Anybody who has tried investing or trading the markets will attest to the fact that it is not easy. Especially for beginners who are new to the markets given the major pitfalls that are present in the markets.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Most beginners struggle with issues such as risk management, which usually lead to massive losses on their part. It is no surprise that most people who try trading usually give up within two years. In other cases, you might have issues with your current broker ranging from a complicated trading platform, and long withdrawal processing, among others forcing you to close your account.

If you fall into either of the two categories, keep reading as we will show you step by step how to close your eToro account, and the available options if you want to keep trading. Ready? Let’s get started.

Table of contents

Why Would You Want to Delete Your eToro Account?

The most common reason for deleting your eToro account is simply that you do not want to keep trading. Maybe you have racked up massive losses and you can’t bear to continue trading, or you’ve realised that you don’t have the time to learn everything you should know about trading.

There is no shortcut to long-term trading success as you have to develop the right skills to transform into a consistently profitable trader and this takes time.

Another common reason to delete your eToro account is that the broker does not offer the instrument(s) that you want to trade. Maybe you want to trade an exotic currency pair or a certain commodity, or even a particular stock that presents a great trading opportunity.

While eToro offers a huge variety of tradeable instruments across different asset classes, they can’t offer everything.

The step-by-step guide to deleting your eToro account

In the past, you had to contact eToro’s support department in order to close your account, but this has since changed as the entire process is now fully automated. Read on to find out how to delete your eToro account.

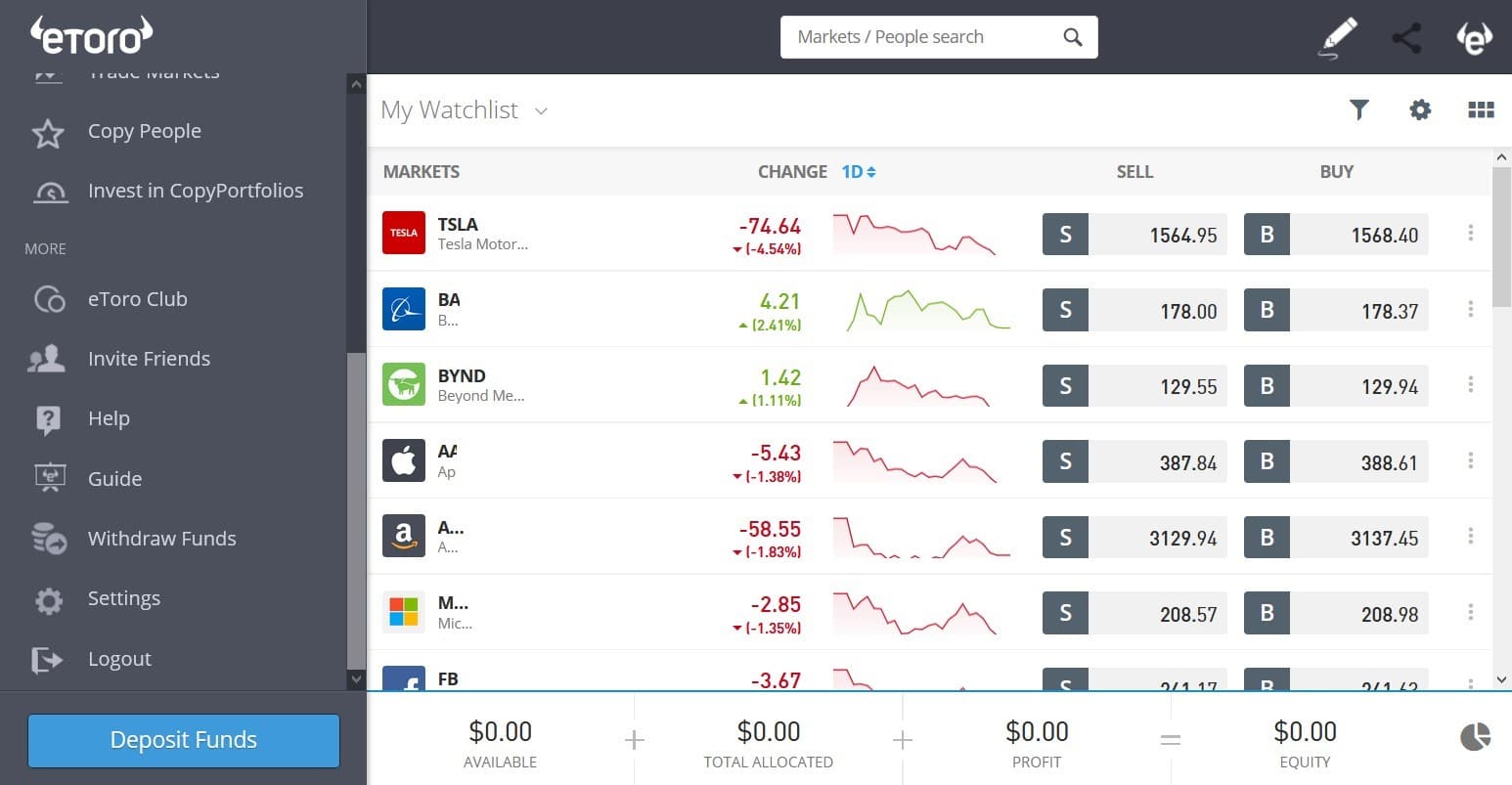

1. Log into your account and scroll to the bottom left where you’ll find the settings tab. Click on it.

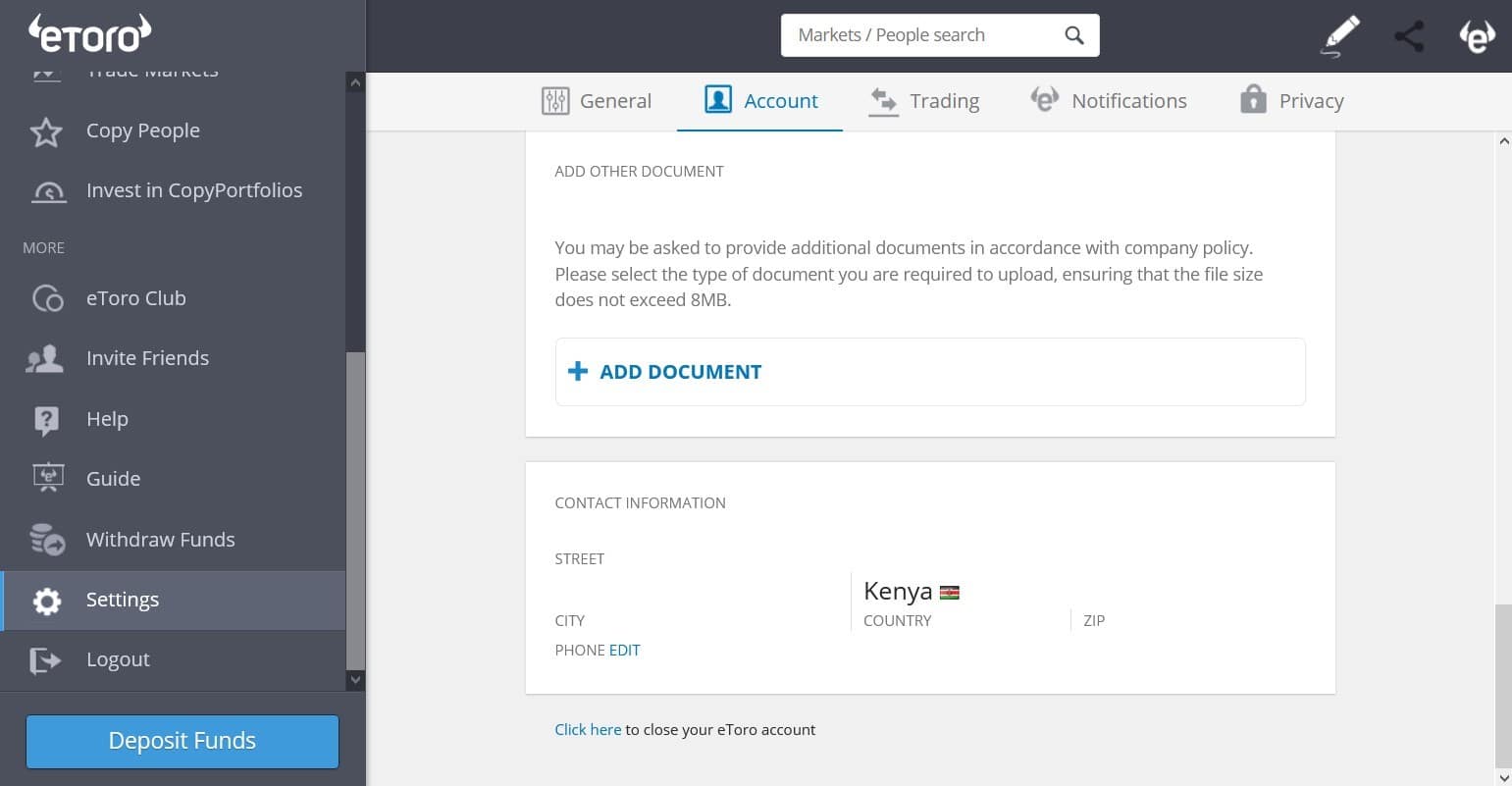

2. Once you’re on the settings page, click on the menu option at the top written account. You’ll find the option to delete your account at the very bottom of the page, written in small letters and you should click on it.

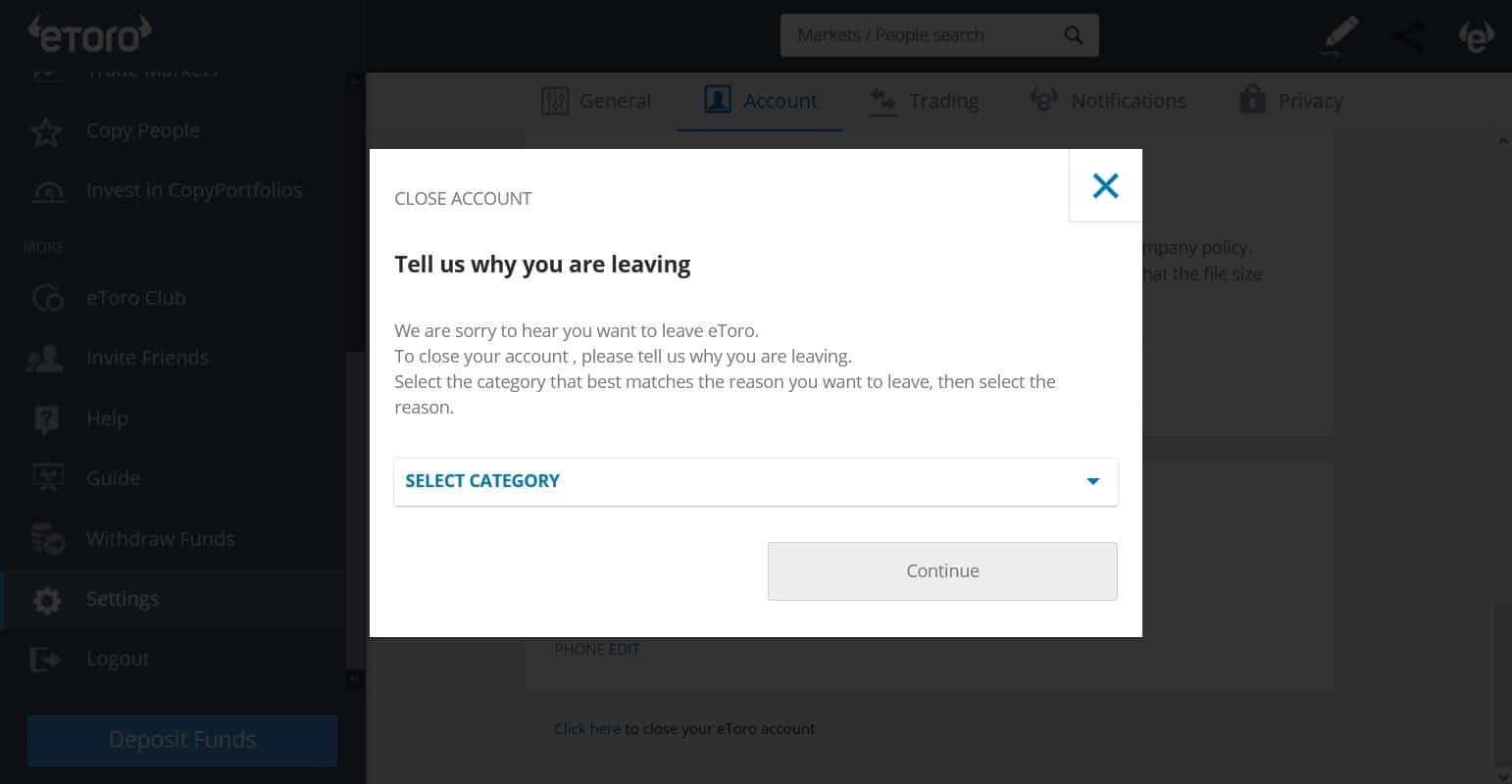

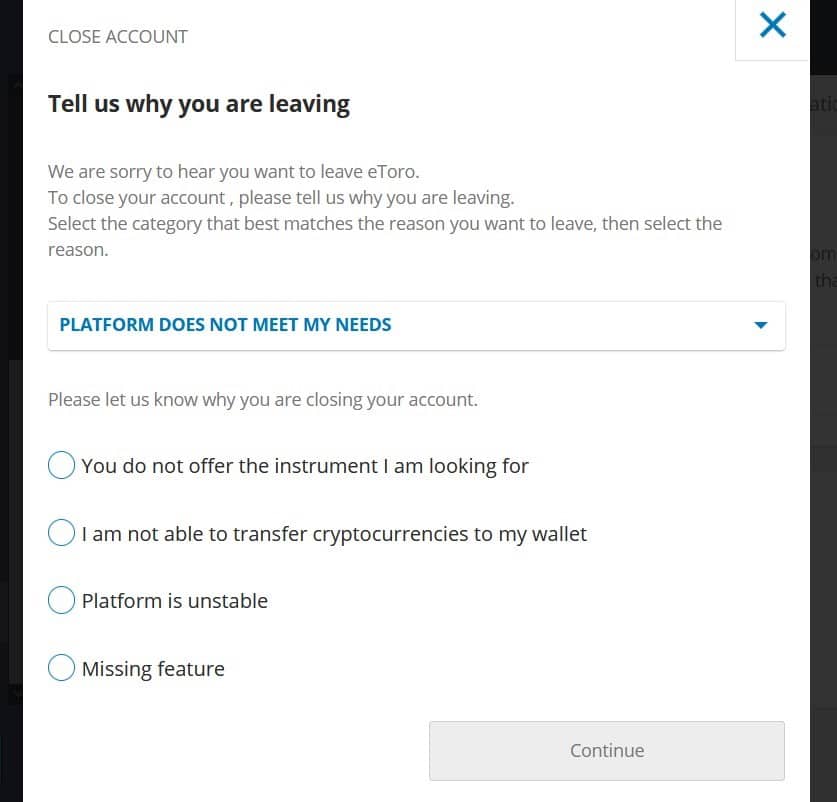

3. You’ll see a popup asking you to specify the reason why you want to close your account.

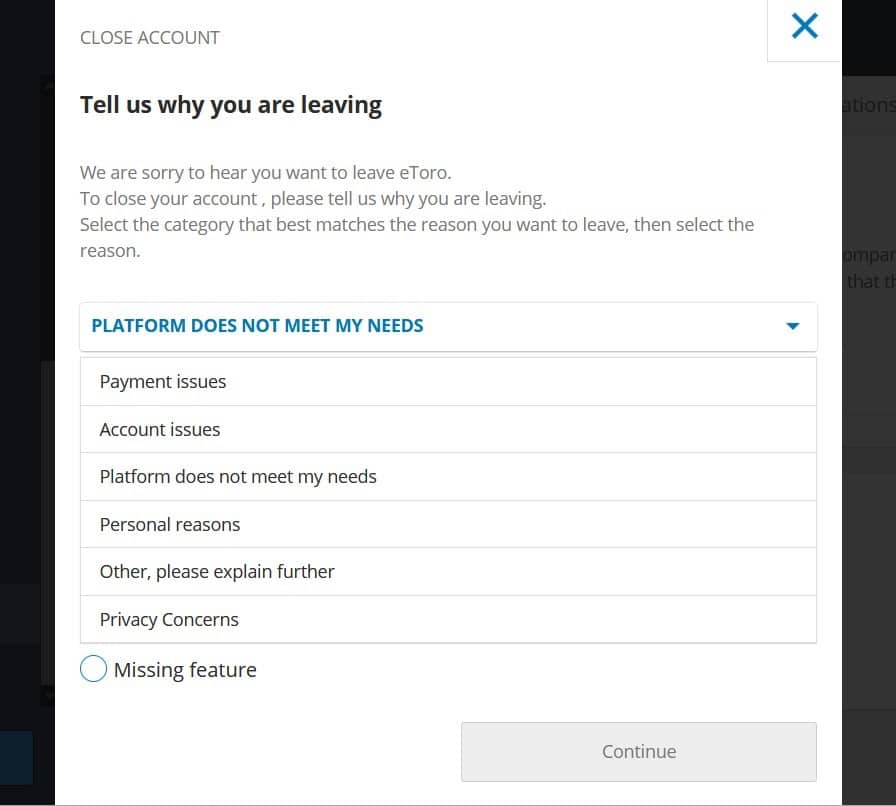

4. Choose the reason that applies to you and proceed.

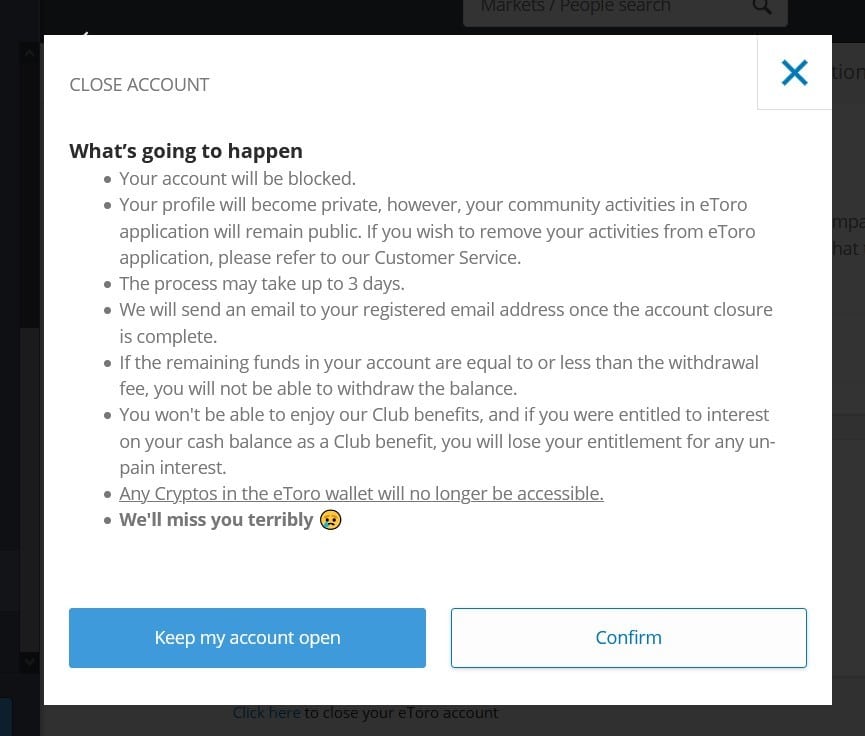

5. Follow the next prompts to complete the process as shown below.

6. The broker will try to change your mind at this stage, but if you’ve made up your mind, you’ll proceed. You’ll finally get to the screen below.

You can see that it will take three days to close your account, which is quite fast as compared to other brokers.

If you deleted your eToro account because you do not have the time to trade the markets, we would suggest that you try their social trading feature, which allows you to copy the trades made by expert traders.

Copytrading allows you to trade the markets without spending hours analysing and learning about the markets, which is a great option for traders who do not have the time to master the markets.

If you are looking to trade a specific financial instrument such as an exotic pair, a particular company, or a rare metal/commodity, you have a ton of options when it comes to brokers.

People who read this also viewed:

- Discover the best blue-chip stocks

- Trade with top-rated eToro Alternatives

- Learn what is eToro take profit

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or

down. Your capital is at risk.

Don’t invest in cryptos unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.