The Smith & Nephew plc (LON: SN) share price extended yesterday’s rally by edging 3.91% higher today, driven by yesterday’s upbeat Q3 earnings results. The company reported its Q3 financial results for the three months ended 30 September 2023 yesterday. The firm received a ratings upgrade due to its impressive results.

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

Smith & Nephew was upgraded to Overweight from Neutral by JPMorgan analyst David Adlington, who upgraded the company's rating but lowered his price target to 1,248 GBp, down from 1,405 GBp.

The British multinational medical equipment manufacturing company reported that the third quarter showed robust financial performance with a total revenue of $1,357 million, a significant increase compared to the same period in 2022, which reported $1,250 million.

The revenue figures represent an impressive underlying revenue growth of 7.7%. The reported growth, including an 80bps FX tailwind, stood at 8.5%, demonstrating the company's ability to drive revenue expansion.

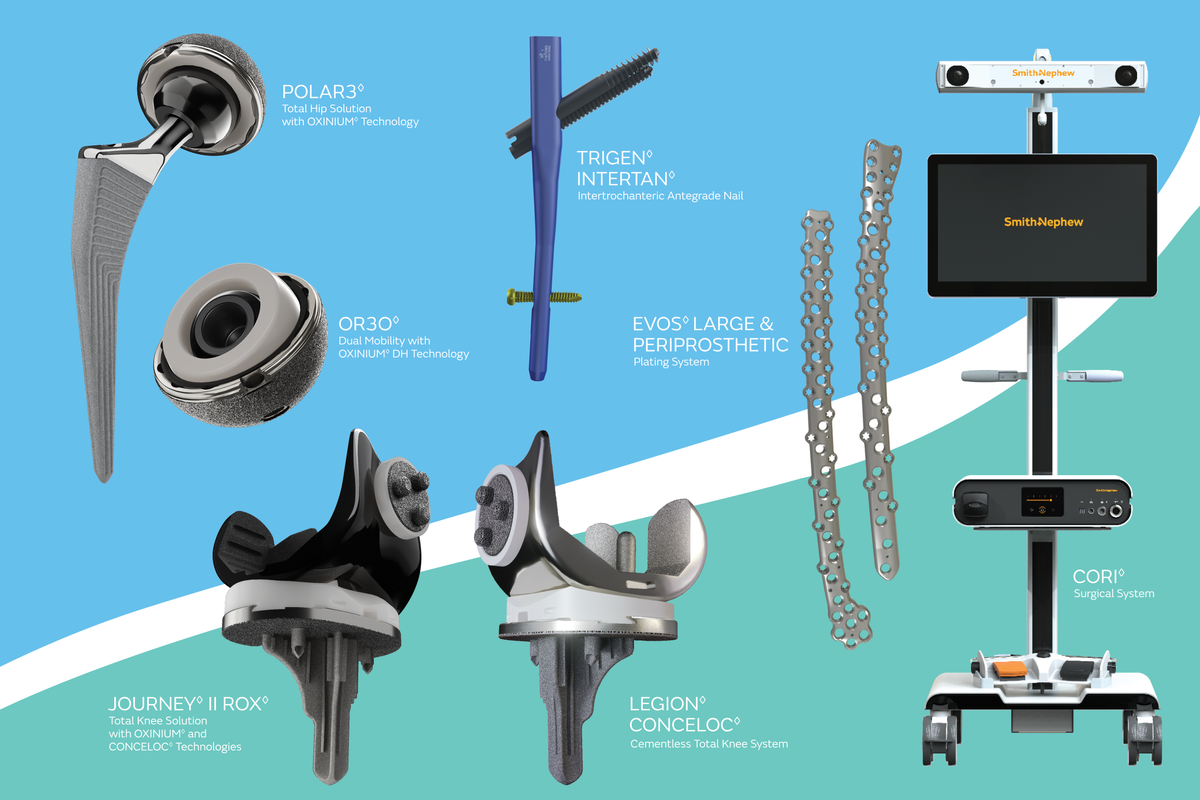

The Orthopaedics segment displayed a notable revenue increase of 8.3%. This growth was partly attributed to successful product launches and improvements driven by the 12-Point Plan. It was also bolstered by higher growth in Trauma & Extremities, showcasing the company's dedication to innovation and meeting the needs of its customers.

The Sports Medicine & ENT segment reported an impressive revenue growth of 11.1%. The strong performance was fueled by sustained growth across most markets, although there were some challenges in the Chinese market.

The Advanced Wound Management segment showed a revenue increase of 3.6%. This growth was driven by double-digit expansion in the negative pressure portfolio. However, the quarter saw a slower performance from Advanced Wound Bioactives.

Smith+Nephew anticipates that the underlying revenue growth for 2023 will likely be towards the higher end of the guided range, which is set at 6.0% to 7.0%.

Deepak Nath, Smith & Nephew’s CEO, said: “We saw strong growth in the third quarter, continuing the momentum from the first half of the year. Performance was broad-based, and I am particularly pleased by the step-up in Orthopaedics as we start to see the real impact from our improving execution under the 12-Point Plan. Our investment in innovation continues to bear fruit. During the quarter, we saw the first surgery with our new AETOS◊ Shoulder System and launched our leading REGENETEN Bioinductive Implant in India and Japan. We are gearing up for the imminent launch of our RENASYS EDGE negative pressure wound therapy in the US.”

Smith & Nephew (SN) share price.

The Smith & Nephew share price rallied 3.91%, adding to yesterday’s gains that were triggered by its

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Top stock trading platform with 0% commission – Read our Review

- Admiral Markets More than 4500 stocks & ETFs available – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.