacturers are two examples of groups that struggle when consumers shy away from making large one-off purchases.

Companies with High Levels of Debt – In the same way that companies with strong balance sheets can be good investments during a recession, those with high levels of debt are best avoided. Recessions generate a lot of uncertainty, and their duration is difficult to forecast.

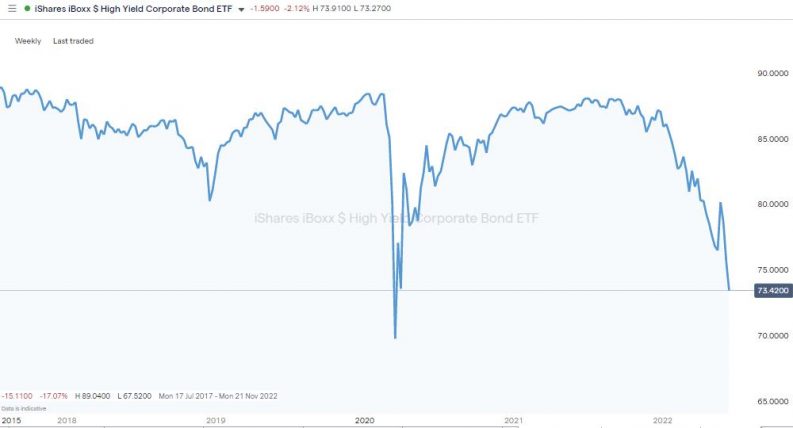

If weak economic conditions lead to problems in the banking sector, then the finance that highly leveraged firms have relied on to operate can become more expensive or dry up completely. The iShares iBoxx High Yield Corporate Bond ETF is a good barometer of investor appetite for lending to higher-risk corporate clients. That ETF fell in value by 15.95% between January and June 2022 on the back of fears a recession might be imminent rather than being actually confirmed.

iShares iBoxx High Yield Corporate Bond ETF – Weekly Price Chart – 2018 – 2022

Source: IG

In a recession, it’s wise to avoid buying and even consider shorting stocks that have balance sheets with any of these features: high company price to book (P/B), high P/E ratios or high levels of company debt relative to equity.

Penny Stocks – These fall firmly at the speculative end of the investment spectrum. The growth they offer can generate eye-watering returns when the economy is booming, but during a recession, investors risk the prices of penny stock holdings going all the way to zero. Trading liquidity levels can also fall away during a recession and that can leave investors stuck in positions and unable to sell even though they want to.

How To Invest During A Recession?

There are some rough guidelines to follow when trading during a recession and considering how you approach the market can be as important as which assets you trade.

Having a clear strategy is always a good idea, but it becomes crucial when navigating a recession. Investment timelines need to be carefully considered because you may have to hold a position for years and months before it comes good. This means investors need to know if their approach is buy-and-hold, where a share dealing account would be the best kind to use – or short-term and speculative, where CFDs might be a better fit.

Another asset group to consider investing in during a recession is options. Although derivatives have a bad name in risk-management circles, that is based on them being used improperly rather than them being inherently high-risk. Options can be used to manage risk or hedge your portfolio. More and more good brokers are offering markets in them.

The final trading approach to consider during a recession is to sell short. This can be done as a ‘naked’ short or as part of market neutral strategy. These offer a way to reduce P&L volatility and manage risk in any kind of market, but come into their own during a recession. It’s possible to go short one stock and long the other and profit from the relative rather than relative performance of the two stocks.

Trading in small size also helps spread your capital across different stocks so that if one goes bust, your total return won’t be impacted too much. Another strategy to consider is whether to use stop-loss instructions or not. These automated instructions to sell out of some or all of a position can be triggered during momentary downturns and result in losses being locked in on stocks which ultimately rebound.

If you’re in the fortunate position of having spare cash to invest during a market sell-off, then buying into positions over time will average out your entry price. It also lessens the risk of going too large, too soon, and then panic-selling just as the market bottoms out.

Final Thoughts

Finding the best stocks to trade during a recession requires some dedication, but if you spot something others have temporarily missed, then the returns can be considerable. There aren’t many hard and fast rules. Shell PLC, for example, is a cyclical stock – the demand for its products falls during a recession, but it has a super-impressive balance sheet, which marks it down as a safe haven stock.

Given that contradictions and uncertainty are in large supply during a recession, building a diversified portfolio is highly recommended so that returns can be smoothed out and single-stock risk mitigated.

That makes selecting a good broker even more important. This shortlist of trusted brokers includes firms that have been reviewed by AskTraders analysts to ensure they are safe and offer a range of markets to help investors spread their risk appropriately. Many also come packed full of free-to-use research and analysis tools to give you the best chance of successfully trading through a recession.