Beginners and experienced traders alike do well to approach the market with their eyes wide open, and one part of that involves understanding the nature of the market, and how to set up to trade as safely as possible. This article aims to confront the question “is Bitcoin legal in India?”.

There is some ambiguity about the extent to which Bitcoin has established a place in the Indian financial system, and the landscape is a fast-changing one. Understanding the shifting view taken by the India authorities on the subject can actually help your trading performance, as regulatory risk is a key price determinant.

When stepping back to understand the facts of the situation, it is probably best to start with the core fundamental, which is that Bitcoin is not illegal in India. Indian citizens can freely get involved in one of the most exciting and volatile asset groups, but getting a full grasp of where the legal lines are drawn can help formulate investment decisions.

Why Is Bitcoin an Unregulated Market?

Part of the reason why authorities in India, and around the world, are reluctant to become too involved in the crypto markets is that price moves can be eye-watering.

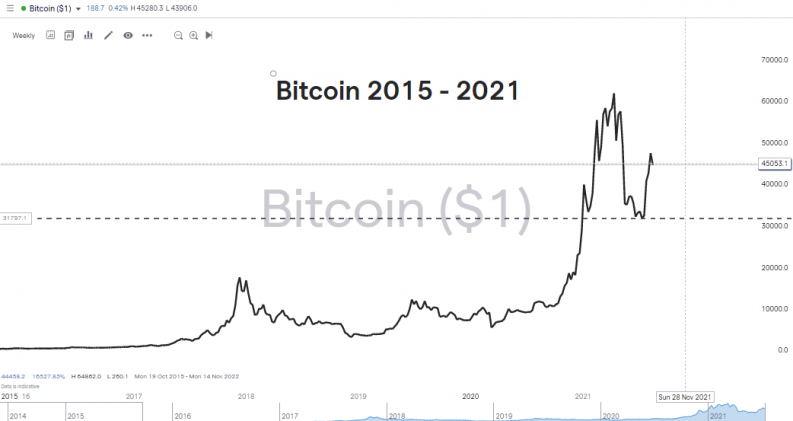

The underlying question of whether blockchain technology will really revolutionise the global payment system is a slow burner, but the moves in the price of Bitcoin are anything but. Between November 2015 and April 2021, the price of Bitcoin increased by 16,826%. Then, in the space of 10 weeks, BTC almost halved in value. By not regulating the Bitcoin market, the regulators are demonstrating that they consider BTC to be anything but mainstream and that those with a conservative approach to risk-return might want to avoid it.

Source: IG

This price volatility may deter Indian regulators from getting involved, but it goes a long way to explaining why so many Indians are flocking to the market. If you get the call right, there are huge gains to be made. The Times of India calculates that there are now 15 million Indians holding cryptocurrencies, compared to 23 million in the US, the country that has traditionally been seen as the primary market for the coins.

The global nature of the market also makes it difficult for any national regulator to exercise any kind of control. Managing the market is almost impossible for countries to do single-handedly even if they wanted to, and international cooperation levels are too low for a combined approach. The alternative, such as outright bans on crypto trading, just drive the market underground or offshore. This leaves Bitcoin and other cryptocurrencies in a grey area, one where it can be traded but where a lot of the onus is placed on the individual trader to manage their own risk.

Law and Regulation Relating to Bitcoin Trading in India

The Indian stock market and shares traded on it are regulated by the Securities and Exchange Board of India (SEBI). Other more traditional asset groups such as mutual funds also trade under licence of that body. SEBI’s role is to ensure that markets operate efficiently and that investor interests are protected and those who break the rules can be sanctioned.

Markets in cryptocurrencies such as Bitcoin are not regulated by SEBI. This doesn’t necessarily make transactions unsafe, and standard market principles apply. Many markets, such as that for second-hand cars, don’t come under the remit of the regulator. If someone thinks that an item, a car, or Bitcoin, is worth something, and is willing to offer cash to buy it, then that is its value.

Bitcoin looks unlikely to come into the mainstream in terms of regulation, but it is increasingly coming into the mainstream in terms of popular acceptance. The more people who accept it as a means of exchange or a store of wealth, the more likely that it is likely to achieve its aim of dominating the global financial system. It’s a self-fulfilling prophecy, just an unregulated one.

Timeline of Crypto Acceptance in India

- 2018 – The Reserve Bank of India (RBI) prohibits banks and non-banking financial companies (NBFCs) and payment systems regulated by the RBI from facilitating transactions for entities related to cryptocurrencies.

- 2020 – The Supreme Court of India quashes that ruling and opens the door to crypto exchanges and crypto brokers supporting trading in the country.

- 2021 – Bitcoin is still not legal tender. In fact, only one country in the world, El Salvador, accepts BTC as legal tender. The situation in India is the same as in most other countries. The only currency in India that is backed up by a sovereign guarantee is the rupee, and those can only be issued by the RBI. However, you are not breaking the law if you trade or invest in Bitcoin, and if you find someone willing to sell another asset, maybe even a house, and they are willing to accept payment by Bitcoin transfer, then that is within the rules.

Bitcoin and Tax

One important clue to something becoming accepted is when you have to pay tax on it. Despite Bitcoin not being mentioned in the Indian Income-tax Act, any profits from trading or investing in Bitcoin are indeed liable to taxation. Profits from short-term speculative trading are treated as business income and buy-and-hold investors are required to treat any profits in line with capital gains tax rules.

What Is the Core Appeal of Bitcoin?

Any form of payment relies on the users of that financial system accepting the currency as a means of exchange and a store of wealth. In terms of Bitcoin, the jury is to some extent still out on that one. Some Indians are buying into it because they are convinced that Bitcoin is the currency of the future – in which case its value will be much higher than it is now. Many others consider it an unviable tech dream that has morphed into a massive market bubble. The eventual outcome will likely be binary in nature. It’s all or nothing, and the massive gap in perceptions as to whether that will happen or not is what causes the dramatic price swings.

Traders in Bitcoin can back whichever approach they want, but there are other features of the crypto that mean that it is unlikely to ever become regulated. This is down to the coin’s DNA. It was designed to be different and fans of the coin like it that way. The blockchain technology involved allows investors to trade with anonymity. It has also got a rebellious streak. Bitcoin challenges the authority of central banks and governments, which have less control over cryptos than they do over their own fiat currencies. For both of these reasons, Bitcoin has developed a hardcore following. However, they are also the reasons why Bitcoin acceptance is a pill that regulators are unlikely to ever be willing to swallow.

If you buy shares and some aspect of the process is exposed to have been misleading or fraudulent, you might be able to get redress through the regulator. With cryptocurrencies, this is not the case – it is very much a case of buyer beware. For that reason, it’s important to understand the pros and cons of the different ways of trading Bitcoin.

What Elements of Bitcoin Trading are Not Regulated in India?

Bitcoin and other cryptocurrencies are not regulated by any organisations in India. The RBI and SEBI are not mandated to protect your crypto assets in any way. It is not illegal to trade Bitcoin in India, but there is no legislative protection to individuals or firms that buy, sell or hold Bitcoin.

If you are a victim of fraud, you are expected to report the matter to the police immediately. Their efforts to rectify the situation will be directed at catching the criminal and protecting the health of the nation rather than working towards compensating you for your loss.

How to Trade Bitcoin in India

With the risks associated with trading Bitcoin in India having been outlined, it’s time to look at the ways to get involved as safely as possible. There is a variety of platforms that facilitate Bitcoin trading, and each has its own pros and cons. One important fact to keep in mind is that even if the broker or platform you select is regulated, it will only be for activity in regulated instruments such as equities. Even if your broker is regulated and something goes wrong with your Bitcoin trade, you have no recourse to the regulator.

Trading Bitcoin in India Using CFDs

CFD trading in India was once outlawed but is now legal and allowed. However, because there isn't effective regulatory oversight through a licensing system, Indian investors are forced to open accounts with offshore brokers. This means that there is less regulatory protection.

Trading cryptocurrencies using CFDs through a broker such as IC Markets, FxPro or Tickmill offers a convenient way to gain exposure to Bitcoin. CFDs are an agreement between account holders and the broker platform. You don’t actually own the underlying crypto – the broker does – so there’s no need for specialist wallets.

The fundamental rules of any financial market still apply, and you are exposed to price changes as if you did own it. You make a gain or loss depending on which direction the Bitcoin price moves. At the end of the trade’s life, the client and broker exchange cash to settle the difference. If you open a long position and the cryptocurrency goes up in value, you’ll make a profit and the broker will pay you – but if it falls in price, you’ll make a loss and pay the broker.

Source: eToro

Setting up an account with a broker can be done completely online using a desktop or handheld device. Registration involves providing some personal details and wiring funds to your new account. Once fully onboarded, you’ll be able to buy and sell Bitcoin from whichever type of device you prefer.

Trading Bitcoin in India Using a Crypto Exchange

An alternative method is to trade using a specialist crypto exchange. While some brokers are regulated, all crypto exchanges are unregulated. They also only offer crypto markets, so if you’re looking to use your account to trade forex, commodities and stock CFDs as well as Bitcoin, then an exchange might not be the best option for you.

Setting up with a crypto exchange requires providing the below information:

- Personal identification documents for verification.

- Payment account/method, which includes credit cards and fund transfers.

- Secure connection to the internet (public Wi-Fi is a seriously bad move).

- Mobile phone for two-factor authentication.

- A crypto exchange account.

- Secured cryptocurrency wallet to store your cryptocurrency.

What are Crypto Wallets?

One way of buying Bitcoin through an exchange is to hold coins sent to your account on the exchange’s platform. There are risks associated with this as you’re relying on a third party to protect your assets. If the exchange is hacked or goes bust, you’ll likely lose out – and remember that the exchange and cryptos are both unregulated, so none of the RBI/SEBI protection measures kick in.

For that reason, some Bitcoin traders consider it safer to set up a personal cryptocurrency wallet. This is a digital account that can be held online (hot wallet) or offline (cold wallet). It’s your wallet, not the exchange’s. A hot wallet is also open to the risk of hacking, which makes many consider using a cold wallet to be the safest option. The trade-off is that there is a risk that you lose the hardware drive used to store the account details, or that it malfunctions.

How to Protect Yourself When Trading Bitcoin in India

Choosing whether to use CFD brokers or exchanges and then wallet types comes down to personal preference. Each has its pros and cons. There are some other more generic risks to be aware of. Some of these aren’t specific to Bitcoin but can be applied to trading in general. However, all deserve some attention as the craze for trading Bitcoin has resulted in some people getting their fingers burnt.

Avoid Investment Schemes Promising High Returns

Because Bitcoin is unregulated, it’s a popular market for scammers, and one of the oldest tricks in the book involves tempting unsuspecting investors into scams by promising unrealistic returns. The price of Bitcoin is highly volatile and this means that some of the exaggerated returns at first appear plausible.

- Any scheme that involves taking trade ideas from another party needs to be treated with caution.

- Even if it is a genuine scheme, it might come with high fees and commissions that increase operational costs and eat into any promised returns.

- Wiring cash to a third-party account is about the biggest no-no there is, as once funds have left your account, you have no control over them.

- When setting up at a broker or exchange, be sure to double-check that the process involves setting up an account in your name. Also, only use platforms that have accounts that you, and only you, have access to.

Consider Money-Laundering and Terrorist Financing Risk

It’s not only scammers who are attracted to the crypto markets. The anonymity that comes as part of the crypto trading package makes it popular among criminals. Factor in the additional benefit of cross-border transactions being able to be made in the same currency and it’s clear that the neat functionality of blockchain payments is attractive to unscrupulous as well as legit users.

If your exchange comes under scrutiny from the authorities suspecting activity relating to organised crime or terrorism, then that will put your own assets at risk.

The fact that Bitcoin is unregulated doesn’t mean that the authorities don’t monitor the markets. It’s just that the work they put in is to protect their own interests. A red flag to look out for is if your exchange offers incredibly attractive terms and conditions. This could be a sign that it is trying to attract enough retail clients to provide a smokescreen for criminal activity.

Consider How Quickly You Want to Start Trading Bitcoin

The many steps involved in setting up an account and the inherent risk of holding a position puts some people off using exchanges. The red tape can create another kind of problem as the platform has to process applications and some exchanges now operate waiting lists. If you’re in a rush to get into trading Bitcoin, then this might be something to check before starting your registration.

Conclusion

Trading Bitcoin in India is legal, but there are some ever-changing variables to consider if you want to tilt the odds in your favour. If you choose one of the relatively low-risk ways of trading BTC, there is no official protection on offer as Bitcoin trading, while legal, is unregulated.

Make sure that you check, double-check and triple-check each stage of the process to ensure that you protect your interests. To many, this means taking the option of using CFDs at a broker. This provides them with the access to Bitcoin, but with fewer technical headaches to worry about.

Even so, trading in Bitcoin remains a risky proposition due to the high price volatility associated with the market. The core fundamentals of the proposition of whether Bitcoin will become the global currency of the future are fiercely debated. In August 2021, the Minneapolis US Federal Reserve President Neel Kashkari said: “Cryptocurrency is 95% fraud, hype, noise and confusion.” (Source: MarketWatch) At the same time, others predict that the innovative features of Bitcoin will democratise the financial markets and BTC will still be the dominant crypto in the market.