Economists and regulators might claim the opposite, but the financial markets don't always operate efficiently. Some stocks can, for various reasons, trade at prices that make them appear undervalued. Identifying one of these diamonds in the dust can result in substantial returns. All it takes is for a catalyst to generate a reappraisal of the firm's fortunes, and the price can skyrocket.

YOUR CAPITAL IS AT RISK

The exact definition of undervalued stocks has fuzzy edges, which comes down to different traders running slightly different strategies in the sector. However, definitions generally refer to a stock priced below its ‘true value'.

It could be a consistently profitable firm with attractive long-term prospects but with a low share price compared to its peer group. Buying undervalued stocks involves identifying targets where their market price is somehow “wrong”. The mispricing is down to the market not picking up on certain information or being slow to appreciate its importance.

Research into undervalued stocks draws on fundamental and technical analysis and introduces the extent to which pricing is subjective. One person's sure thing is another's stock to avoid. Understanding the approach and how these differences of opinion ultimately pan out can help develop an understanding of the markets. It can also result in life-changing profits. This report on the fundamental analysis used to buy GameStop is a case study on how buying an undervalued stock was followed by a price rise from $15 to $480 per share.

Best Undervalued Stocks to Buy Right Now

Undervalued stock investing is very much about looking into a firm's prospects and identifying something which the market has missed. The below firms are all currently out of favour but are associated with a potential trigger for a market-wide revaluation.

- Best Undervalued Banking Stock To Watch – ICICI Bank Ltd (NYSE:IBN)

- Best Undervalued Blue Chip Stock To Watch – 3M Company (NYSE: MMM)

- Best Undervalued Tech Stock To Watch – GoPro Inc (NASDAQ: GPRO)

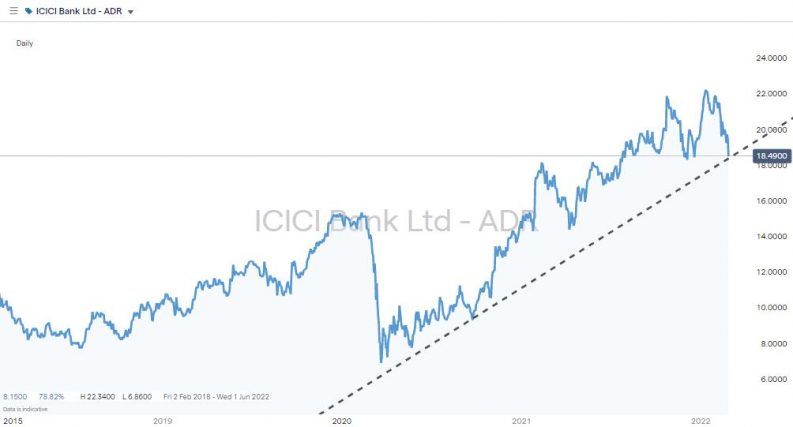

1. ICICI Bank Ltd (NYSE:IBN)

Sourse 123RTF

Covid and low-interest rates have been a considerable drag on banking share prices over the last few years. Lockdowns and reduced economic activity, and increased default risk, reduced the need for borrowing. Low-interest rates are also a problem as they squeeze the size of the spread between borrowing costs and interest rates on savings offered to customers. That has been reflected by bank sector shares being suppressed. They're well-run businesses, but there have been more attractive opportunities for investors.

Both things look about to change, and ICICI Bank Ltd has already begun shaking off the stigma of being undervalued. The Indian bank can be traded in ADR (American Depositary Receipt) form on international exchanges. That allows global investors a chance to get exposure to the banking sector in the country that is forecast by the United Nations to have the largest population in the world by 2026.

ICICI Bank Ltd Share Price Chart – 2019 – 2022

Source: IG

The world economy generally follows the lead of the US Federal Reserve in terms of interest rate policy, and the Fed has, since 2009, set base rates below 1% for more than 50% of the time. Guidance now being offered is that rates are set to rise, and if runaway inflation overshoots, they could rise even higher than the forecasts suggest. That would turn the tables on many stock picks as some stocks, such as growth stocks, struggle during periods of higher interest rates, making this undervalued stock an ideal long-term proposition.

Profit margins are a healthy 19.69%, and the dividend yield of 0.284% is a nice-to-have feature, but the standout metric is the P/E ratio which currently sits at 22.66 and leaves headroom for further share price growth.

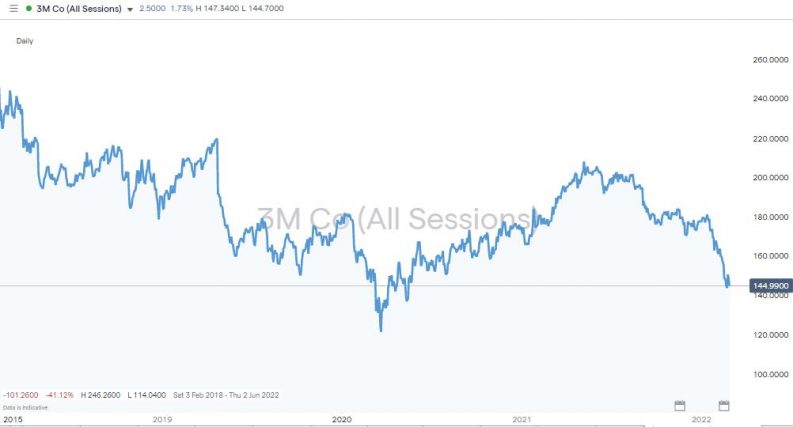

2. 3M Company (NYSE: MMM)

Source 123RTF

3M's core offering of industrial, consumer and health care goods should have positioned it to benefit from the return to economic normality following Covid. Unfortunately for existing stockholders, the 3M share price has underperformed against its peer group, with the share price plunging in value by +30% in the last twelve months. Investors who aren't holding loss-making positions and are approaching the situation for the first time could benefit from buying shares in one of the best undervalued stocks in the market.

The big drag on performance is a pending litigation suit relating to one of the firm's products – Combat Arms Earplugs Version 2. Analysts at big banks have cut their ratings on the stock thanks to claims that those products were defective and resulted in personal injury.

As expected, it's taking some time to work through the associated legal proceedings and estimates on possible losses range from $2 – $53bn. The financial hit from even the worst-case scenario appears to be already priced into the MMM stock price. Other divisions of the firm are providing plenty of reasons to believe in the firm's future.

3M Company Share Price Chart – 2018 – 2022

Source: IG

Earnings reports for Q4 2021 state that free cash flow was an impressive $1.5bn, organic revenue growth for the year was 8.8%, and the firm is building on its existing positions in developing markets. With over 60,000 products in the home improvement, automotive, health care and manufacturing sectors, it offers diversified exposure to global economic growth.

The legal threats to 3M are a short-term issue rather than an existential crisis. Buying in at current levels would allow investors to take advantage of the firm's current P/E ratio of 13.94% and a generous dividend yield of 4.14%.

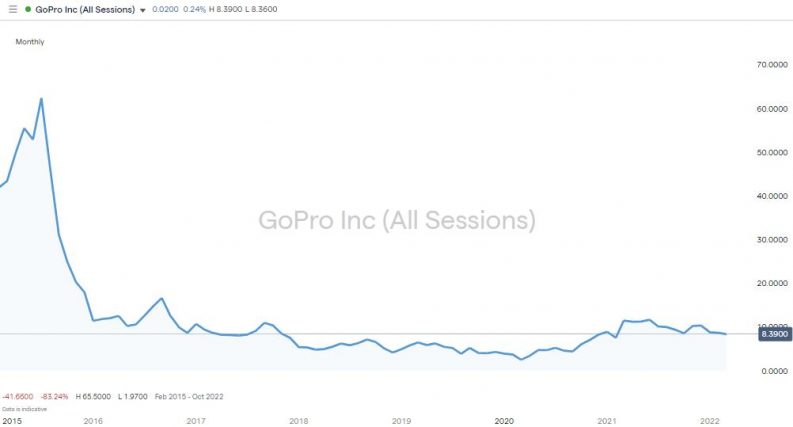

3. GoPro Inc (NASDAQ: GPRO)

Source 123RTF

Camera and drone manufacturer GoPro is upgrading its core business operations to improve returns to investors. Following its high-profile launch in the Nasdaq in 2014, the stock surged as high as $65 per share but slumped to below $10 as investors concluded that the firm was too much of a one-trick pony.

GoPro Inc Share Price Chart – 2018 – 2022

Source: IG

The shake-up of the firm's operations includes selling its products directly to consumers via the GoPro.com platform, and with such strong brand recognition, the firm's products have a chance of being sought out directly. Removing the need to go through wholesalers resulted in the gross profit margin expanding 9.5% in Q2 of 2021 to an impressive 39.8%. Subscriber numbers are also on the rise, with last year seeing the number of registered users increase from 372,000 to 1,160,000, which all points to the firm proving it has the potential to improve the extent it monetises its brand.

Why Invest in Undervalued Stocks Now?

A decision to buy the best undervalued stocks offers investors a little more juice in their trade. Strategies used in this sector tend to be at the higher end of the risk-return spectrum, which means going ‘all-in' isn't recommended, but balanced portfolios certainly have room for them. The increased levels of price volatility that have recently been experienced also increase the likelihood that mispricing is exacerbated, making any potential return greater.

What to Know Before Investing in Undervalued Stocks?

Investors need to be aware of some aspects of the undervalued stock sector. They are:

Opportunity Cost

One potential drawback is that it is possible to get into a position in an undervalued stock that remains undervalued for some time. Being right doesn't necessarily make you rich, and the cash tied up in a position could generate better returns elsewhere.

Catalysts Needed

Markets can gradually come round to changing their opinion of a stock, but the presence of an attention-grabbing piece of potentially game-changing news is ideal. It can be stock specific, such as 3M's lawsuit, or related to a shift in macro-economic fundamentals, such as the impact higher interest rates might have on the share price of ICICI Bank.

Imperfect Information

Different analysts can quickly draw different conclusions on the fair value of a firm. Stocks that appear undervalued to one investor are printing at those lower price levels because the market has reached a consensus on its prospects. It's essential to establish why your analysis is more accurate and is not omitting important factors.

Long-term Investing

Even stocks with potential catalysts in play can still be associated with long-term holding periods. If you are considering a buy-and-hold approach, choosing a platform from this list of trusted brokers and opting for the right instruments to trade long-term strategies will improve your bottom line.

How to Start Trading Stocks Online

Market risk, the possibility that price might move in the wrong direction or that your undervalued stock might never take off, is an unavoidable part of investing. One risk that can be managed is Operational risk, which refers to ensuring other areas of the trading process are as safe and reliable as possible. This step-by-step guide offers tips from experienced traders, some of whom have made mistakes so that you don't have to do the same.

1. Find a Safe Broker

The first and most crucial step is to ensure your broker is trustworthy and reliable. Security of funds is vital, and the best way to start is to ensure your broker is regulated by a tier-1 authority such as one of the below:

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The U.S. Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

2. Find a Broker Which Supports Trading in Undervalued Stocks

Different brokers focus on different markets. Some, for example, specialise in providing low-cost access to forex markets. However, brokers who specialise in trading undervalued stocks offer a more comprehensive range and a higher grade of research.

3. Research Undervalued Stocks in the UK

Brokers are an excellent first place to look for topical research reports. There is also a range of third-party service providers which offer company insights using fundamental and technical analysis.

Source: IG

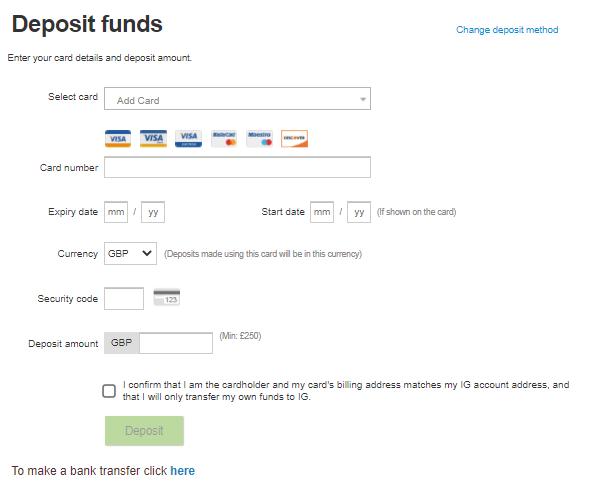

4. Open and Fund an Account

Signing up for an account at an online broker can be completed in as little as a few minutes using a desktop or handheld device. Most platforms have functionality designed to support beginner traders, and funding an account is a straightforward process. Good brokers will offer various payment methods, including bank transfers and credit and debit cards. Getting up to speed with the T&Cs can help you find the format which best suits your strategy, and the majority of brokers don't charge any commissions on funding payments.

Source: IG

5. Select and Buy Undervalued UK stocks

The different stocks on the platform will all have their own dashboard with charts, news and analysis. Use the search function to locate the one you want to trade and enter the quantity you wish to buy and click or tap ‘Place Order'. At that point, part of your cash pile converts into a stock position. Some traders use stop-loss and take-profit orders to manage risk, while others trade in small sizes and diversify their portfolio.

6. Post-Trading checks

After your trade has been executed, its performance can be monitored in the site's Portfolio section. That is also where to head when the time comes to sell some or all of your position by reversing the buying process.

Checking in on your trades can help you find the optimal time to sell, and one vital check to run is done immediately after trading. Even experienced traders make fat-finger errors, so double-check you bought what you intended as any mistakes are best corrected before the market price moves too far.

Final Thoughts

Investing in undervalued stocks is a relatively high-risk strategy but following the guidelines on managing the process from start to finish mitigates some of the risks involved.