Key points:

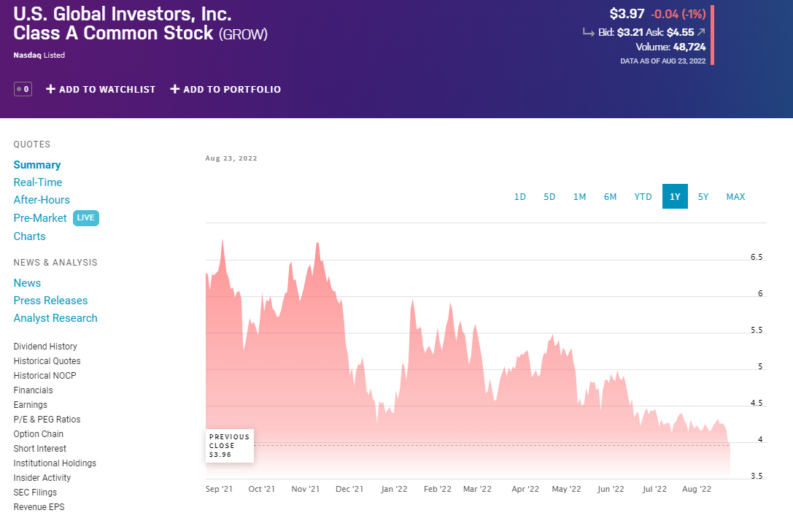

- US Global Investors rejected a bid at $5.30 recently

- Today's 12% rise leaves it still well below that level

- The big question now is where next?

US Global Investors (NASDAQ: GROW) stock is up 12% which is nice, but it's still well below the recent bid that it received. Which is not so good – normally management would probably prefer to get their stock price up over a bid they've received. But US Global has a specific share ownership structure which makes this less of a worry. That same structure also makes US Global less interesting to outside investors of course. The trick here is that Frank Holmes is both the CEO and also the controlling shareholder. There are two classes of stock and Holmes owns 99% of the issue that carries voting rights.

There are two ways of looking at this. One is that therefore this is a great investment. So, OK, we've not got voting rights. But the money manager in there definitely has his interests aligned with ours. Which is true to an extent. The other way is to think, well, perhaps not quite so aligned. For losing a CEO position if the company is taken over might lead to a certain reluctance to accept a bid. Even if it were in the best interests of the outside stockholders.

As it happens there was a bid made. Echo Lake and Dearhaven offered to buy out US Global for $5.30 a share. Which is significantly above the $3.97 of yesterday or the $4,45 of this morning, after this 12% rise. We can again read that either of two ways. As that reluctance to sell into a larger organisation by that major vote owner, or perhaps the indicated reason – that it undervalues the company – is true too.

Also Read: What Are Exchange Traded Funds

Aside from that takeover attempt it's also possible to wonder a little bit about the investment strategy being followed as well. Yes, there are what appear to be sensible statements being made. The dividend and stock buybacks are not being raised, instead cash is being preserved. The argument being that there's a recession coming which is when cash is king. Certainly, any substantial recession would likely create some useful number of interesingly priced positions that could be picked up.

On the other hand it's also possible to think about the current investment portfolio. There's that part of the business that manages ETFs which can be a very profitable little business. The Global JETS ETF has become a standard way to track the global airline industry for example. Global also runs similar industry verticals ETFs. On the other hand there's a more direct investing arm as well. There's an investment in HIVE Blockchain Industries for example, which at times is 28% of total corporate valuation. Crypto might not be quite the space we want to be in at present. Also, if we wanted to be in Hive, which is separately quoted, we could be directly.

Today's specific move in US Global has no specific news attached to it – we should assume therefore thatit's investors chewing over much of the above and changing their view of the company.