Key points:

- REVBU, the Revelation Bio stock unit is up 1000% this morning

- REVB, the stock itself, is lagging well behind

- What is causing this divergence of prices?

Revelation Biosciences (NASDAQ: REVBU) units (that's one piece of stock and one warrant) are up 1000% premarket by some tickers. This is real trade, even if rather thin, so it's important for us to work out why this is going on. If we want to try and trade it, that is. There's no particular news that has been released generally. So quite why this is happening needs to be worked out from first principles.

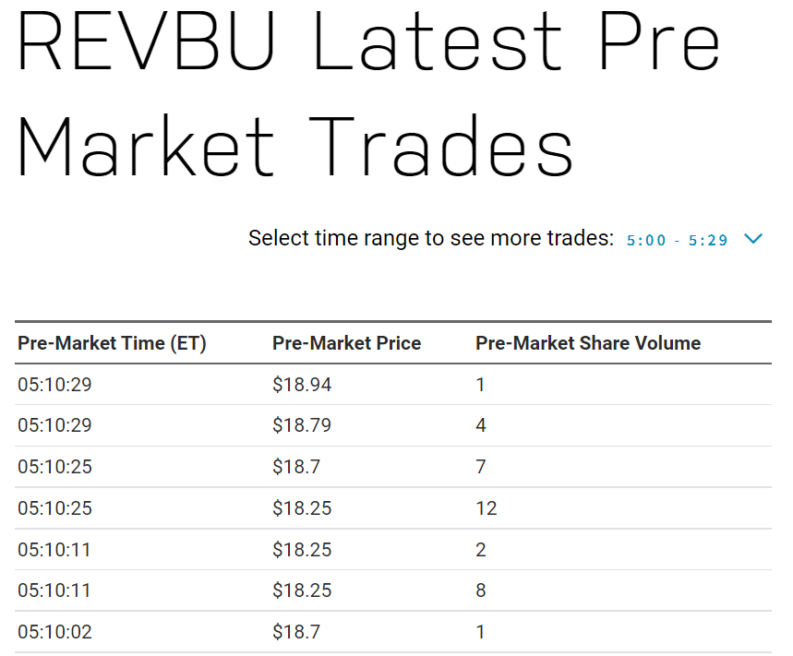

We need to note that Revelation has two different listings. There's the stock itself, (NASDAQ: REVB) and the unit, (NASDAQ: REVBU). It's the unit that is soaring. The stock has moved, yes, but nothing like the same amount. Here's the listing of the last few trades (at pixel time) for the stock:

Here's the pricing on the stock unit (recall, one stock, one warrant):

Friday's closing price on the Revelation Bio stock was 65 cents, that on the stock unit was $1.82, which itself was 54% down on Friday's opening price. The stock itself only listed in the early part of this year, the units have only been on the market for a week. So, a certain volatility, yes, we could expect that. But 10x, a thousand percent price changes, those are pretty large.

One thing to note is that the change in the underlying, the stock price, even given the gearing of the warrant in the stock unit, doesn't explain this price change.

Also Read: Five Best Pharmaceutical Stocks to Watch in 2022

So, we've got to try and work out what is going on here. This is not just the one or possibly two stock purchases which determine prices in very thin markets. As we can see from the above NASDAQ tickers there is real trade going on here even if not of huge amounts. So this isn't automated ‘bots for market makers being caught napping by flighty traders.

On the other hand, the market for the stock units really is pretty thin. Perhaps 20,000 units trade in an average day (well, OK, each day last week, which is as long as they have existed). So it is indeed possible simply that this caught someone's fancy and now we're in the middle of no more than a momentum trade. If that's true then we've got to work out how far it might go. And even if it will continue to do so for of course if this is all some passing fancy then there's the price to ride down again.

The problem with assuming it's all silly and shorting is the risk of course. The sensible position to take therefore being to keep searching for the actual news – which we assume will be along in the next few hours – that has triggered this soaring price for the stock units but not the stock. With that information it would be possible to decide how to trade. Even, whether to trade at all.