** Content does not apply to US users**

Although MetaTrader 4 is the most widely used trading platform in the world, eToro does not offer its clients the cutting edge product from MetaQuotes.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Also, while several CFD brokers offer the choice of multiple terminals plus the MT4, traders registering with eToro would not have the opportunity to experience the tons of features offered by the globally renowned platform, unfortunately.

However, you can trade in the 2000+ assets offered by eToro via its proprietary trading platform, which is pretty good and used by millions of traders worldwide.

Before We Get Started, Take A Look At Our Other EToro Guides:

In this trading guide, we would be looking at the eToro platform and the several benefits that you can derive as a trader. However, if you still prefer to go with a CFD broker with an MT4 platform, we provide a glimpse of a couple of well-renowned brokerage firms that do offer the MetaTrader 4 terminals.

So, let’s get started.

The eToro trading platform and app

eToro is one of the leading social trading platforms with over a million users in 140+ countries. The platform is available as web and mobile applications and features 2000+ assets comprising currencies, stocks, indices, commodities, cryptocurrencies and ETFs. The eToro terminal is accessible directly from the client area on your computer and supports Google Chrome, Safari, Firefox and Edge. You can also download the mobile app from Google Playstore or the Apple App Store.

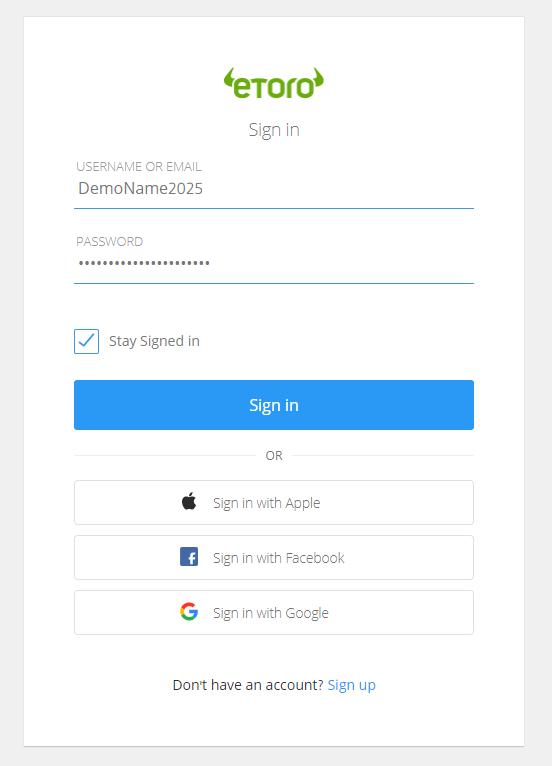

You can access the client terminal in three simple ways.

- Create a user id and password

- Sign-in from your Apple device

- Log in using your Facebook/ Gmail account.

Once you hit the ‘sign-in’ button, you are directly inside the eToro client area from where you can choose between a real or a virtual account and start trading.

In this guide, we analysed both the web and mobile applications and have highlighted the key features in our review.

eToro Web

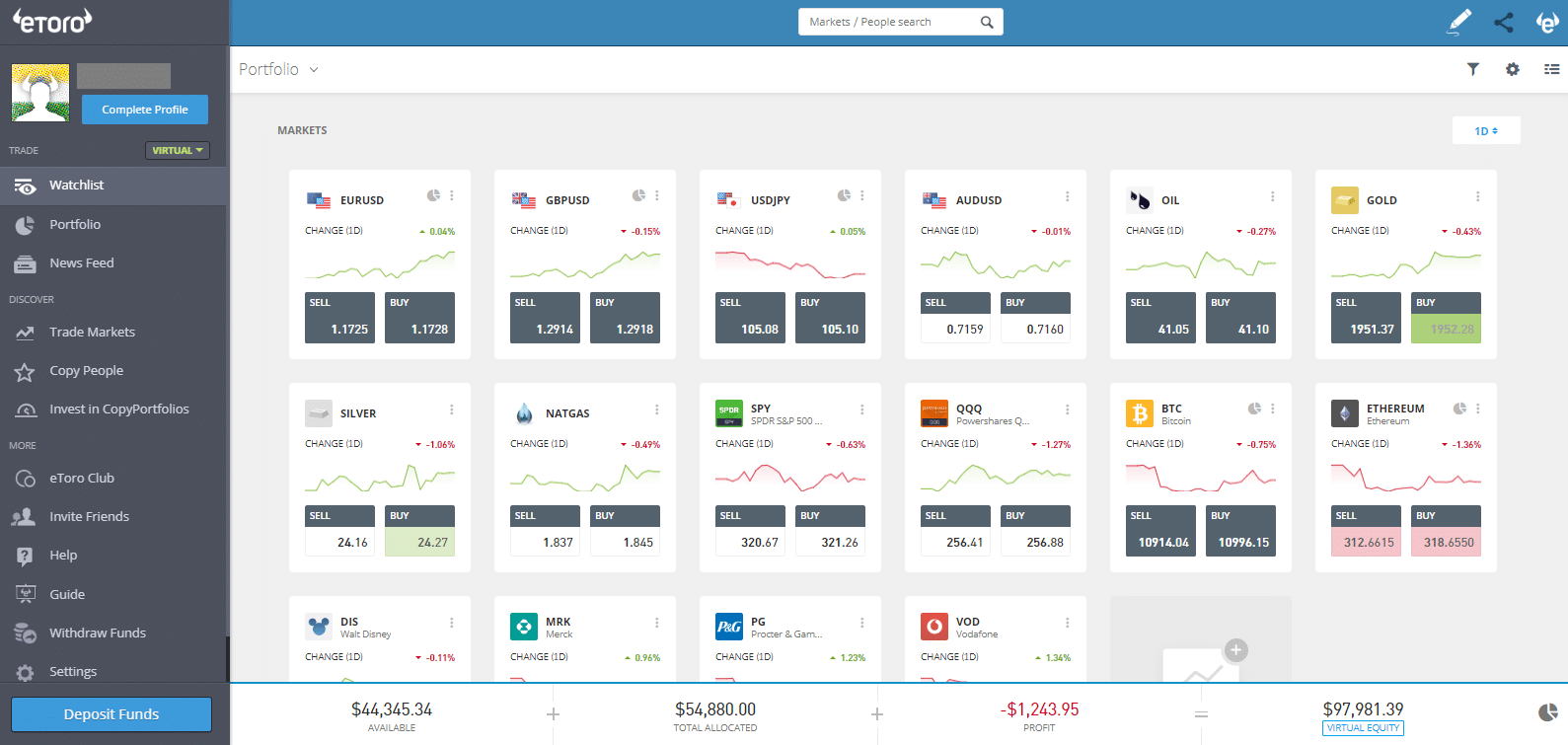

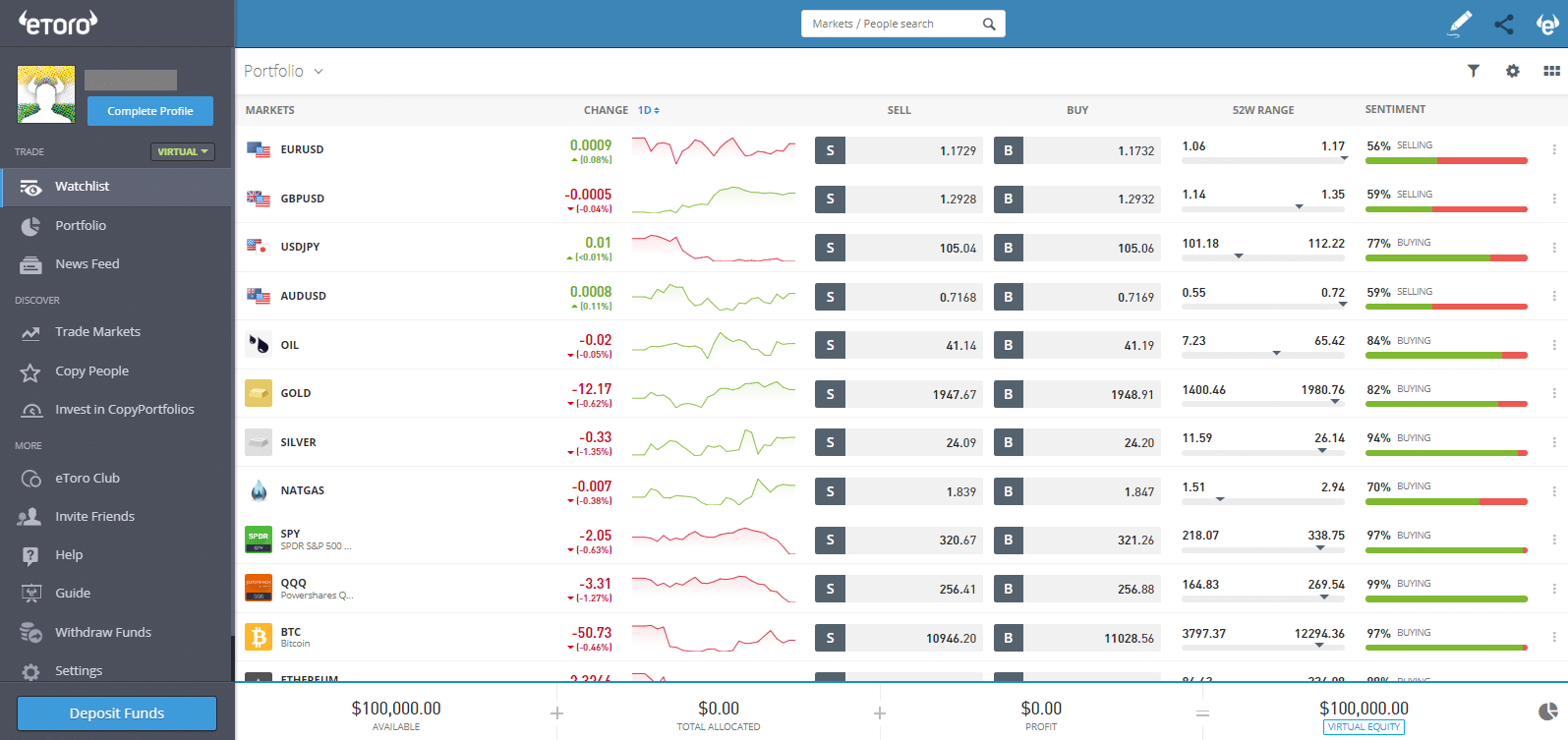

As mentioned earlier, you can access the web application directly from the client area once you sign-up with the broker. The default workspace comprises a menu on the left, available capital at the bottom, the option to share your screen or add notifications at the top, while the watchlist covers the rest of the area.

The workspace also includes a market sentiment indicator and a chart icon that takes you to eToro’s Procharts. You can change the default workspace, include notifications, choose your local currency from 18 available options, and also set your privacy status.

If you’re looking for help, eToro has included a quick guide that would take you through the various features of the client trading terminal. The eToro web terminal supports multiple trade types, including one-click order entries and the SL/TP function. Here are some of the other key features of the platform

Market sentiment indicator

The panel shows the percentage of long/short positions along with the proportion of traders invested in each financial instrument.

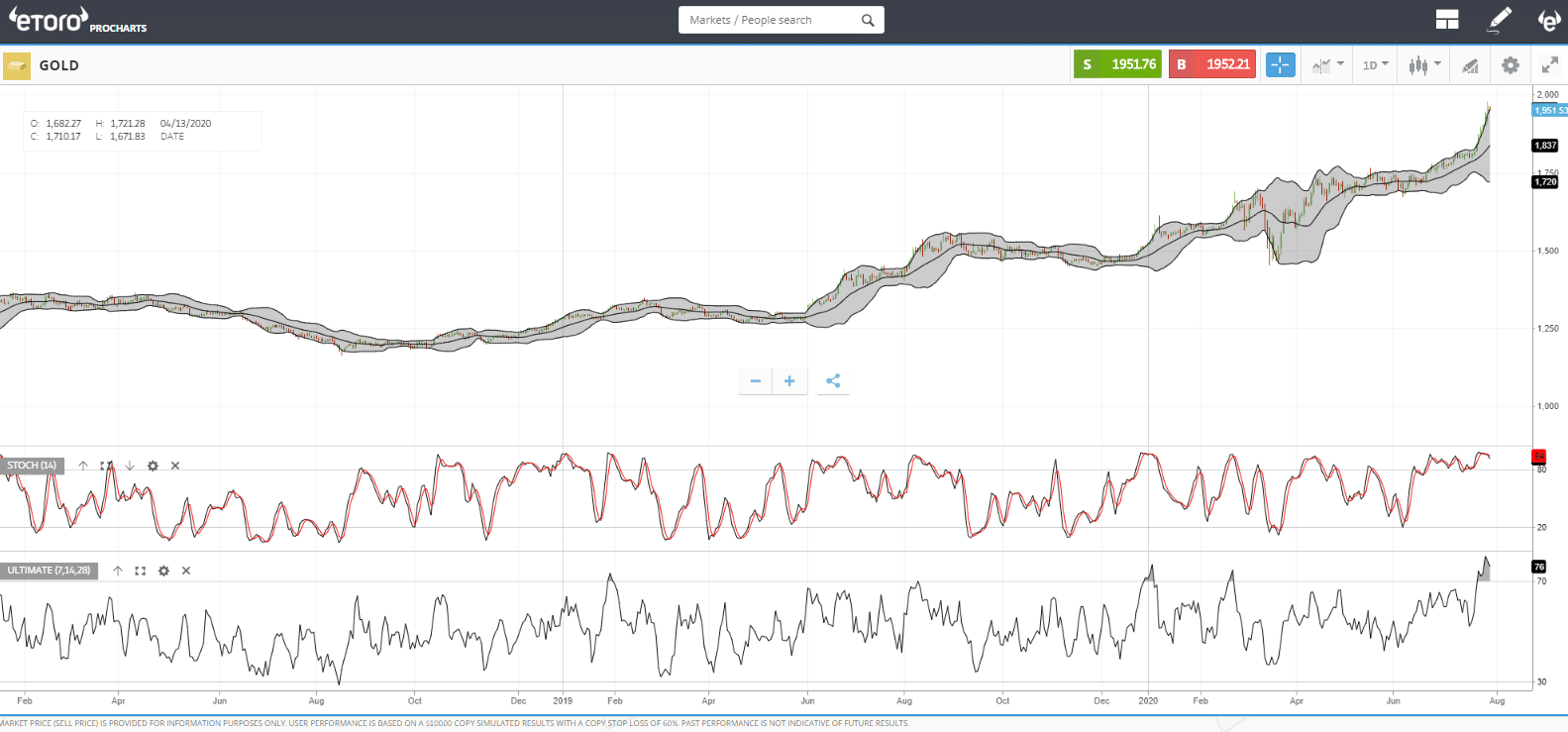

Procharts

Click on the chart icon on the eToro platform to access live charts from Procharts. The technical analysis software includes five chart types in nine-time frames- One minute- one week. Besides, you can carry out a detailed chart analysis using the 65 technical indicators plus drawing tools.

Portfolio

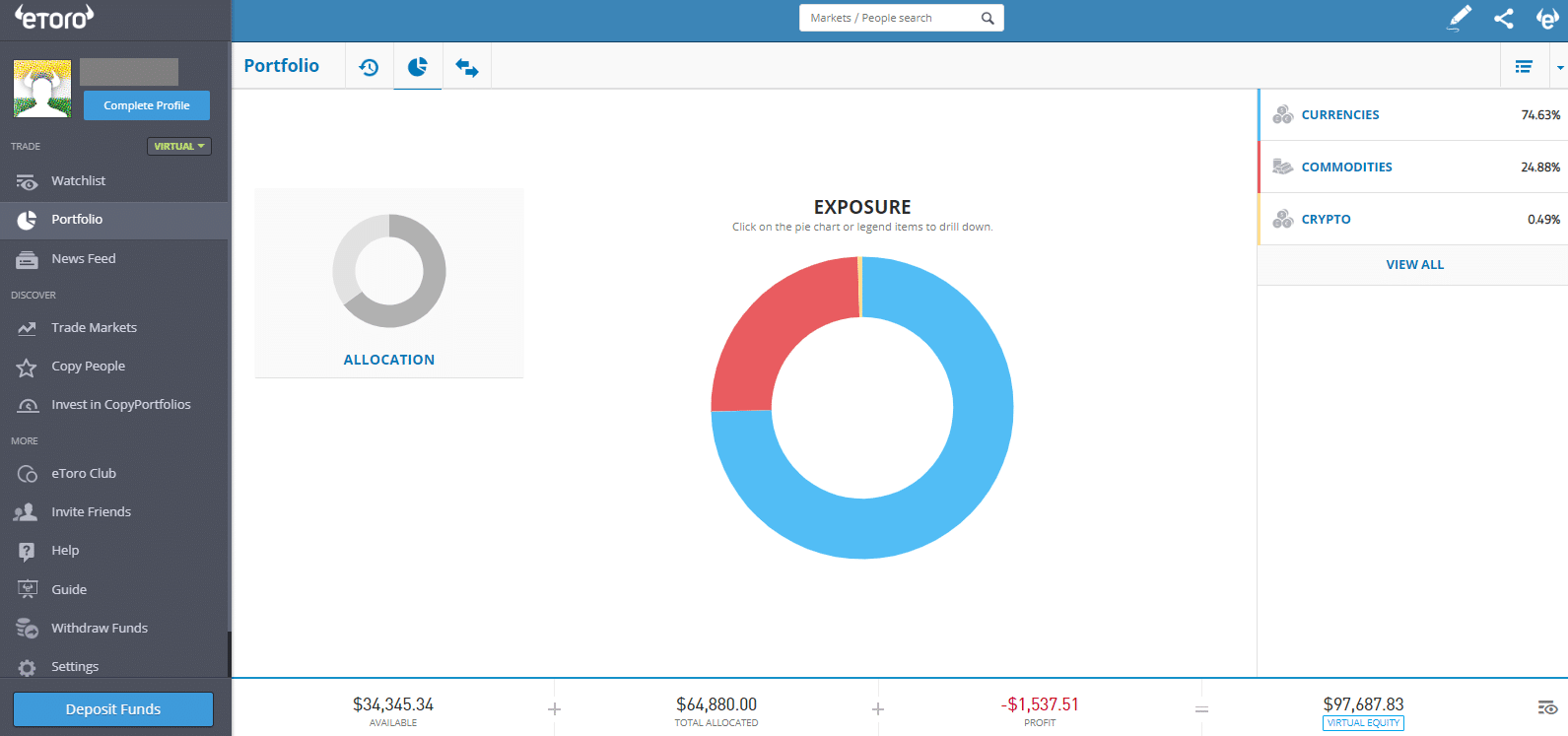

The portfolio section displays the asset allocation and the real-time performance for each instrument. You can increase/decrease your allocation, view charts and set price alerts for individual scrips.

Newsfeed

This section includes updates from the eToro trading community.

Trade Markets

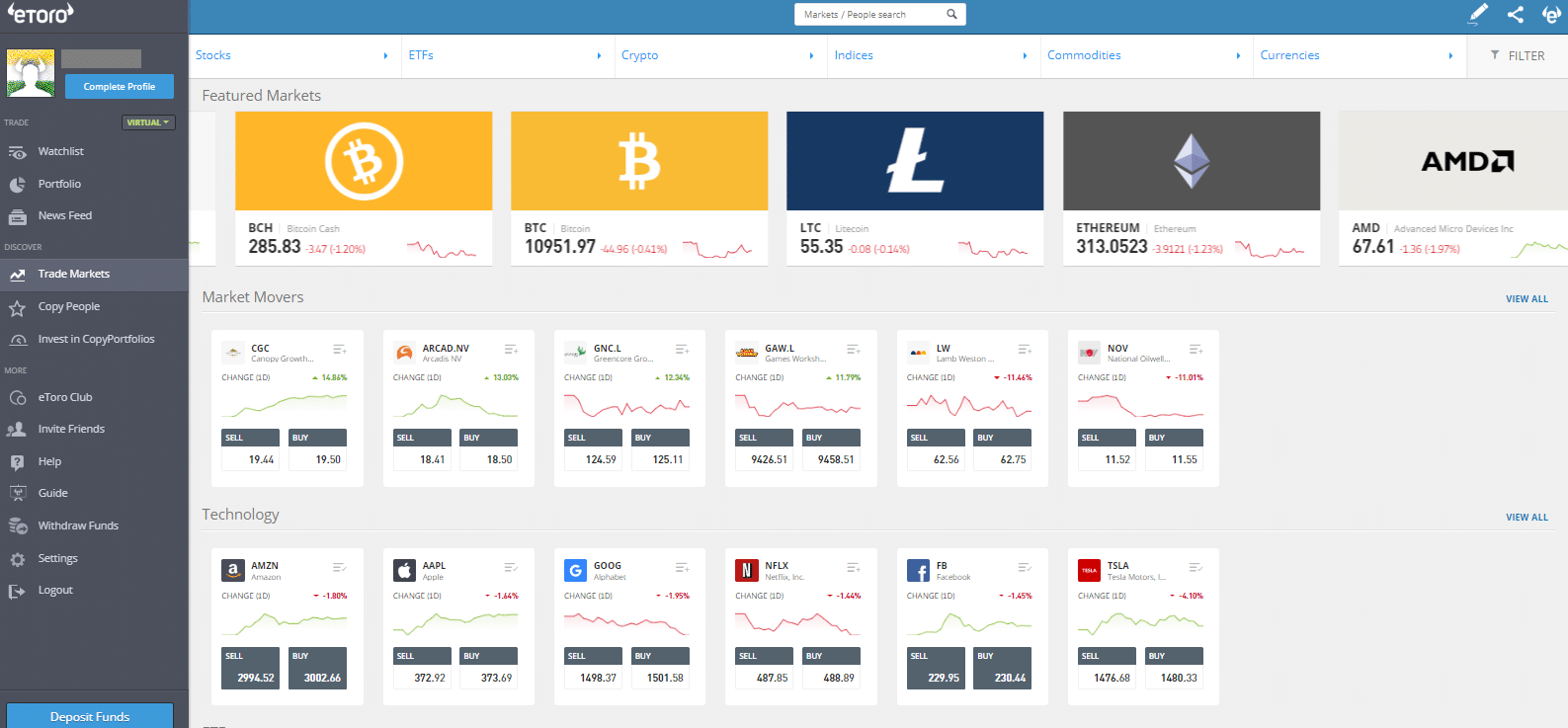

Categorise your trading parameters based on featured markets, market movers, technology, ETFs and others.

Copy People

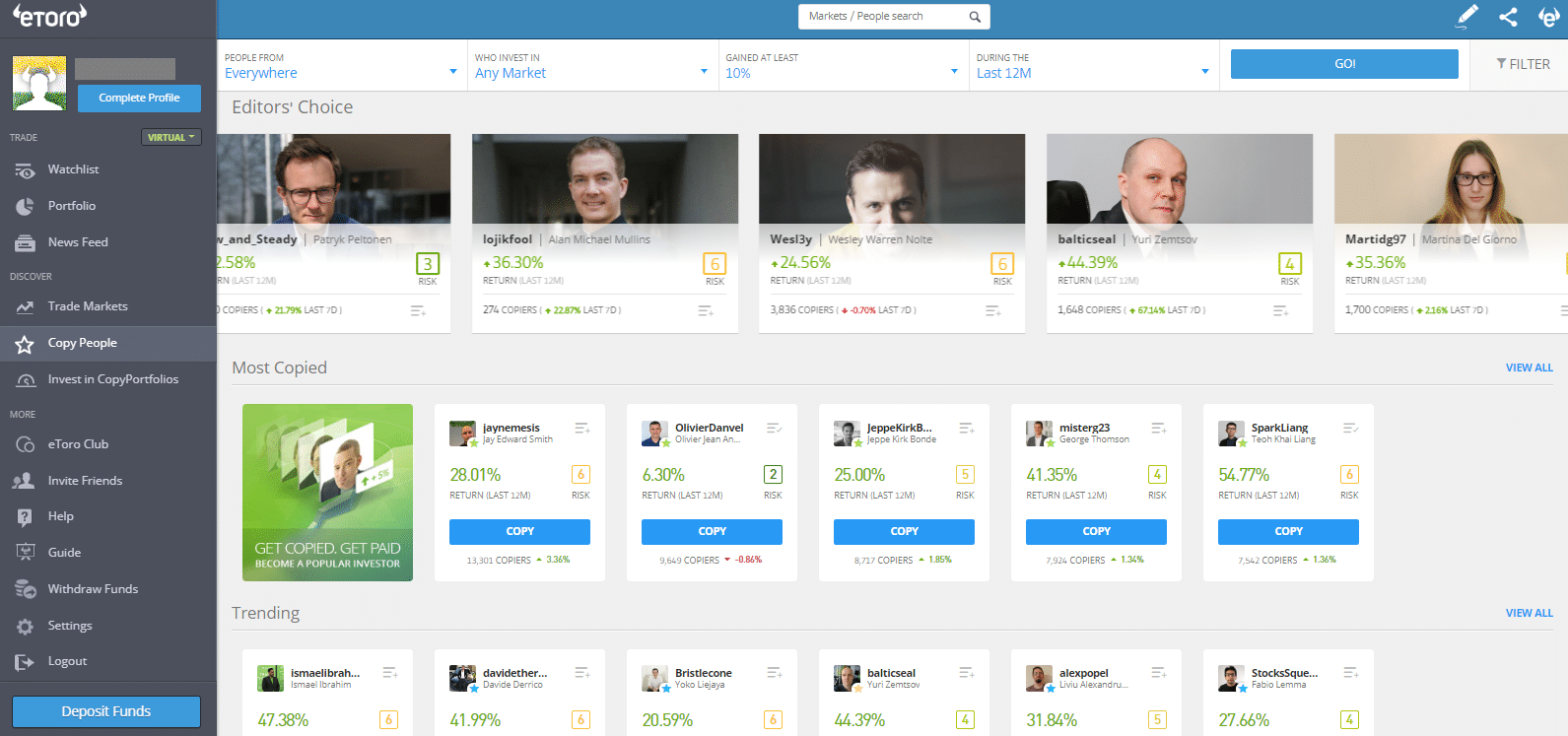

Here, you can choose the trader/s you wish to copy by filtering them according to their nationality, markets, and profits earned. eToro also displays a large number of successful traders, grouping them under editor’s choice, most copied traders, top investors and on their risk score.

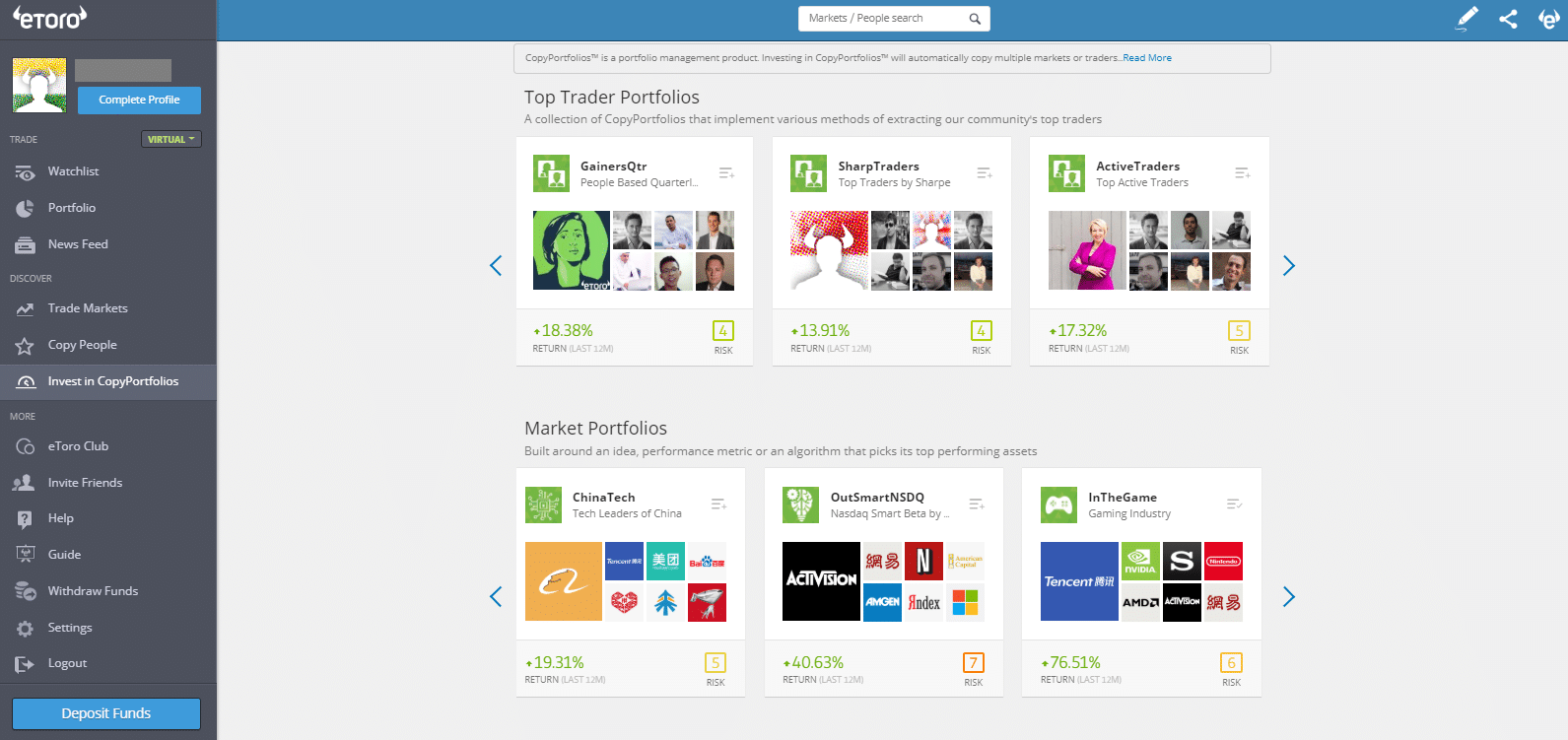

Invest in CopyPortfolios

The section includes a collection of portfolios from the top traders in the eToro community. Click on the portfolio to view the asset-wise allocation, risk metrics, assets under management, and the returns.

Happy with the performance! Go ahead and subscribe to copy multiple markets or traders based on a predefined investment strategy.

eToro Mobile app

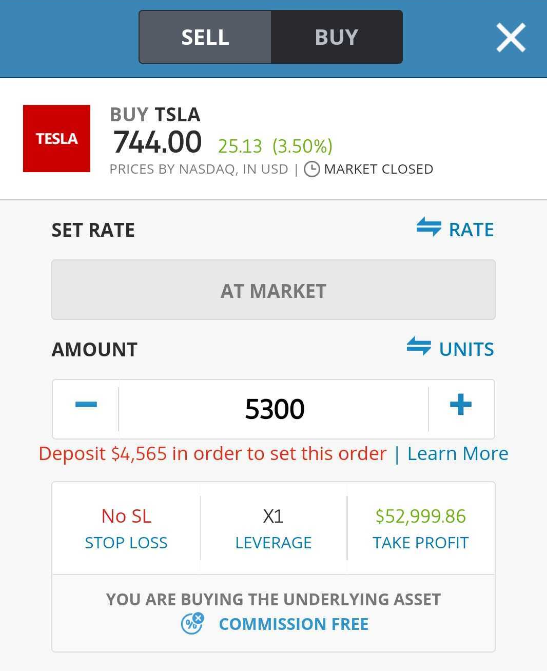

We tested the eToro mobile app from an Android device and found it extremely easy to operate. The user-friendly interface has a menu on the top left with all the characteristics segregated into independent panels. Besides, the platform replicates all the features of the web terminal, including streaming real-time price data, portfolio monitoring, one-touch orders, CopyPortfolios and the option to deposit/withdraw funds.

CFD brokers that support MetaTrader 4

The cutting edge eToro platform is one of a kind, especially with social trading and the CopyPortfolio features. While the charting software may not be the best in the industry, it does serve the purpose.

However, if you still prefer a CFD broker who offers the MT4 platform, you could look at the following two alternatives

Pepperstone

Pepperstone is a multi-asset CFD broker based out of Australia. Incorporated in 2010, the award-winning broker offers a range of 150+ assets comprising CFDs in FX, commodities, cryptocurrencies, shares, indices and the US dollar index. Besides three powerful platforms- MT4, MT5 and cTrader, the broker also provides clients with the opportunity to carry out social trading via Myfxbook, Mirror Trader and DupliTrade. Pepperstone is a multi-regulated broker and users can benefit from the low trading costs, lightening-speed order execution and VIP client service.

XTB

The XTB Group, established in 2002, is headquartered in Poland and regulated by multiple agencies in Europe, the UK and Belize. The CFD broker’s product offering includes 2000+ financial instruments across five asset classes from two trading platforms- MT4 and the proprietary xStation 5.

With multiple account types comprising a mix of zero or low commissions, max leverage of 500:1, XTB provides retail traders with the opportunity to access hundreds of global markets instantly. XTB currently operates from 13 global offices, including the UK, Germany and France.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Don’t invest in cryptos unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.