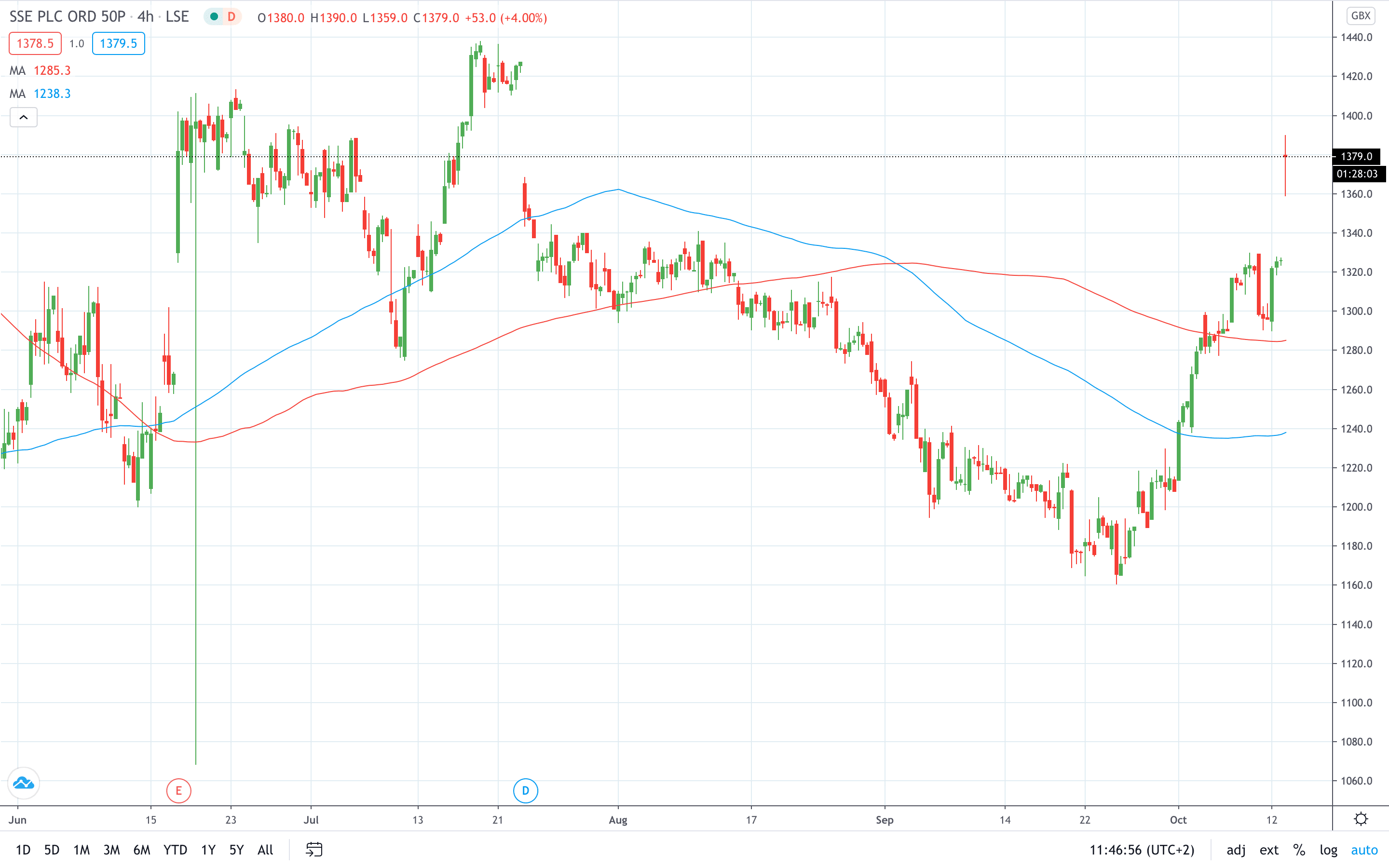

Shares of SSE PLC (LON: SSE) gapped about 4% higher this morning in London after the company agreed to sell its 50% stake in two ventures to First Sentier Investors, an Australian fund manager, for £995 million in cash.

This sale is a part of the company’s £2 billion disposal programme and it is expected to be completed by the end of 2020, subject to antitrust approval by the European Commission.

The firm will use cash from the sale to fund its £7.5 billion in low-carbon energy infrastructure over the next five years, as well as to decrease the net debt.

“This sale marks a major step in our plans to secure at least £2bn from disposals by autumn 2021, with just over £1.4bn now delivered. While these multifuel assets have been successful ventures for SSE, they are non-core investments and we are pleased to have agreed a sale that delivers significant value for shareholders while sharpening our strategic focus on our core low-carbon businesses,” said Gregor Alexander, Finance Director.

SSE share price gained 4% to trade at 1390p for the first time since July.

PEOPLE WHO READ THIS ALSO VIEWED:

- Aston Martin share price up 15% in two days. Here’s why

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan