Below, an experienced trader explains the essential things you have to look out for and how CFD stock trading works.

- What is a CFD?

- What is CFD stock trading?

- Good Stock CFDs to trade.

- The most important rules of CFD trading?

- How to set up your stock CFD account.

- How to trade stock CFDs.

- Next steps – strategy ideas for CFD trading.

What is a CFD?

The principles and mechanics of trading CFDs are very straightforward.

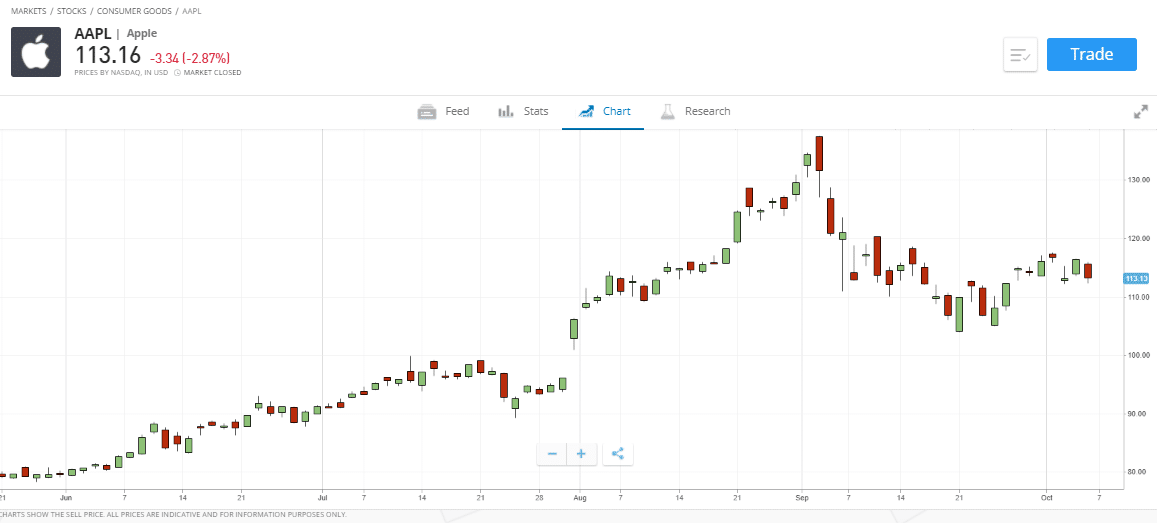

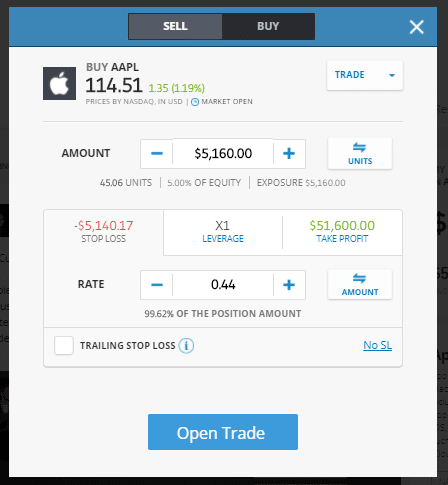

The contract for difference terminology explains how two parties, a trader and a broker, enter into a ‘contract’, for example, to buy Apple stock. Over the next few days following the transaction, the market price of Apple moves and the ‘difference’ between the opening and closing price on the trade is the real-time trading profit or loss.

Source: eToro

Taking out a contract to pay or receive the ‘Difference’ is made very easy by online brokers. There is one over-arching contract which you agree and sign when you open an account. That agreement means you can then open and close contracts as often as you like.

What is CFD stock trading?

The good news is that you will be well supported in the process of buying and selling stocks. Modern online broker platforms have features including news services, research & analysis, ‘Trade of the Week’ and educational resources. All designed to make your trading easy and profitable.

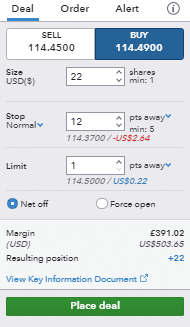

To book a trade, you enter the volume you want to trade, of what stock, and then click a button to execute the transaction.

Taking the Apple stock trade as an example: clicking the ‘Buy’ button will credit your account with the stock (at a price of $114.49) and will debit the corresponding amount of cash. The trade execution process is relatively universal, so it will look the same with any brokers you use.

Source: IG

While the US stock market is open, the price of Apple will fluctuate. If you made the right choice and there are more buyers than sellers, then you’ll post a real-time profit. Get it wrong, and you’ll make a loss.

Two neat characteristics of stock CFDs need to be highlighted.

- You can sell something you don’t own– If you take the view that Tesla stock is over-priced, you can ‘sell-short’ using CFDs. In this case, you will profit if the price falls after you enter the trade.

- CFDs can be tax-efficient– Part of the reason for the CFD market being invented in the 1990s is that UK clients do not have to pay SDRT on stock purchases.

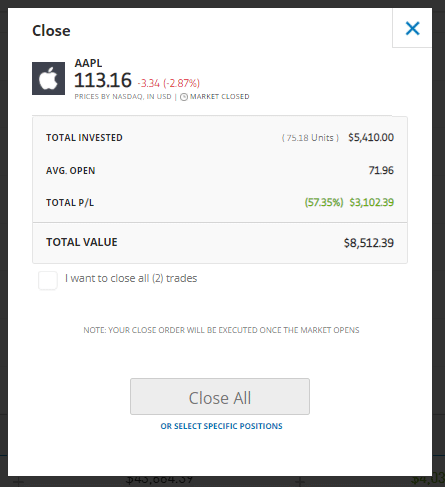

Whether you buy or sell, when you decide to close out your stock position, you have to book a reverse instruction. The broker will help here, and you’ll usually find a button saying something like ‘Close Position’.

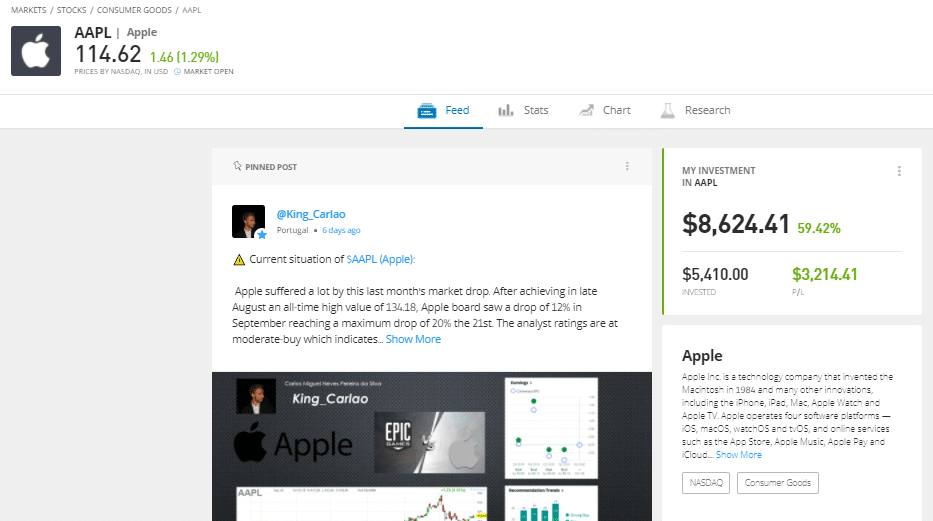

Source: eToro

Once you close the stock position, the difference between the opening and closing price will be established and is shown as a realised profit. You stock balance will return to zero and your cash balance will be initial investment + / – trading returns.

Best Brokers for Trading Stock CFDs:

eToro: 68% of retail CFD accounts lose money

Take a lookTickmill: FCA Regulated

Take a lookIG: Over 16k stocks to trade

Take a lookIf you are ready to start trading CFDs you'll need a broker that is regulated, has low fees and a user-friendly platform. Finding one can be a daunting task, which is why we've selected some of our favourites that tick all of these boxes to help you get started.

Good Stocks to Trade

Having a reason to believe a particular stock is going to experience a price move is a good starting point. That thought could be based on any element of your strategic planning. There are, however, some stocks which are ‘better’ to trade than others.

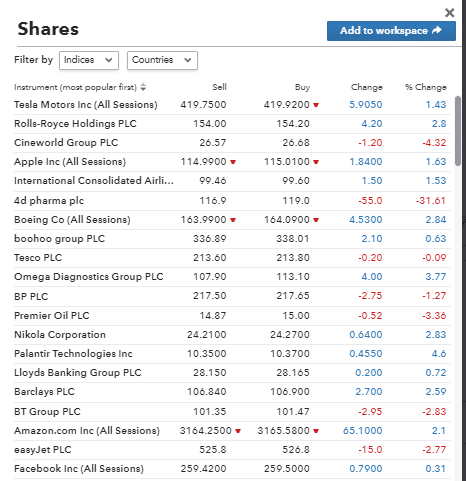

When starting, it’s advisable to pick stocks that are being actively marketed because they are more liquid.

You’ll also want to consider the volatility of the price moves. The price of Tesla CFDs move within a greater range and at a faster pace than, for example, the CFD market in high street retailer J Sainsbury PLC. That reflects the uncertainty about the prospects for Tesla’s ‘moon-shot’ style business model.

Brokers often have a Popular Markets area on their site where traders can find the names in which the majority of investors are active.

Source: IG

Something to look out for with stock CFDs is market hours T&C’s. The CFD instrument you hold with your broker will be priced according to the price of the underlying stock trading on the exchange. When the exchange is closed, the price stops moving.

That can lead to a Gapping Risk, which is the likelihood that the price of your holding will move dramatically overnight. As the market is closed, you’ll be unable to trade out of it.

The most important rules of CFD trading

There are some fundamental guidelines that traders need to keep in mind at all times. Market risk is one thing but losing your money due to ineffective administrative checks is another.

The first is to ensure you use a broker regulated by a Tier-1 authority. Some brokers are regulated by more than one of the below three but look out for the rubber stamp of at least one of them.

- Financial Conduct Authority (FCA) in the UK.

- Cyprus Securities and Exchange Commission (CySec).

- The Australian Securities and Investments Commission (ASIC) in Australia.

Check to see that your broker offers Risk Management tools and other support services. Even traders on Demo accounts can practise using stop-losses, ask questions of customer service, and test the effectiveness of a broker’s research and analysis.

Source: eToro

Mobile trading is becoming increasingly popular. As the quality of service on hand-held devices can range quite widely across brokers, it might be worth considering this review of the best stock trading Apps.

How to set up your stock CFD account

Getting set up to trade on a Demo account takes moments. The accounts use virtual funds but real-world prices. That helps you develop the skills needed to be profitable in a risk-free environment.

Converting your Demo account to a Live trading account requires some form filling. This is so brokers can comply with KYC (Know Your Client) regulations. It’s designed to protect the clients and although it takes a few minutes to complete is part and parcel of using a regulated broker.

The final piece of the process is funding your account. Online brokers support a variety of payment methods, from bank transfers to Skrill. Wiring funds into the account using a debit or credit card is usually the fastest route. In some cases, your account will be funded instantly.

How to trade stock CFDs

Quality brokers offer trading platforms which are examples of user-friendly functionality. The trading monitors are how traders engage with the markets, and as a result, the brokers invest a lot of time and money in getting them just right.

There are still noticeable differences from broker to broker and checking out a selection using a Demo account is one way to find a good fit for you.

Next Steps – Strategy Ideas for CFD Trading

Now that you are up and running the question is how to identify and execute effective trading strategies.

Source: eToro

The top tips come from an experienced trader. There is some benefit from keeping all of them in mind, all of the time. There are times in your trading ‘journey’ when you might be more likely to come across them, so we have broken them down into three categories.

Beginner’s top tips:

- Trade in small size– take the emotion out of trading.

- Know your limits– choose trading styles that fit in with your other commitments.

- Be realistic– top investors are happy with a 20% annual return. If you’re trying to make that on every trade, your downside will also be scaled up to a level that risks you blowing up your account.

- Accept your losses – the aim is to make a profit, not have a 100% track record. Accepting and cutting losses early on can help you avoid blowing up your account on one bad trade.

Intermediate top tips:

- Self-analyse– continuously analyse what works and what doesn’t.

- Don’t’ over-trade– This is a common error, and ‘unnecessary’ bad trades can make the difference between profit and loss.

- Consider new strategies – Consider the strength and weaknesses of both Technical Analysisand Fundamental Analysis.

Advanced top tips:

- Paradigm shift – The dynamic nature of markets is a constant threat. Even successful traders get caught out when the rules of the game suddenly change.

Final thoughts

Trading stocks using CFDs is incredibly easy. Mastering the techniques and making a consistent positive return is harder to achieve. There’s no way around the fact that becoming a profitable trader takes time and dedication.

People who read this also viewed: