This review looks at the pros and cons of the two methods. While they are in some ways similar, each has their own characteristics that make them a better fit for you.

- What is share dealing?

- Why buy shares?

- What is CFD trading?

- Similarities between CFDs and share dealing

- Differences between CFDs and share dealing

- Pros and cons – CFDs vs shares

What is share dealing?

Share dealing has been part of the financial markets for centuries. It’s a tried-and-trusted way to invest in businesses. This is big business today, with billions of dollars-worth of shares listed on global stock exchanges.

The centuries-long boom in stock exchanges came about from their ability to provide businesses and investors with a means of interacting with each other. They make it possible for companies to sell a stake in their company in the form of shares. This becomes capital that the firms can invest back into their day-to-day operations.

In return for putting cash up front, investors take a cut of future profits. The more shares you own, the greater the percentage of company profits you receive – these being paid out in the form of dividends.

- Stock exchanges are markets where share dealing can be regulated, offering investors greater security.

- Brokers facilitate trading in different shares by investors.

- Shares are the electronic or paper certificates that can be bought and sold, and when held, provide the owner with a right to any corporate profits.

Why buy shares?

From Mumbai to New York, investors ranging from individuals to pension funds can buy shares in companies they think will prosper.

Source: Forbes

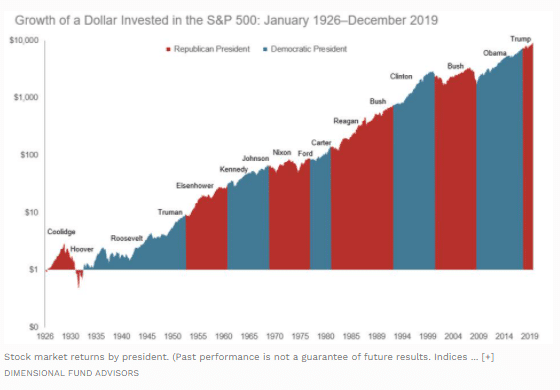

NerdWallet calculates that the equity market’s long-term average return is 10%. Factor in one or two percentage points of inflation and the return drops down to single figures.

The track record of the last 30 years points to this still being a good way to get a return on your capital. Not least because the returns are exponential, if you invest your annual returns, then each year the percentage increase is applied to a larger position.

What is CFD trading?

CFDs are specially designed instruments that allow investors to gain exposure to an asset.

When you are trading stock CFDs, you hold a derivative of the shares in the underlying company. CFD trading is closely related to share dealing. However, being one step removed from the market does allow for CFDs to be used differently.

CFDs are used by beginner and advanced traders. This guide is designed to help novices learn more about how they work.

Similarities between CFD and share dealing

In the case of stocks and shares, a CFD in Microsoft Inc. stock would, for example, have the same price as a share in Microsoft Inc. If the price of Microsoft on the Nasdaq exchange rises, so will the price of the CFD equivalent.

- The profit and loss moves will be the same as if you held the real thing.

- Holders of stock CFDs also received dividends in the same way that regular shareholders do.

- You can hold a position in CFDs and shares for as long as you

Differences between CFDs and share dealing

There are also differences between CFDs and equities. Contracts relating to CFDs are known by only the broker and the client – it’s a two-way agreement. Share holdings, even if bought via a broker, are recorded at a registrar, which has information on all the holders of stock.

Different risks

If you hold shares, your risk is limited to the price of the firm you have invested in seeing its share price fall. If you hold CFDs, then as well as this market risk, there is also counterparty risk. If the CFD broker you are using defaults on your deal – for example, by going bust – then you stand to lose out.

Tax treatment

In the UK, buying shares incurs a 0.25% SDRT charge. Buying CFDs does not.

Leverage

CFDs can be leveraged – a broker effectively lends you money so that your position size can be larger than your initial capital deposit. Share dealing is unleveraged – if you want to buy $5,000 of Amazon stock, for example, then you need $5,000 in cash funds.

Restrictions

Some investors are only able to buy shares. Pension funds, for example, may have an investment mandate that prohibits them from buying CFDs. Individual investors don’t tend to have the same constraints, though US retail investors are prohibited from trading CFDs.

Market coverage

Being a derivative product means that CFDs can be used on a range of markets, not just stocks. It’s possible to buy or sell CFDs in:

Convenience

If you’re using a top-level online broker, then you can trade all of these markets at the click of a button at your desktop or on a handheld device.

Financing costs

CFDs can incur overnight financing charges. These are fees to hold your position at a broker. Share dealing can incur similar administrative charges, but being associated with a ‘buy-and-hold’ approach, this is less likely to be the case.

Short selling

CFDs allow for short selling. You can sell something you already own. Share dealing is ‘long only’. It’s possible to get an insight into which firms investors are currently betting against. You can do this by accessing reports provided by exchanges that give details on ‘short interest’.

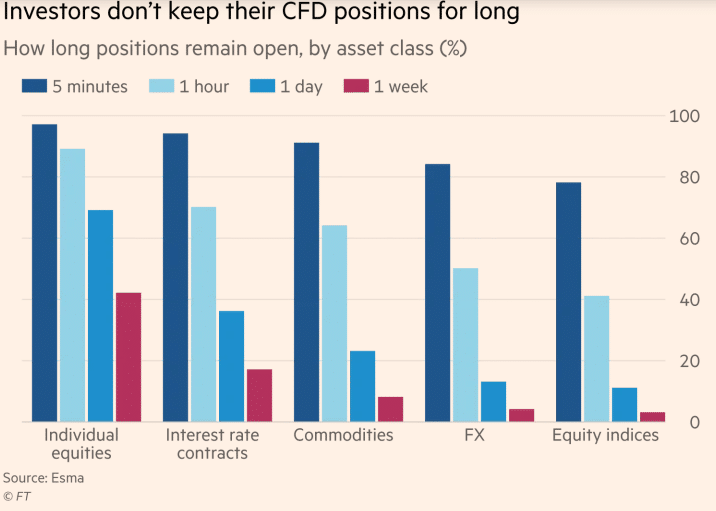

Source: FT

CFDs vs shares – pros and cons

CFDs were invented in the 1990s and have grown into a multi-trillion-dollar market. Their popularity largely comes down to their versatility. Once you understand the principles, you can trade CFDs in a wide range of asset groups, not just shares.

They are well suited to online trading platforms. Electronic trading suits many, and buying and selling CFDs is very easy. In fact, short-term trading strategies such as day trading have strong associations with CFD markets.

Share dealing is still massively popular. Its many fans tend to have a long-term approach to investment.

Both CFDs and shares offer a route to making a return from the financial markets. Choosing the approach that suits you largely comes down to personal preference.

People who read this also viewed: