Key points:

- Sonnet Bio should be up 1,400% this morning

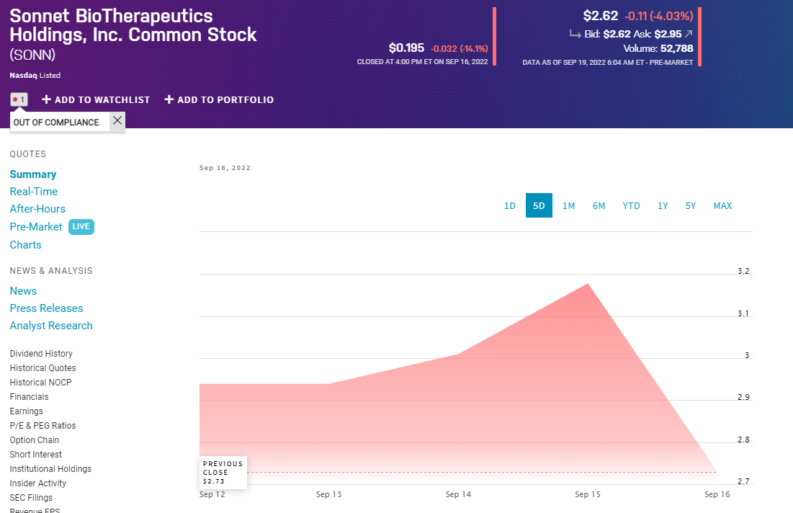

- SONN stock is bouncing around that theoretic rise

- The real price change is the variance from that in theory one

Sonnet BioTherapuetics (NASDAQ: SONN) stock is listed as up 1,505% on the ticker at pixel time. Given that SONN stock has fallen 67% over the past year this sounds like a welcome relief for stockholders. But sadly this isn't quite so – only some of that (now, 1,469% – the price changes over time) Sonnet stock price change is a real price change. If we stick with that 1,505% change to use in our calculations, it's about a 7.5% rise, something like that. Nice to have of course, but not exactly record breaking. It's also true that there was a 14% fall on Friday, meaning that over the two trading days we're still down.

As to what Sonnet BioTherapeutics does it's a clinical stage oncology focussed company. Developing cancer treatments that is, some based upon human interleukin. This all matters for the future of the company, sure it does, but it's not really relevant to the SONN stock price movement today.

We can look back and see that Sonnet gained FDA approval to move into Phase I testing of a treatment. SONN stock also rose 18 months back in gaining finance through the exercise of warrants. But the real point for us to understand is that at this stage of development Sonnet BioT swallows capital. That's just what drug development does. So, being able to access more capital across time is vital to the continuance of the company.

Also Read: Five Best Pharmaceutical Stocks to Watch in 2022

What's actually happened today is that a certain fashion in the New York markets has come into play. Those markets simply think that penny stocks are, well, they're penny stocks. This has implications of being not quite fit for the main markets – but the main markets are where the liquidity is, the ability to raise capital. So, companies – like Sonnet – whose prices languish below $1 have to do something about that stock price or lose their NASDAQ (or NYSE, roughly the same rules) quotes. That would impact on being able to continue to raise capital.

The thing to be done is a reverse stock split – a consolidation to Brits. Simply declare that 14 pieces of the old stock are now 1 piece of the new. Directly and alone this should mean a 1,400% rise in SONN stock. No change in the valuation of the company as a whole, no change in the value of any individual stock holding.

So, our theoretical Sonnet stock price change should be 1,400%. It was, back 20 minutes, 1,505%. That's a rise on that split-adjusted stock price of perhaps 7.5%. But then there was that 14% fall on Friday, meaning we're behind. Right now the price is 1,248% up, meaning that we're behind that theoretic price even on just the stock split.

The investing issue here is that we really must distinguish between nominal price changes and real ones. SONN stock should be up 1,400% this morning. That's the nominal price change – the real change is the variance from that theoretic 1,400%.