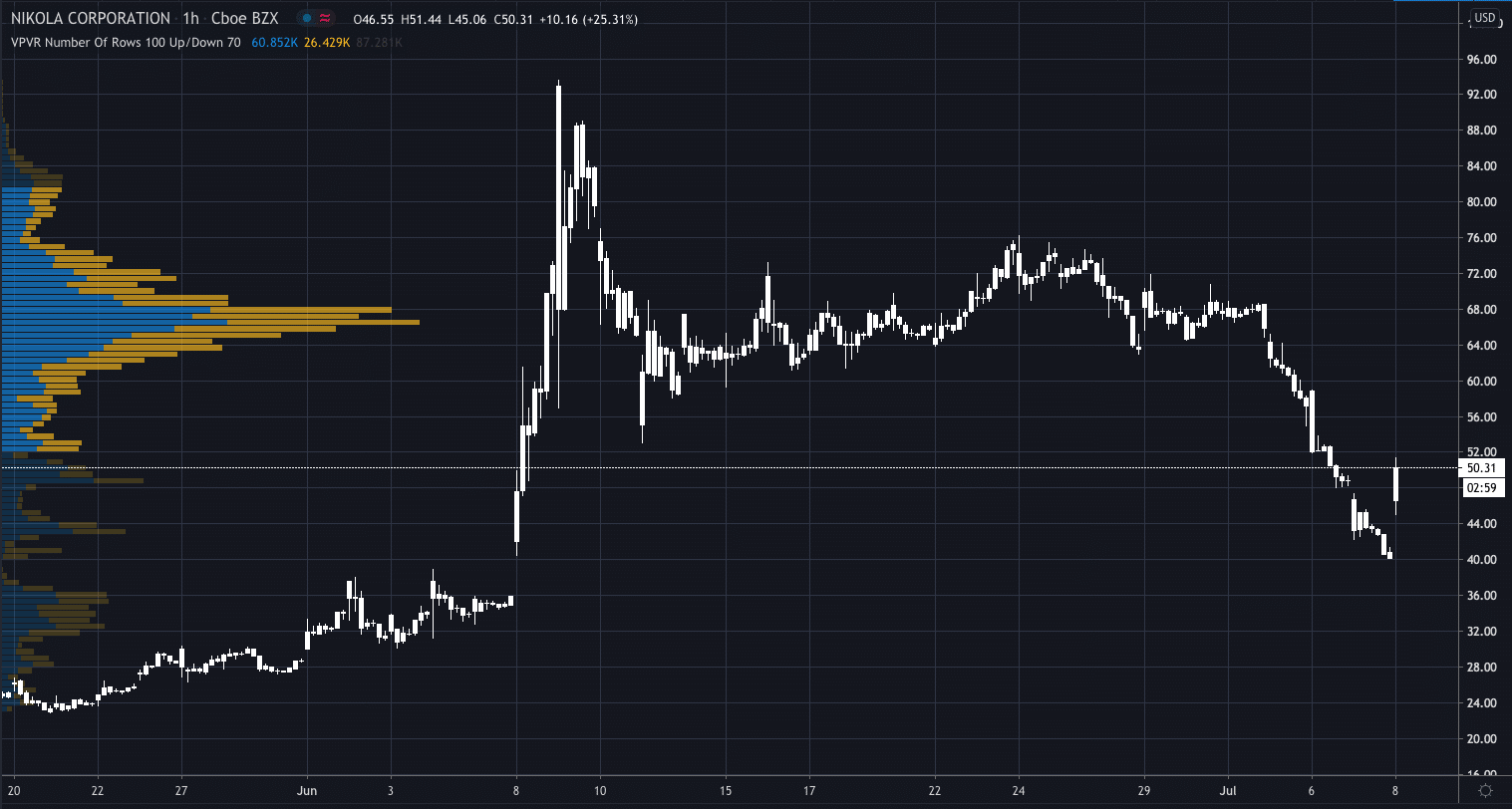

Nikola Corporation’s (NASDAQ:NKLA) share price surged in the first hour of US trading after JP Morgan upgraded the company’s stock from neutral to overweight…

The bank also raised its price target for the stock to $45 per share.

In its note, the bank said:

“The stock has fallen 40% in July month-to-date (S&P 500 up 1.5%), and could fall some more in the near term when the SPAC shares are freely tradable (and can be sold short), but NKLA stock is now trading below our $45.00 price target and starting to look attractive for long-term investors in view of a number of potential positive catalysts in coming weeks and months.

In our view, NKLA is currently a story-stock, but we are on board as long as the company executes to plan, and providing the stock offers a favorable risk-reward trade-off.”

The company has gained a lot of publicity recently after drawing comparisons with Tesla and even revealing that it will be releasing a pickup truck (Tesla have also done the same).

The preorders for that truck opened on June 29th, and Nikola said they were taking $5,000 deposits, despite the vehicle only existing in designs.

That hasn’t stopped investors piling in, however, with its share price exploding int he first half of the year.

So far today it is up 25%, trading at $50.31 per share.

- Find out how you can Trade NKLA Shares With These Brokers

- Learn How To Evaluate Stocks