Some of the best ETFs to buy during a recession are detailed below. They've been selected using fundamental and technical analysis, which has identified them as having the potential to offer relatively stable, recession-proof returns.

What Is A Recession?

Recessions pose real problems for investors. In the broadest sense, they are periods with a significant, widespread, and prolonged downturn in economic activity. They are associated with rising unemployment levels, firms going bust, and lower consumer confidence.

Market analysts have fine-tuned the definition to ensure everybody is on the same page. They classify a recession as confirmed when a country's economy posts two consecutive quarters of reduced Gross Domestic Product (GDP).

The bad news is that in July 2022, the U.S. government released its GDP statistics for the period from April to June. That report revealed the U.S. economy had contracted by 0.9%. As the data for January to March had previously reported a 1.6% fall in economic output, the U.S. was confirmed as having technically entered into recession.

Are ETFs A Good Investment During A Recession?

The ETF market has grown in popularity over recent years thanks to its user-friendly functionality. These fund-style products allow investors to buy a whole basket of securities with the click of a button. At that point, the fund manager goes into the market and buys various instruments, usually stocks, with a shared theme. The fund's investment mandate may stipulate it invests in a particular sector, such as renewable energy, a type of company (such as large-cap stocks), or a specific region of the world.

Trading in and out of ETFs is much more flexible than traditional mutual funds; there's no need to wait for a month-end dealing day to build or trim your position. The innovative technology that makes ETFs more user-friendly also helps with transaction costs. The average annual expense ratio of ETFs is calculated to be 0.45%. However, many of the below-mentioned ETFs charge significantly less than that because the instruments they invest in have low price volatility.

Any product offering easy diversification of risk and low-cost trading is a good idea at any time, but when economic activity stalls, the attractive features of ETFs come into play. Previous recessions have been marked by household names surprisingly going bust, and ETFs offer a way to swerve that ‘single stock risk'. The way capital is spread across many smaller positions also smooths out performance returns.

Considering that recessions are associated with moments of market panic, any way of helping investors maintain a calm, professional approach to investing is a good thing.

Best High-Dividend ETF To Buy During A Recession – Vanguard High Dividend Yield ETF

Stocks that pay high dividends represent a way of earning a passive income and scream out that a firm has a healthy balance sheet. Firms with low debt, secure income streams, and significant spare cash offer protection from the risk of a recession turning nasty, exposing undercapitalised firms.

The Vanguard High Dividend Yield ETF employs a passive management approach to buy large and mid-cap company stocks in developed and emerging markets. It doesn't invest in REITS, limiting the risk of returns being hit by a recession morphing into a property price crash.

The stocks the Vanguard High Dividend Yield ETF buys pay higher than average dividends, there are no charges on trades entering or leaving the fund, and the expense ratio on the fund is 0.29%. The low-risk approach of the fund doesn't involve sacrificing too much in terms of returns. The annual returns in 2016, 2017, 2019, and 2021 were 10.6%, 19%, 21.3% and 17.9% respectively. The largest annual drawdown over the last five years was the -11.6% posted in 2018.

Factoring in that the stocks which make up the ETF typically outperform during a recession makes this ETF an even more attractive proposition following the poor GDP data out of the U.S.

The Vanguard High Dividend Yield ETF – Weekly Price Chart – 2015 – 2022

Source: IG

Also Read: The best undervalued stocks in 2022.

Best Consumer Staples ETF To Buy During A Recession – Fidelity MSCI Consumer Staples Index ETF

Cyclical stocks tend to underperform during a recession as consumer spending on discretionary items drops. Consumer staples sold by supermarkets and bulk retailers and household goods tend to see demand hold up. The essential nature of those items means spending levels are maintained regardless of how much household budgets are squeezed.

The Fidelity MSCI Consumer Staples Index ETF offers a great way to tilt your investing towards recession-proof stocks. It targets firms which make well-known brands of the everyday items consumers need regardless of the economic environment.

As of 30th June 2022, the five largest holdings of the fund were Procter & Gamble Co, Coca-Cola Co, PepsiCo Inc, Costco Wholesale Corp, and Walmart Inc. Taking positions in blue chip multinationals results in the fund paying a dividend yield of 2.34% (as of June 2022) and the average annual return for the last three years is 10.35%.

As investing in the Fidelity MSCI Consumer Staples Index ETF is essentially a defensive move, the good news is that frictional costs are impressively low, with an expense ratio of only 0.084%.

Fidelity MSCI Consumer Staples Index ETF – Weekly Price Chart – 2017 – 2022

Source: IG

Best Money Market ETF To Buy During A Recession – SPDR Bloomberg 1-3 Year U.S. Treasury Bond UCITS ETF

The versatility of ETFs means they can invest in asset groups other than stocks, and that helps canny investors pick a path through a recession by diversifying risk. The SPDR Bloomberg 1-3 Year U.S. Treasury Bond UCITS ETF invests in short-dated U.S. government bonds with future redemption dates of one to three years. T-Bills are one of the most secure investments in the world and pay coupons (interest) regularly. This makes ETFs, which include these instruments, ideal for pensioners and other investors looking for a guaranteed income stream rather than stellar capital growth.

An obvious alternative to investing in this ETF would be to keep cash in a savings account, but the fund allows investors to get closer to the market and marginally increase their returns. By dealing in the money market directly, less of the returns are eaten away by intermediaries such as banks but still offer a reliable return.

Continuing with the theme of ensuring bond ETFs provide the best possible returns, the expense ratio on the fund is a super-low 0.15%. That means, if interest rates rise by 1%, investors would only lose 0.15% of that gain in the form of charges.

This kind of low-yield investment requires paying some attention to the details of the T&Cs. Investors will want to consider promotional offers, especially those offering low fees, as that can help optimise returns. Even without those kickers, this style of ETF can be relied on to generate consistent returns even during a recession.

SPDR Bloomberg 1-3 Year U.S. Treasury Bond UCITS ETF – Weekly Price Chart – 2017 – 2022

Source: IG

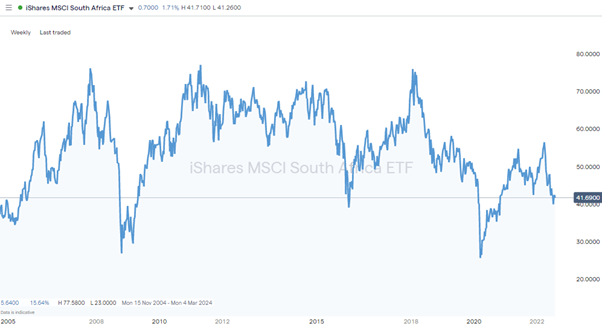

Best Regionally Focused ETF To Buy During A Recession – iShares MSCI South Africa ETF

The extent to which the world's economies are interlinked often results in a recession in one country spreading to others. The news that the U.S. economy has tipped into one will undoubtedly have knock-on effects on its trading partners, given the country's dominant role.

That being said, there are precedents of countries managing to outperform their rivals during a downturn. A wide range of ETFs allows investors to invest in a particular region to pick the best markets that provide shelter.

One strategy which involves tapping into a specific market involves buying the iShares MSCI South Africa ETF. As of 2nd August 2022, its most significant holdings included Naspers Limited, FirstRand Ltd, MTN Group Ltd, and Standard Bank Group. These firms and South Africa, in general, are often regarded as ways to tap into the long-term growth prospects of the African continent.

Big mining firms such as AngloGold Ashanti and Anglo-American Platinum provide additional protection from the threats posed by a recession, ranking in the ETFs' top-20 positions. Precious metals have a reputation for holding their value during recessions, and those firms claim some of the world's largest reserves of gold, silver, and platinum.

iShares MSCI South Africa ETF – Weekly Price Chart – 2005 – 2022

Source: IG

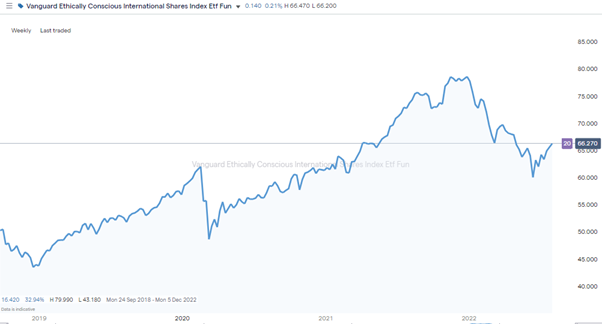

Best Ethical ETF To Buy During A Recession –Vanguard Ethically Conscious International Shares Index ETF

Ethical investing has in recent years moved mainstream and no longer represents a case of investing with the heart rather than the head. Companies that have caught the shift in the zeitgeist have generated stellar returns. Big institutional investors are also considering ethical investment principles when deciding where to allocate trillions of dollars.

Ethical funds could be an excellent ETF to buy during a recession because a large percentage of an ethical investor's decision-making tends to be influenced by long-term objectives rather than short-term returns. The Vanguard Ethically Conscious International Shares Index ETF provides exposure to many of the world's largest ethically compliant companies listed in the major developed countries. Its investment mandate excludes companies with significant business activities involving fossil fuels, nuclear power, alcohol, tobacco, gambling, weapons, and adult entertainment.

Since its inception, the Vanguard Ethically Conscious International Shares Index ETF has generated averaged gross returns of 10.01% per annum, and the management fee is a modest 0.20%.

Vanguard Ethically Conscious International Shares Index ETF – Weekly Price Chart – 2019 – 2022

Source: IG

Recessions and Stock & ETF Prices

Most ETFs invest in stocks, which means they have some of the same core characteristics as those instruments. That creates an interesting situation in terms of a time lag which is often seen between the time GDP data is released, and stock market prices move.

Like much official data, the GDP numbers are backwards-looking and take time to come to the table. The first half of 2022 was marked by market sentiment turning bearish as investors and industrial leaders gave early warning signs that the economy was in trouble. Geopolitical uncertainty in Ukraine, higher energy prices and supply-side log jams all led to investors feeling a recession was imminent. It wasn't until July that a recession was technically confirmed. By that point, the world's major stock indices had already plummeted in value, with the Nasdaq 100 index down by 28% between 1st January and 30th June 2022.

Nasdaq 100 Index – Daily Price Chart – 2021 – 2022

Source: IG

The time lag can work in the other direction as well. Because the ‘real' economy and stock markets are not the same thing. Stock markets can rally long before a recession is confirmed as being over.

The best ETFs to buy have already priced in some of the bad GDP data, which is good news for investors entering the market for the first time. ETFs can be used to plot a course through a recession but also allow investors to be in a position to benefit from capital returns when the market bounces.

Final Thoughts

ETFs offer a way to adopt the strategies used by sensible investors. Diversification is guaranteed, operating costs are low, and as trading is instant, there is little risk of getting stuck in a position. They also allow investors to invest in macro ‘themes' such as a need to take positions in defensive sectors, which is essential when a recession brings about a fundamental realignment of the financial markets.

While fund-style products mitigate the risk of one particular company in your portfolio failing, there is still the security of your broker to consider. A recession which spreads to the financial sector can put pressure on credit lines, and balance sheets of the platforms traders use to place their trades. This list of trusted brokers includes firms which are not only regulated by Tier-1 authorities but also have track records of successfully navigating previous downturns. The AskTraders team has reviewed them to ensure they offer clients a safe way to enter the market and provide competitive pricing terms so that investors, not intermediaries, benefit from the returns.