Key points:

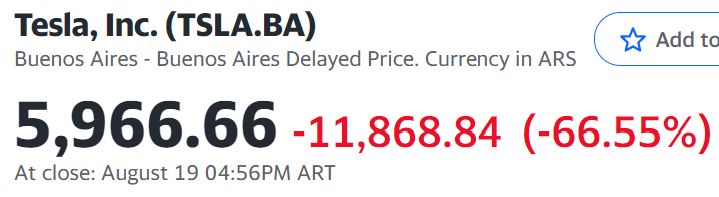

- Tesla stock dropped 66% on Friday night

- Well, TSLA.BA dropped that much

- The same price change arrives for us on Thursday

Tesla (BA: TSLA) stock dropped 66% on Friday. This will come as something of a shock to other holders of Tesla (NASDAQ: TSLA) given that we're used to variances of a percent or two in the TSLA stock price each day. However, that same price change is coming to New York as well – should happen on Thursday. This is more than just a little “gotcha” story though, there's an important point behind this.

What's happening is that Tesla is doing a stock split. A 3 for 1 – everyone who owned one Tesla share will, after the split, own three. That should indeed mean that the price falls by 66%. All that's changing is the number of shares in issue, not the total valuation or market capitalisation of Tesla itself. That should also mean no change in the total value of any specific stockholding – it'll just be a larger number of shares.

The thing is these changes don't, necessarily, all take place at the same time. The Tesla stock which is listed on the Buenos Aires exchange (that's the BA. bit) in Argentina has listed the coming share split as being valid from last Friday. For the rest of us it arrives this coming Thursday, the 25th August. OK, possibly so far so minor – but there is that underlying point to make. Detail matters.

Also Read: How To Buy Tesla Shares

As to why there's a stock split coming that's just fashion. There's an idea in New York that a “good” price for a stock is in the $10 to $100 range. So, when prices roar well ahead of this range issue more share in order to reduce that nominal price. That it is all just fashion is shown but the same range in London being £1 to £10 – which is why US ADRs of London listed stocks are usually 10 pieces of the London stock. Both ends get into that fashionable range.

There was even good reason for this way back when. But with fractional share ownership there's no reason for a high single stock price to mean that it would be too large a part of any individual portfolio. It's just custom which has carried on.

That BA has its stock split a week before New York could be viewed as just fun. But it's also another piece of evidence that details really do matter. Someone trading across geographic boundaries – someone arbitraging between markets – could get very confused by this just as one example. There are other times when details matter much more of course. There was that famed moment when Zoom Technologies – an OTC company with 10 employees – erm, zoomed 50,000% when the entirely unrelated Zoom Video Communications had its very successful IPO. Details really do matter.

A useful little rule of thumb is that if a price change seems entirely extraordinary then it almost certainly is truly extraordinary – and trading on it before working out why it is might not be a good idea.