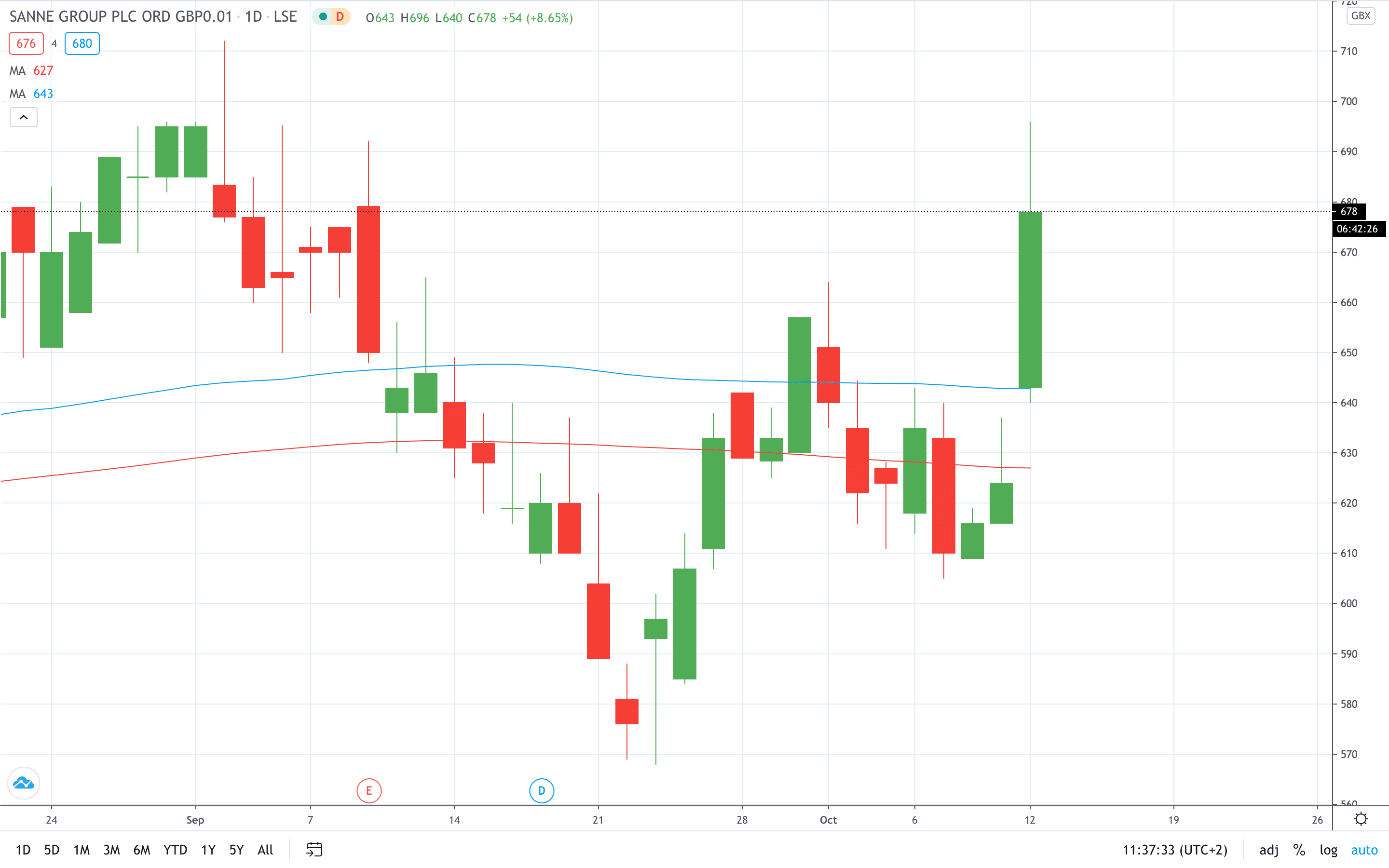

Shares of Sanne Group PLC (LON: SNN) soared around 10% after RBC upgraded the stock to “Outperform” from “Sector Perform”. Moreover, the stock price target is hiked from 600p to 730p.

Last month, Sanne Group reported net revenue of £83.9 million for the six months ending June 30. This is 11% higher compared to £75.9 million reported a year earlier.

The asset fund administrator posted a pretax profit for the first half of £11.6 million, which is much higher than £3.8 million a year prior. As a result, Sanne declared a dividend of £4.8p, higher than 4.7p paid last year.

“The changes that we have made to the business over the past fifteen months have enabled the group to deliver a resilient financial performance during the first half despite the backdrop of the Covid-19 pandemic,” said Chief Executive Martin Schnaier.

“We remain excited about the long-term opportunities for the business and committed to our stated strategy,” he added.

Sanne share price currently trades at 678p, or 8.65% higher on the day.

PEOPLE WHO READ THIS ALSO VIEWED:

- Aston Martin share price up 15% in two days. Here’s why

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan