Key points:

- RM PLC shares are down 32% this morning

- This is off the back of the interims – they're not good

- But is it past performance or predictions about future that are the problem?

RM PLC (LON: RM.) shares are down 32% this morning on the release of a horror of an interim results announcement. Profits have vanished, margins are down, sales revenues aren't keeping up with inflation – just not a good set of results. As those of us who remember when it was called Research Machines the market is IT into schools and while there's a certainty of cashflow in that sector there are also considerable headwinds likely in the near future. RM tries to sound cheerful but it's not obvious that it is right to do so.

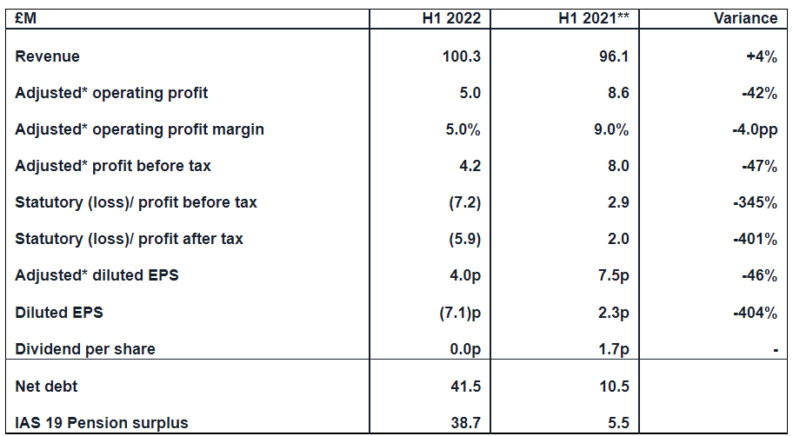

Here's the layout of the results themselves and they're not pretty reading:

As we can see that headline revenue number is up. But we've had 8 and 9 % inflation over that same time period so that's actually a fall in real revenues even as there's a rise in nominal. The problem with this is that those input costs – wages and all the rest – have risen at more like the rate of inflation because that's what inflation means. So, margin compression happens when this does – when revenue growth doesn't stay ahead of the inflation rate.

RM also reports that its own internal IT development is costing more and taking longer than expected – this is not a good look for an IT firm of course. The debt level has risen enough that banking covenants have had to be relaxed twice – no doubt at a fees and interest rate cost. Also, the dividend is being “paused” as a result of those debt levels. All in all not a happy set of results looking back at the past.

What may well be contributing to that 32% RM share price drop though is the insight into the future. Yes, of course, management are cheery because that's what you do. Things will get better, of course they will. But then there's this: “School funding is increasing in the UK, but school budgets have challenging headwinds notably salaries, energy costs and inflation which will impact discretionary spend.” What that means – and we always have to translate corporate releases to make sense of them – is that while school budgets are increasing in nominal terms it's not obvious, at all, that they're increasing in real terms given the inflation rate. This will reduce the amount that schools have to spend on things like IT. Which is not a good time to be an IT supplier into schools.

This then leads to this: “Macroeconomic environment is challenging and together with IT implementation impacts, will dilute profit conversion in the short-term.” To translate again, the short term is going to look worse for RM, not better.

A useful – but not perfect – way to think about this is that RM might well have an interesting future in that education IT sector. We're not going to stop teaching the kids about computers after all. But the interim between now and some sunny uplands is going to be difficult. The task for us as traders is to try and determine and then catch that bottom of the cycle.