** Content does not apply to US users**

A good online trading broker is one that offers low minimum investment deposits, high-quality trading tools, and full access to excellent customer service with no hidden fees.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

At AskTraders, we believe that one of the exceptional trading brokers is eToro, with its low minimum deposit and great additional features.

Table of contents

Below is a summary of why eToro is the best brokers to meet all your trading needs. You can also look at our eToro review for complete detail on trading with the broker.

- Low minimum deposit

- Easy access

- Short and long-term investments

- Innovation

eToro Minimum Deposit

The minimum first-time deposit varies from $50 to $10,000 depending on your region and country. All redeposits are required to be at least $50. For deposits made by wire transfer, the minimum deposit is $500.

Deposits in the United Kingdom

The minimum first-time deposit for UK residents is $100 unless you're funding your account via Wire Transfer ($500 min.) Redeposits must be at least $10. If you fund your account using GBP, eToro will charge a fee to convert your deposit into USD.

| Country | First-Time Deposit | Redeposit Min. |

| Australia/United States | $100 | $50/$1 |

| United Kingdom | $100 | $10 |

| Israel | $10,000 | $50 |

| South Africa | $2,000 | $50 |

Related: eToro Fees Guide: What Fees & Charges To Expect

The minimum first-time deposit on eToro for a corporate account is $10,000. Unverified accounts are limited to a maximum total deposit of $2,250, so be sure to verify your account if you want to make a larger deposit.

How to Make a Deposit

- Log in to your eToro account

- Click ‘Deposit Funds' in the lower left-hand corner

- Enter the deposit amount and select your base currency

- Select your payment method

- Click ‘Submit' to confirm your deposit

eToro Deposit Methods, Time, and Currencies

| Credit/Debit Cards | Instant | USD, GBP, EUR and AUD | International – Credit Card not supported for UK users | $40,000 |

| PAYPAL | Instant | USD, GBP, EUR and AUD | International – Paypal not supported for UK users | $10,000 |

| NETELLER | Instant | USD, GBP, EUR | International | $10,000 |

| SKRILL | Instant | USD, GBP, EUR | International | $10,000 |

| RAPID TRANSFER | Instant | USD, GBP, EUR | EEA | $5,500 |

| iDEAL | Instant | EUR | The Netherlands | $50,000 |

| Klarna / Sofort Banking | Instant | USD, GBP, EUR | Germany, Austria, The Netherlands, Switzerland, Italy, Spain, Belgium and Poland. | $30,000 |

| WIRE TRANSFER | 4-7 days | USD, GBP, EUR | International | Unlimited |

eToro Deposit Currencies

eToro platform operates in USD, so it will not charge any fees for USD deposits. They also accept deposits in 6 other currencies: EUR, GBP, AUD, IDR, MYR, VND. When converting the funds to USD, a conversion fee is charged.

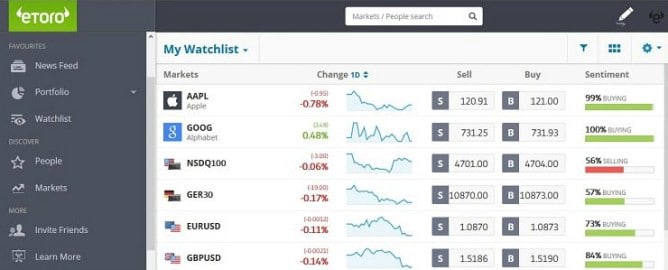

Easy Access to eToro Trading Platform

Despite eToro's low minimum deposit, the platform is easy to access and navigate. The platform was initially conceived as one that would make online trading available to anyone anywhere. The developers wanted to build an intuitive platform to give traders an authentic online experience and continued developing their ideas through social trading.

eToro provides cutting-edge financial technology, including CopyPortfolio, Popular Investor Program, and the CopyTrader system.

Additionally, eToro has a mobile option for tablets and phones and is available for iOS and Android. The mobile option makes all features accessible using an intuitive interface.

Besides, the ability to use eToro on the move lets traders have easy access to their portfolios and take advantage of investment opportunities at any time.

Short and Long Term Investments on eToro

eToro offers a range of investment types that can be either short or long term. Traders looking for fast-moving financial instruments may look at trading in currencies with Forex or invest in Bitcoin and other cryptos on eToro.

Long-term investments can include oil, precious metals (gold, silver, diamonds), and natural gas. eToro offers many options for trading in a wide range of financial instruments. To make things easier, take a look at our top-rated stockbrokers in the UK to find the right stock broker for your trading journey.

eToro is Leading on Technical Innovation

eToro was at the forefront of the fintech revolution when it was launched in 2007. Since then, it has developed the WebTrader platform in 2009 with tools that both experienced traders and beginners could benefit from.

In 2012, eToro added to its offer of currencies, commodities, and other assets by giving access to a wide selection of stocks for trading, allowing traders to diversify their portfolios further and invest in the global stock market.

CopyPortfolio was introduced in 2016 as a long-term investment product. These are managed portfolios with a predetermined strategy that bundles various assets or top traders together.

Social Trading and Other Benefits

Copy Trade

The technology behind Copy Trader lets you replicate another trader's portfolio and trading activity automatically. Some traders prefer to trade on their own, and eToro supports this and offers social trading opportunities.

eToro's copy trading was launched in 2010. The platform offers transparency so that each trader's portfolio, track record, and a risk score is exposed to enable you to make sound decisions when deciding who to copy.

Newsfeed

Any trader can post relevant information, such as explaining a decision on a particular investment or sharing any other type of knowledge with the eToro community. Successful traders can be followed, and you gain the benefit of becoming more knowledgeable about how to trade in various markets and make better investment decisions.

A vital feature of the platform is eToro's excellent apps for mobile devices that allow investors to trade wherever they are and giving non-stop access to markets day and night.

The platform also allows new traders to open a demo account to begin to practise the skills they are picking up but using virtual money instead of their own. It's a risk-free way of easing into the world of trading and helps traders prepare to open a live account when they have the confidence to do so.

Further Reading

- What our experts about eToro web trader

- Which are the best shares for beginners

- How good is eToro's app

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or

down. Your capital is at risk.

Don’t invest in cryptos unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.