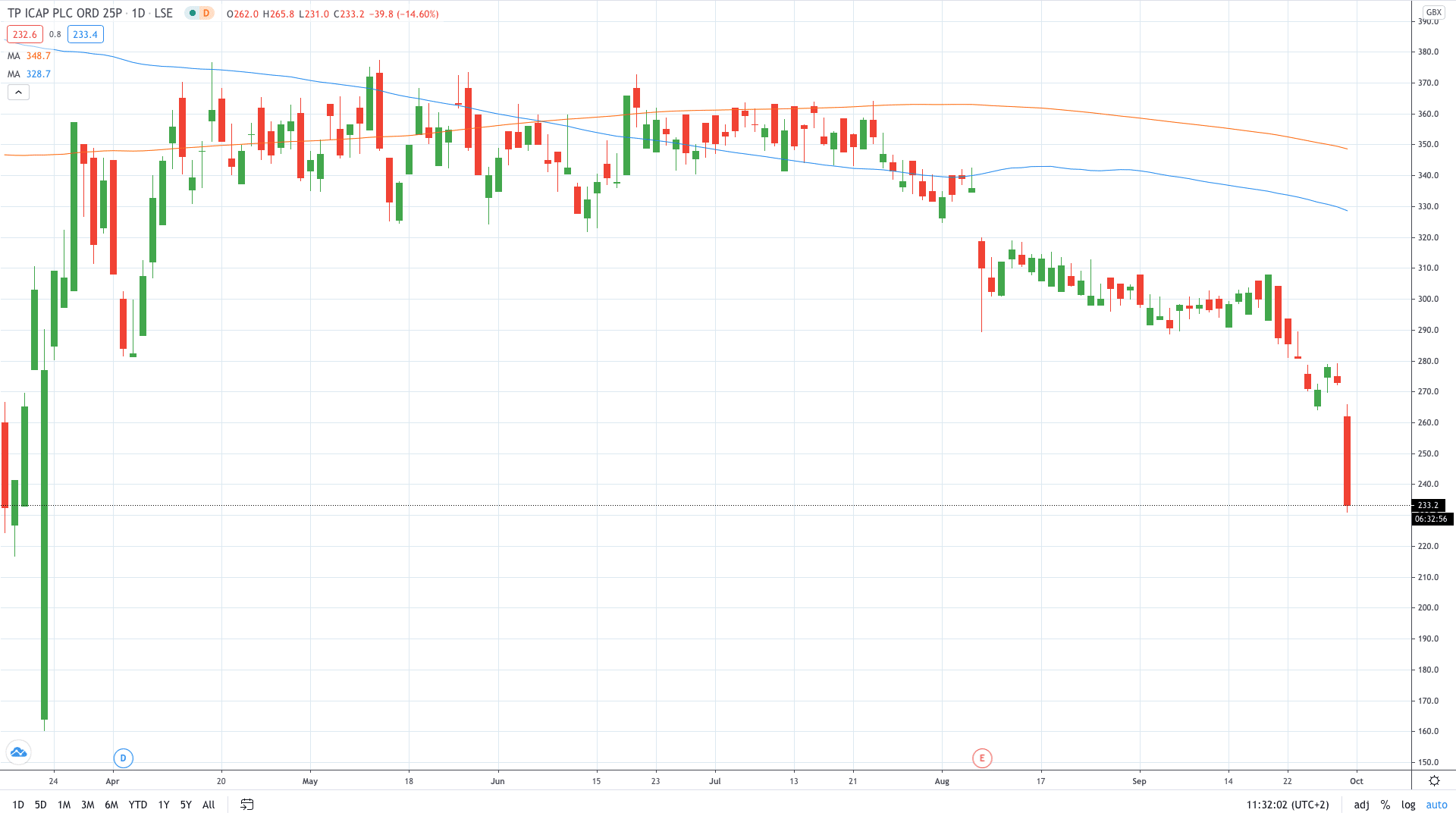

Shares of TP ICAP PLC (LON: TCAP) fell more than 15% on Wednesday on reports that the world’s largest interdealer broker is in talks to acquire Liquidnet in a deal worth up to $700 million.

The talks on the potential deal are centred on upfront payment of $550 million, in addition to deferred non-contingent payment of $50 million. Liquidnet will be due an additional $100 million if certain milestones are met.

The US-based company offers solutions that allow institutional investors to trade stocks anonymously. It is estimated that today Liquidnet has over 1,000 asset managers who manage around $33 trillion in equity and fixed-income assets.

The British company believes that the deal offers numerous benefits as it sees great potential for growth. The company may invest up to $30 million in Liquidnet in the 1-2 years after completion of the potential takeover.

TP ICAP share price collapsed over 15% to print a 6-month low at 231p.

PEOPLE WHO READ THIS ALSO VIEWED:

- Hammerson Share Price Crashes 92%, here’s why

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan