Shares of TUI AG (LON: TUI) gapped 4% on Friday after the tour operator confirmed reports that it is considering a potential equity raise.

Tui stock price opened lower after media reports mentioned a sum between €1-1.5 billion. Although the company confirmed reports it is considering to raise cash and improve its balance sheet, it said the targeted amount will be “significantly lower” than the €1-1.5 billion.

Accordingly, Tui hasn’t yet decided about whether it will definitely go ahead with such plans, let alone the size and time.

In August, Tui share price fell more than 7% after reporting an earnings loss of €1.4 billion.

“We are targeting a permanent annual saving of more than €300 million with the first benefits expected to be delivered from FY21 and full benefits to be delivered by FY23. In two years' time, TUI Group will emerge stronger, leaner, more digitalised and more agile, in what is likely to be a much more consolidated market,” TUI said in a statement back then.

Moreover, Tui was forced to cancel all tours to Turkey after the country, considered a major holiday hotspot, was being added to England and Scotland's quarantine list.

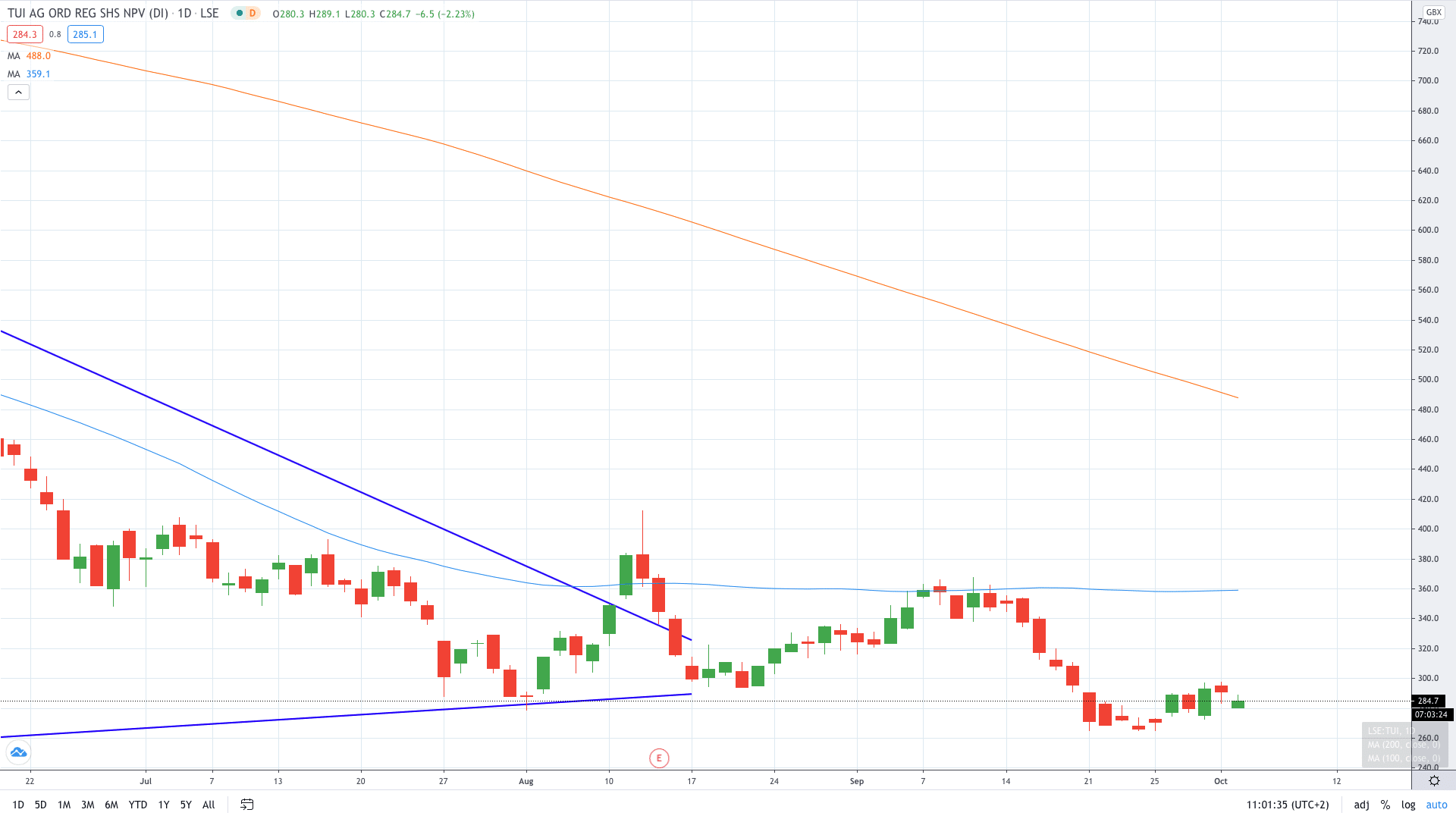

Shares of Tui currently trade at 284.7p, which is 2.23% lower on the day.

PEOPLE WHO READ THIS ALSO VIEWED:

- Aston Martin share price up 15% in two days. Here’s why

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan