Key points:

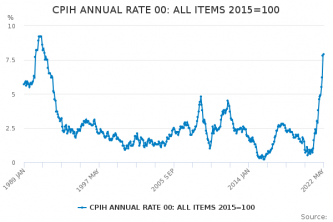

- ONS reports the UK's CPI inflation at 9.1%

- This is a decline in the value of money

- So, which shares might be able to beat inflation?

The UK's CPI inflation rate is reported – by the Office for National Statistics – this morning at 9.1% so what we want to know is which shares can beat that inflation rate. After all, we'd all like to preserve our capital in the face of such a raging drop in the value of money.

One answer is, as we've pointed out before, Mastercard (NYSE: MA) and Visa (NYSE: V) (there are also the London quotes, (LON: 0R2Z) and (Lon: 0QZ0)). The insight here is that revenues are a straight percentage of transactions. Inflation will push up the nominal value of transactions and therefore revenues.

This is true but perhaps doesn't go quite far enough. There is the possibility that spending will move away from what is spent upon cards for example, – few pay their rent this way and what if rent or mortgages become a larger part of spending? But the real reason this is an imperfect UK inflation hedge is that Mastercard and Visa revenues are worldwide. So, it'll be the weighted inflation rate across territories, not the UK one alone, which determines changes in credit card transaction revenues.

Also Read: Best Financial Stocks to Buy Right Now

Another possibility we've again discussed before is the British banks. Lloyds (LON: LLOY), NatWest (LON: NWG) and so on. The insight here is that rising interest rates increase bank gross margins. We've had deliberately suppressed interest rates this past decade, inflation is going to mean they rise to try to tame that inflation. Bank profits should therefore rise.

The problem with this as an inflation hedge is that the observation is entirely true but not sufficient. If inflation becomes embedded, rather than merely being transitory, then the only real way to shake it out of the economy will be to induce a recession. Recessions are not good for banking profits, however much higher nominal interest rates will flatter bank margins.

A third possibility is the observation that inflation is a rise in the prices of things bought often. Fast Moving Consumer Goods, FMCG, that is. So, those who sell FMCG will be somewhat protected from inflation – it is their nominal prices going up which is that inflation itself. As we've said about Diageo (LON: DGE) there could also be some trading down to affordable luxuries from the more expensive, the so-called “Lippy Effect”.

Finally, there's the observation of what inflation actually is. It's a change in the value of money – no, not a change in the price of goods, but it's money itself that is changing in value. Continuing inflation means a continual change – decline – in that value of money. What this means is that money now becomes worth more than money in the future. So, profitable companies paying good dividends now become more valuable relative to those investing to make profits in the future. Simply because the money that will be received in that future will be worth less. This means that boring and established firms become – relatively, always relatively here – more valuable as compared to tech and other growth stocks.

Sadly, there is no one answer as to which stocks can beat the UK's 9.1% inflation. There are only indications of what might be able to.