What at first looked like any other altcoin became the go-to altcoin for crypto investors suddenly in 2021. At one point the coin increased in value by 600% overnight, challenging bitcoin’s position as the crypto to talk about. The resulting price crash in 2022 looked like it might represent an existential threat to the coin, but it is still widely available to trade on online platforms. It’s a high-risk proposition, but timing trade entry right could result in significant returns — Dogecoin isn’t going anywhere just yet.

- What is Dogecoin?

- How Dogecoin Compares to Other Cryptos

- Technical Differences Between Dogecoin and Bitcoin

- How to Buy DOGE in the UK at eToro

- How to Buy DOGE in the UK at Kraken

- Which is the Best Dogecoin Wallet?

- Is Dogecoin a Good Investment?

- Conclusion

What is Dogecoin?

Dogecoin is only one of over 18,000 cryptos in existence. It uses the same blockchain technology as Bitcoin and offers similar functionality, being a virtual store of wealth and a means of transaction.

Invented by software engineers Billy Markus and Jackson Palmer, Dogecoin supports instant transactions, something Bitcoin struggles to do, and it is free from traditional banking fees. However, the coin was initially set up in 2013 as a parody of BTC. Founder Billy Marcus claims to have sold out of his personal holding in 2015, highlighting the tongue-in-cheek approach taken by its creators.

How Dogecoin Compares to Other Cryptos

Dogecoin's Unique Selling Point

The USP of Dogecoin that led to its incredible price spike sums up the crypto market's sense of irreverence. In short, Dogecoin is fun. While other coins are carefully managed by their creators and other parties with vested interests in a coin being successful, Dogecoin has followed a different path. Set up as a spoof version of BTC, it's mainly been left to fend for itself.

Self-Supporting

Taking this open-source approach one step further means that the coin is not actively maintained, with the last code update taking place in 2019. Instead of active maintenance, miners of the coins are responsible for maintaining the platform and receive 10,000 Dogecoins for each block they extract. This hands-off approach divides opinion. Some claim that Dogecoin won't ever become a mainstream coin because of it. For others, it has ironically become another plus point. They believe that by proving that its system is self-sustaining and doesn't need to be overhauled, Dogecoin has taken a step towards being universally accepted as a means of exchange.

Technical Differences Between Dogecoin and Bitcoin

More than 128 billion DOGE are in circulation, a number that far exceeds the 18.5 million BTC that have been mined. That is due to Dogecoin following an inflationary design. Whereas the total supply of Bitcoin is capped at 21 million, the number of Dogecoins available to be mined is endless. The pros and cons of the two systems soon move into economic theory and questions of whether increasing money supply is good or bad for an economy. For investors, it is essential to know that this feature marks a critical difference between Dogecoin and a lot of other big-name cryptos.

Dogecoin Attracts First-Time Buyers of Crypto

Despite (or possibly because) of its peculiarities, Dogecoin is a popular entry coin for first-time buyers of crypto. This has resulted in a thriving online community of Dogecoin fans who've created a friendly space where no question is too obscure, with help always on hand. When it comes to buying cryptocurrencies, eToro is a popular choice due to the user-friendly platform and strong regulatory protection it provides for clients.

How to Buy DOGE in the UK at eToro

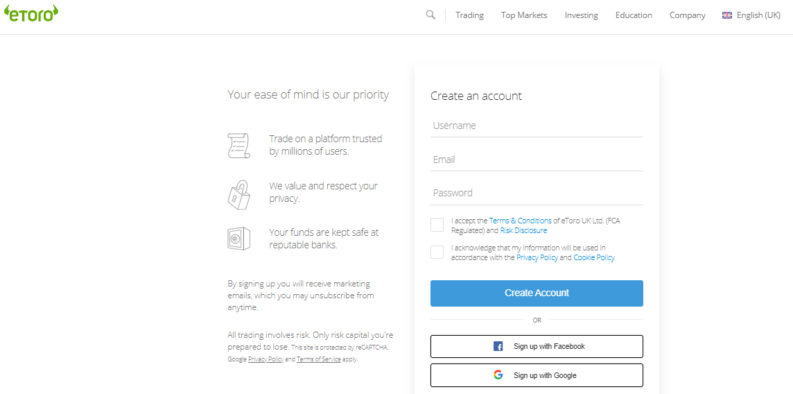

Step 1. Create an account

eToro is possibly the easiest trading platform to sign up to. Its functionality is specifically tailored to beginners, and while the broker makes sure to tick all the boxes in terms of regulatory rules, it does so in an extremely user-friendly way.

The first step in the online process is to visit the eToro onboarding page. Click on the ‘Join Now’ button to enter the onboarding screen. At this point, it’s simply a case of inputting information such as your name and email address, or alternatively, using existing profiles from Google or Facebook to auto-fill that information.

*Your capital is at risk

The intial stage of onboarding will give you access to the eToro platform in demo account format. The services on offer for demo and live accounts are identical, but in demo mode you’re practising with virtual funds rather than real money.

Dogecoin is a fast-moving market and a lot of investors want to head straight to trading real cash. To trade with real funds, you need to provide more personal information. This is so that the broker can identify you and keep your funds secure. As eToro is regulated by the FCA, it requires that you set up a profile based on your trading experience and investment aims.

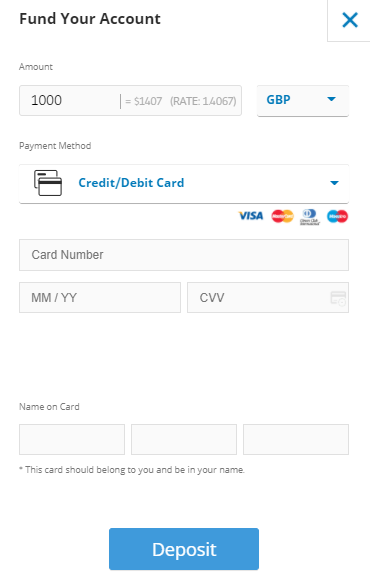

Only you will have access to your online account at eToro and funds sent to it can be returned solely to the paying account. This is part of the broker’s regulatory licensing and is intended to cut down on money laundering. However, it also adds an additional layer of security. There are a variety of ways to pay funds into an eToro account, but debit and credit cards are popular due to the transactions being almost instant.

The actual monitor used is very similar to any other online bank account or purchase. Locate the ‘Deposit Funds’ button in the left-hand sidebar. Clicking on this will take you through to a screen where you are prompted to input the amount you want to send and click ‘Deposit’.

Source: eToro

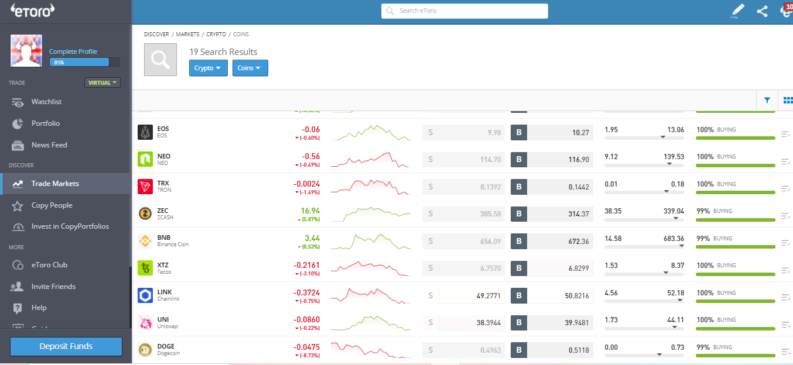

Step 2 – Find Dogecoin

Use the search function bar at the top-centre of the eToro homepage to locate the Dogecoin market, or alternatively click on the ‘Discover Markets’ button near the top of the left-hand toolbar.

*Your capital is at risk

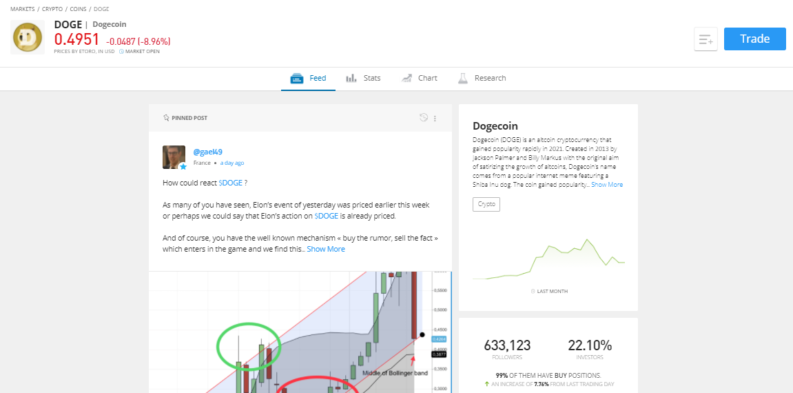

Clicking on the DOGE icon will take you through to the Dogecoin market. Here, you can check the price chart and catch up with all the latest views and comments of other eToro clients who input their thoughts into the ‘Feed’ section of the Dogecoin page.

Source: eToro

Step 3 – Buy Dogecoin

Click on the blue ‘Trade’ button on the top right-hand area of the eToro Dogecoin screen to be taken through to the part of the site where you input your order to buy the coin.

Step 4 – Complete your order

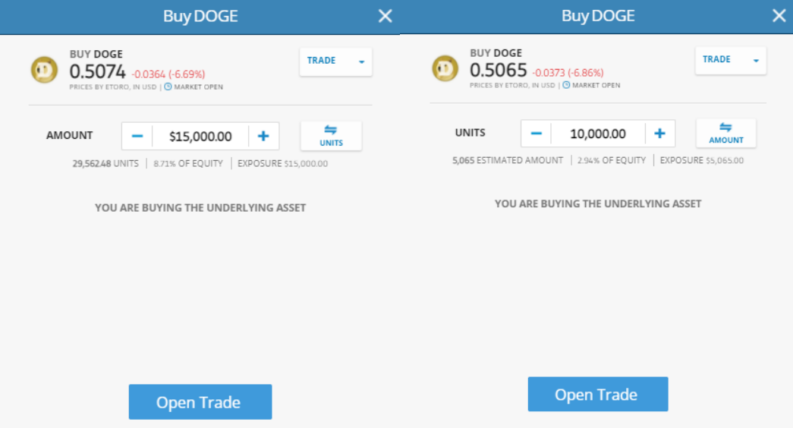

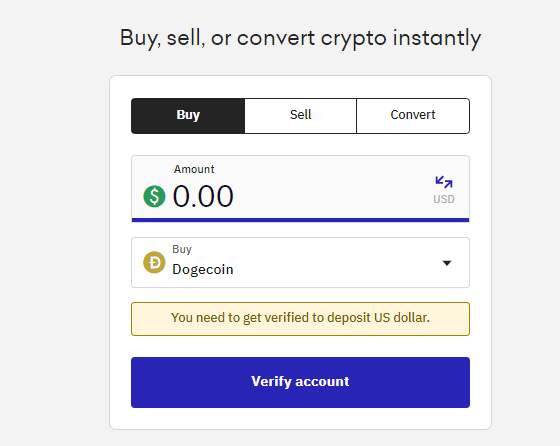

The trading dashboard will present data fields where you need to input the details of your trade. You can buy, sell or convert to another crypto.

You’ll see confirmation of what you are about to trade on the screen. In this case, we’re buying $15,000 worth of Dogecoin.

*Your capital is at risk

Step 5 – Check your order

While eToro is one of the easiest platforms to navigate, there is still a small chance your order might be incorrect. This will be due to human error rather than system error, so running a quick check of what you bought is strongly advised.

The Dogecoin price is particularly volatile so checking your position after trading is recommended and can be done by visiting the ‘Portfolio’ section of the eToro site.

Step 6 – Sell Dogecoin

You can hold your Dogecoin position for as long as you want. Accessing the ‘Portfolio’ screen will allow you to check the profit and loss on your position, which will be a function of live market prices. When it comes to selling some or all of your DOGE, it’s simply a case of inputting that order.

Enter the amount and click ‘Close Trade’. At that point, your crypto position will be sold at the current market rate and the trading P&L crystalised. The cash proceeds will be reflected in an adjustment made to the cash balance on your account.

How to Buy DOGE in the UK at Kraken

Read on as we describe how to buy DOGE using the broker Kraken.

Step 1. Create an account

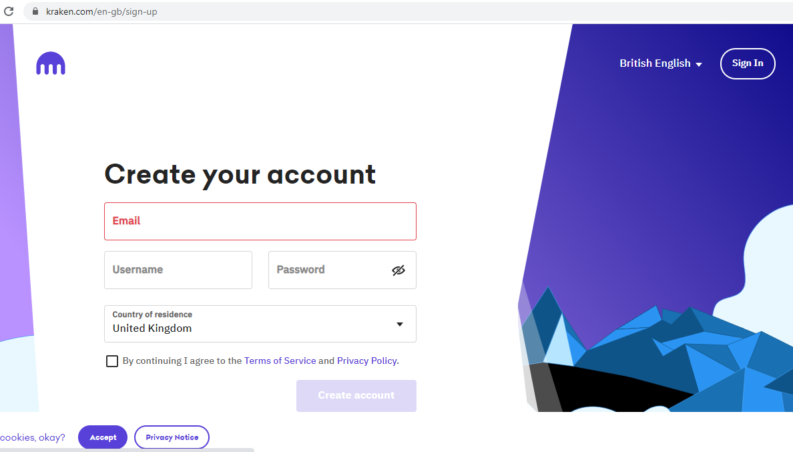

Source: Kraken.com

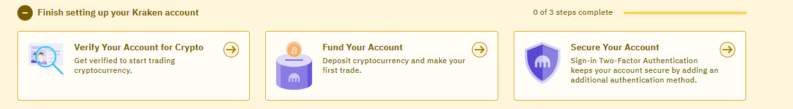

Signing up to the Kraken platform takes mere moments as the first stage involves providing little more than an email address and setting up a user profile. Once on the platform, follow the simple steps to verify, fund and protect your account.

Source: Kraken.com

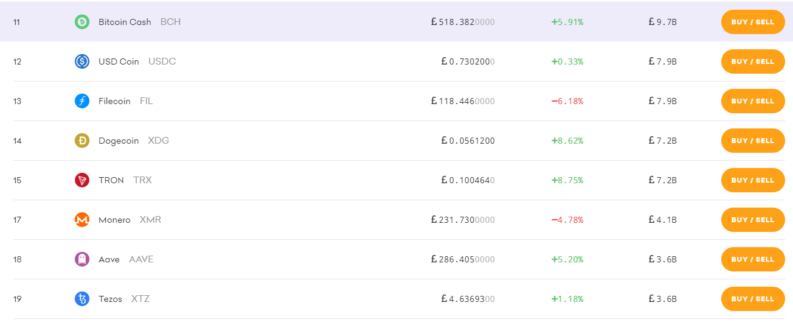

Step 2 – Find Dogecoin

Use the search function to locate the Dogecoin market.

Source: Kraken.com

Step 3 – Buy Dogecoin

Click on the Dogecoin icon to go to the trading dashboard for that market. Use the price chart to check if your strategy is still valid. It's possible to set the graph to different periods so you can see both long and short-term price history.

Source: Kraken.com

Step 4 – Complete your order

The trading dashboard will present data fields where you need to input the details of your trade. You can buy, sell or convert to another crypto.

Source: Kraken.com

Step 5 – Check your order

Despite the neat functionality of trading platforms, it is still possible for human error to get in the way. Sage advice is to check your trade details straight after trading to make sure you bought the right coin in the size you intended. The site's portfolio section will also have a live price feed so that you can monitor your profit/loss on the position.

Step 6 – Sell Dogecoin

You can hold your Dogecoin in your wallet for as long as you want. During that time, your profit and loss will fluctuate until the time comes to sell your DOGE. At that point, any gains or losses will be crystallised and the funds returned to your trading account.

The functionality associated with trading cryptos is relatively generic across the different platforms. That means it makes even more sense to choose a broker that is regulated by a recognised authority.

Which is the Best Dogecoin Wallet?

Best Mobile Wallet – eToro

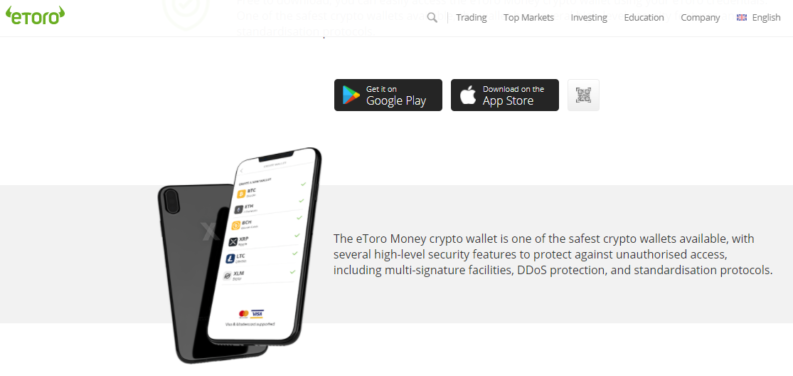

All the above functions can be done using a desktop or mobile device, which means you can keep track of your investments from wherever you are. Mobile bitcoin wallets can be incredibly secure and are available on Android and iOS operating systems.

As phones don't have the processing power of desktop machines, trading will involve logging onto a web-based platform. From there, you'll be able to access all the areas of the platform and perform functions ranging from wiring funds to buying and selling coins. eToro is one of the few regulated brokers that offer crypto markets to UK clients, and its award-winning mobile wallet comes with additional layers of security.

*Your capital is at risk

Best Hardware Wallet – Ledger Nano X

Using a hardware wallet allows you to keep your coins in cold storage. The high-tech devices operate in the same way as any other secondary hard drive. As they aren't online all the time, they spend less time hooked up to the internet, thereby avoiding scammers who might try and hack your Dogecoins. This ‘cold storage' approach is favoured by many.

One of the safest hardware wallets is the new Ledger Nano X. However, you get what you pay for in terms of security, and the Nano X costs little over £100 to purchase.

Best Exchange: Kraken

The most important thing to look out for in terms of crypto exchanges is the security of your holding. Many are unregulated and rely on newbies choosing them because they specialise in crypto trading. It can be a foolhardy decision as you are depending on a third party's security protocol to protect your assets. Even worse, the unregulated nature of the market allows scammers to set up fraudulent platforms.

Is Dogecoin a Good Investment?

Questions over the fundamental approach of Dogecoin continues to divide opinion. On the one hand, the framework is barely maintained. On the other, this offhand approach has enabled DOGE to demonstrate a degree of self-sufficiency, suggesting it could be a viable payment system.

The other plus point for DOGE users is the relatively fast transaction times. Payments can be confirmed within two minutes. That compares well to Bitcoin and is thanks to behind-the-scenes protocols, which Bitcoin appears unable to match.

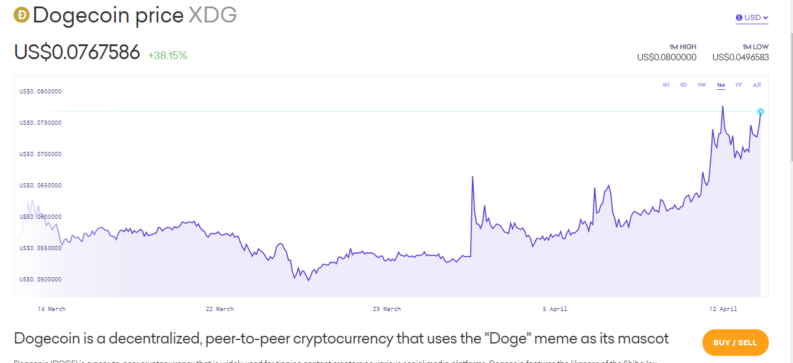

Dogecoin Price Chart – 2019 – 2022

*Your capital is at risk

The crypto space is a fast-moving one and Doge still plays a part. Contrary to many opinions, it hasn’t disappeared from this volatile scene. Like other cryptos, Dogecoin had a terrible first half of 2022. Massive deleveraging in the whole sector smashed prices to low levels which will attract some dip-buyers. Timing that entrance into the market is key and waiting for a change in narrative would be recommended. When and if cryptos resurge as a whole , Doge can be expected to be one of the altcoins tipped to overshoot to the upside.

Conclusion

Dogecoin has bounded onto the scene largely thanks to Elon Musk's support, and there's certainly a possibility that the Tesla founder could drive the DOGE price even higher. Before Musk's intervention, Dogecoin was just another ‘also ran', but it is now much discussed. In the crypto-space, that counts for a lot.

DOGE offers a reminder of the maverick and alternative spirit that brought about the crypto-revolution in the first place. For that reason, it is fondly thought of by crypto purists. Its role may be little more than a walk-on, walk-off part, as it comes just as mainstream institutions are taking crypto more seriously.

While Goldman Sachs and Morgan Stanley say they now ‘get it' about Bitcoin, asking them to convert to being fans of Dogecoin currently appears a step too far. Then again, as recently as last year, BTC was trading at $5.30, with the then perceived wisdom being that those same big banks would never consider Bitcoin a serious investment.