An experienced trader gives their view on what are the most important things to look out for and how CFD forex trading works. In this CFD Forex guide we will explore:

- What is a CFD?

- What is CFD Forex trading?

- Good Forex pairs to trade

- The most important rules of CFD trading?

- How to trade Forex CFDs

- Next steps – strategy ideas for CFD trading.

What is a CFD?

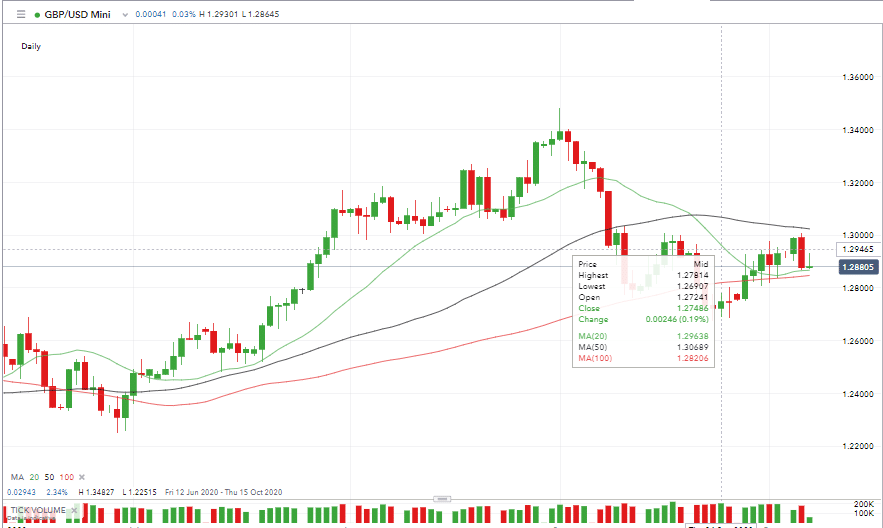

The contract for difference terminology is a bit of a mouthful. To simplify matters and as an example, a trader opens a Contract with a broker by buying GBP. After the market price of GBP moves, the Difference between opening and closing price on the trade is booked as a trading profit or loss.

Source: IG

Taking out a contract to pay or receive the difference is made super-easy by online broker platforms.

What is CFD forex trading?

A trading platform will have all sorts of features designed to support your trading. There will be news features covering the latest currency market events and in-depth research notes to help you freshen up your trading ideas.

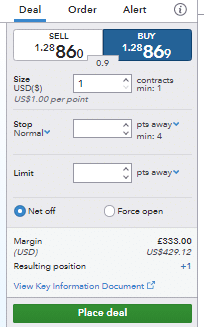

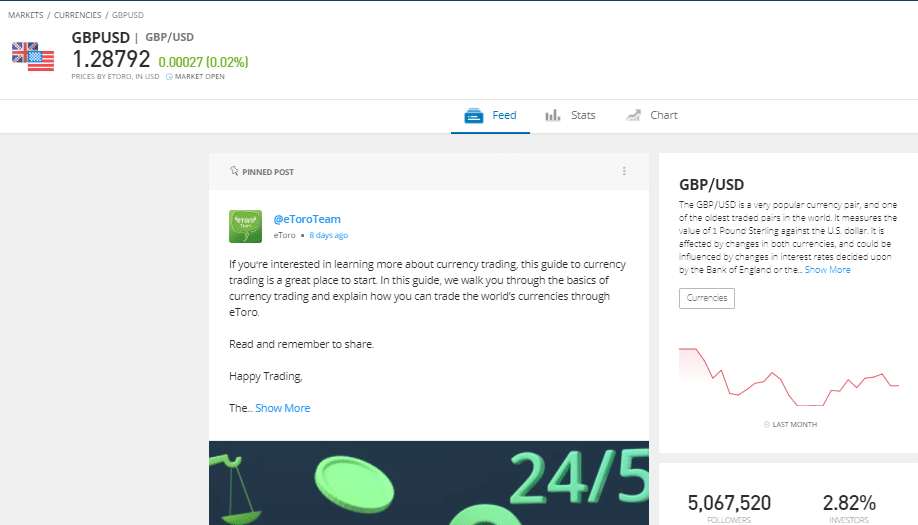

The basic process of booking a trade is much the same across all brokers. The trading dashboard will have a price monitor for each market. Taking GBPUSD for example, by clicking the ‘Buy’ button, your account will be credited a balance of GBPUSD. You have gone long GBP and short the US dollar.

Source: IG

As the two currencies interact with each other in the global market place, the price will move according to whether there are more buyers (like you) or sellers at any one time.

If you get the call right, GBP will go up in value, and you’ll show a profit. Misread the situation and you’ll report a loss.

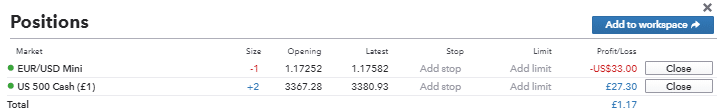

Source: IG

As and when your trade idea comes to the end of its life, you can close the position. This again requires little more than a click of a button. You will sell the GBPUSD position and the difference between the opening and closing price will then be shown as a realised profit.

Good forex pairs to trade

Our example used GBPUSD. It’s a popular currency pair to trade and is one of the major currency pairs. The currencies of the two major economies jostle with each other, and due to the size of the countries involved, there are millions of traders active in GBPUSD. That causes the market to be very liquid and limits the risk of individuals or organisations intentionally or unintentionally manipulating it.

Other Major Currency pairs and their nicknames are:

- The euro and US dollar: EUR/USD – Eurodollar or Fiber

- The US dollar and Japanese yen: USD/JPY – Gopher

- The British pound sterling and US dollar: GBP/USD – Cable

- The US dollar and Swiss franc: USD/CHF – Swissie

- The Australian dollar and US dollar: AUD/USD – Aussie

- The US dollar and Canadian dollar: USD/CAD – Loonie

- The New Zealand dollar and US dollar: NZD/USD – Kiwi

The Major currency pairs are popular markets for beginners and advanced traders. There’s a lot of useful research information freely available, and the CFD spreads – the difference between the buy and sell price at any one time – are tight because of the large volume of activity.

Each currency pair has distinct characteristics, so some traders find a good natural fit with one pair. Others trade across the board and some trade the Minor and Exotic markets which offer something different. Minor forex pairs include:

- EUR/GBP – Euro/British pound

- CAD/JPY – Canadian dollar/Japanese yen

- GBP/AUD – British pound/Australian dollar

- GBP/JPY – British pound/Japanese yen

- EUR/JPY – Euro/Japanese yen

- EUR/NZD – Euro/New Zealand dollar

- EUR/AUD – Euro/Australian dollar

- EUR/CHF – Euro/Swiss franc

- EUR/CAD – Euro/Canadian dollar

- CHF/JPY – Swiss franc/Japanese yen

- AUD/JPY – Australian dollar/Japanese yen

- NZD/JPY – New Zealand dollar/Japanese yen

- GBP/CHF – British pound/Swiss franc

- GBP/CAD – British pound/Canadian dollar

Some of the Exotic pairs are:

- USD/HKD US Dollar/Hong Kong Dollar.

- USD/SGD US Dollar/Singapore Dollar.

- USD/SEK US Dollar/Swedish Krona.

- EUR/TRY Euro/Turkish Lira.

Forex trading is a 24/5 business so you’ll want to get up to speed on some of the market T&C’s such as market hours.

The most important rules of CFD trading

There are some fundamentals that you need to keep in mind when trading forex CFDs.

The first is to ensure you use a broker regulated by at least one of the Tier-1 authorities below:

- Financial Conduct Authority (FCA) in the UK

- The Australian Securities and Investments Commission (ASIC) in Australia

- Cyprus Securities and Exchange Commission (CySec)

Also, find a broker that offers a comprehensive range of support services. Even traders on Demo accounts can use the customer service, research and analysis.

Getting familiar with Risk Management tools such as stop-losses and Negative Balance Protection is also a good idea as is trialling your forex trading on a hand-held device.

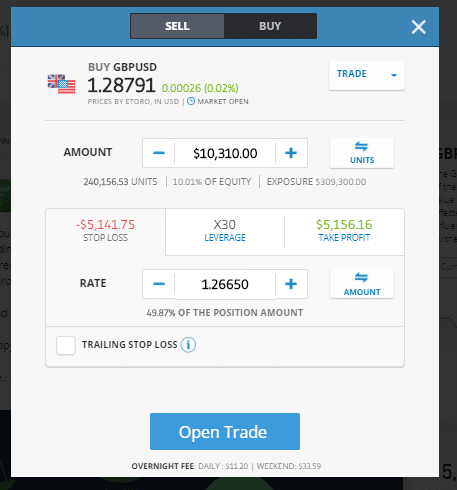

Source: eToro

Many brokers now offer Apps for mobile trading and the quality of service can range quite widely. If you think you’ll be trading on the move then factor in the quality of the mobile trading service and consider this review of the best forex Apps on the market.

How to trade forex CFDs

Most Demo accounts take a few moments to set up and bring a lot of the same privileges as enjoyed by Live account holders. Setting up a Live trading account requires some form filling – most of which is based around client protection procedures.

Brokers typically offer several ways to transfer funds into your trading account. Wiring funds into the account using a debit or credit card can in some cases see your account funded almost instantly.

Quality brokers have trading platforms which are world-class examples of how to make a complicated situation easy to understand. They have been designed to optimise the user experience and to provide you with everything you need and nothing that you don’t.

It’s still worth giving a few different broker platforms a ‘test-drive’. There’s nothing to lose from signing up with a few other brokers and booking some forex trades on Demo.

Next steps – strategy ideas for CFD trading

Getting set up and building an understanding of how to trade CFD forex is Stage 1 in the process of making a profit. The next part involves developing strategies that help you get the better of the market.

Source: eToro

The top tips below come from an experienced trader. There is some benefit from keeping all of them in mind, all of the time. There are times in your trading ‘journey’ when you might be more likely to come across them, so we have broken them down into three categories.

Top tips for a beginner

- Keep position size small– trade in amounts that you don’t care about; unemotional trading is good trading.

- Understand your resources– choose trading styles that fit in with your existing lifestyle commitments.

- Be realistic– risk return is the name of the game. The greater the targeted return, the greater the chances of you losing your stake.

Intermediate top tips:

- Self-analyse– give yourself feedback on what works and what doesn’t.

- Trade less frequently– Win/Loss ratio is important. You may be picking winning trades but losing overall because of ‘boredom’ trades.

- Consider new strategies – Technical Analysis and Fundamental Analysis often work hand in hand but getting to know the workings of each will improve your understanding.

Advanced

- Automated trading has its benefits – using software to implement your trading can free up time to develop new ideas, or indeed enjoy the benefits of being a profitable long-term trader. Automated trading is particularly well suited to trading the forex markets.

- Keep an open-mind – A paradigm shift is a constant threat. What worked yesterday and last year might not do so tomorrow.

Final thoughts

Trading Forex using CFDs is incredibly easy to do but hard to master. Some beginners do get lucky and make returns immediately, but the process of becoming a profitable trader usually takes time and dedication.

Fortunately, the top-grade brokers provide Demo Accounts, which allow you to trade the currency markets at zero risk.

It’s not only novices who take up the option of trading in a virtual environment. Experienced and pro traders also do so when testing new ideas. The basics of Forex CFDs are easy enough to get to grips with, and Demo and Live trading accounts are where lessons are learnt.

People who read this also viewed: