Key points:

- The ticker has Southwest Gas down 89%

- Q2 results were yesterday, were they really that bad?

- No, there's something else going on here

Southwest Gas Holdings (NYSE: SWX) stock is on the ticker as having fallen 89% overnight – or in premarket trading, your choice of words there. The results were out yesterday and they were indeed bad, not what people were looking for at all. But were they really this bad that a major utility company loses 89% (actually, 89.4%) of market capitalisation overnight? That's the sort of performance we might, just, believe from some clinical stage pharma as the FDA refuses authorisation, or a crypto company perhaps. But a utility?

The results weren't what investors were hoping for, that's true. Q2 earnings came in as a miss. Earnings per share – the big and important number – were expected to be 53 cents and they came in at 23. That's a 56.7% miss which is, by the standards of these things, both bad and an embarrassment. That was also 46.5% down from last years results of 43 cents per share. Operating revenues were a beat though, the consensus was for $1,011 million and they came in at $1,146.1 million. That was a 39.5% increase from last year's $821.4 million.

So, these results are a disappointment but they're not – barring them leading to something extraordinary like a bankruptcy – the sort of thing to cause an SWX 89% stock price decline. But according to the ticker that's exactly what's happened. So, why is this?

Also Read: Five Best Green Energy Stocks to Watch in 2022

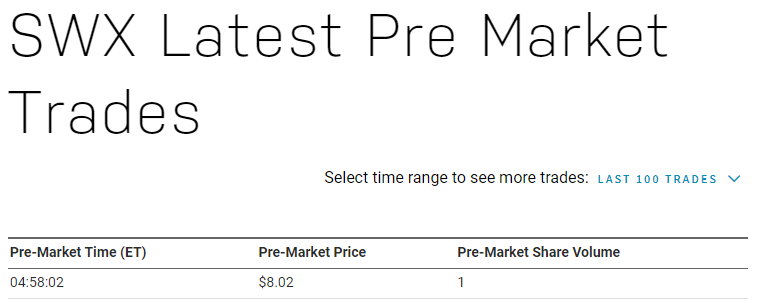

That's showing last night's price so where does this 89% fall come from? That's explained here:

We've got one single trade at that $8/change price, the ticker has picked that up and recorded it as an 89% fall in Southwest Gas. This will clearly revert as the market opens. It'll not be possible to buy stock at that price (offer seems to be around $100 at present) but if you can then, well, good luck to you. Entirely a bargain.

The big question we've got though is why that one rogue trade? And more than that, we've seen this before. It happened to Diebold, it has happened to Tricida. Single, or at least tiny, stock trades at prices wildly at variance with market prices. Alays happening in the very thin trade of early premarket trade (4 am and the like, NY time). Who is doing this and why?

One answer is that these trades often happen – big fingers and small mobile phones maybe. But in liquid markets they get washed away quickly, in seconds, in thin they hang around a bit. Another less appetising one is that there's some nefarity going on here. Imagine – no, just pretend – that someone had a derivatives position that would be closed out at some early premarket time. If they can get the thin market moved toward their position by trading $5 or $10 of actual stock then might they try it? We might imagine that some would in fact try that, yes. It would be pretty easy to find those who they were of course, looking for someone closing out a derivatives contract isn't that hard.

But there's been a series of these pricing “errors” recently and that's something that we as traders have got to think about. For it means that we cannot always trust what the ticker is telling us.