Birkenstock, the German footwear company known for its iconic sandals, recently went public. This means that investors are now able to buy shares in the company and participate in its growth.

YOUR CAPITAL IS AT RISK

For some time, potential investors in Birkenstock stock were left wondering if they’d have the chance to profit from its possible future growth. That opportunity has now arisen.

Table of contents

Birkenstock Overview

The footwear company was founded in 1774 and is headquartered in Neustadt, Germany. Birkenstock sandals are popular with people of all ages, and it became known as a luxury brand after a rising number of celebrities began to wear the footwear, starting in the 1990s.

In recent years, Birkenstock has expanded its product line to include shoes, boots, and other accessories. The company has also opened new stores in key markets around the world.

Due to Birkenstock being a privately held company, there is limited information available about its finances. However, in its IPO filing, the company revealed its revenues exceeded EUR 1 billion in 2022. When it IPO'd, the company was valued at the high end of its valuation range. Its stock debuted at $46 per share.

Birkenstock Shares: The Basics

Birkenstock shares are listed on the New York Stock Exchange (NYSE) under the ticker BIRK. The company’s shares made their market debut on Wednesday, October 12, 2023, but fell, closing the session at not far above $40. The company sold around 32 million shares.

Before it decided to IPO, the Birkenstock family sold the majority of the company to L Catterton in 2021. L Catteron, backed by LVMH, is a private equity firm. Birkenstock brothers Christian and Alex retained a minority stake in the company.

Despite being a German company, BIRK decided to IPO in the US, which represented another blow to European stock markets. The company is the latest in an increasing line of businesses opting to go public in the US over Europe.

YOUR CAPITAL IS AT RISK

Steps to Buy Birkenstock Shares

Despite being a new stock on the market, trading in Birkenstock shares using an online broker is a very straightforward process. Brokers have invested heavily in their platforms and services, ensuring they have user-friendly functionality. Customer service teams will also be able to assist clients, whether they are novices or experienced traders.

One thing to establish straight away is how long you intend to hold your BIRK position. If it’s likely to be more than four to six weeks, you may want to look at purchasing the shares outright. The buy-and-hold incurs fewer daily fees.

Shorter-term trading fits well with trading in the CFD format. These also offer the opportunity to sell short or use leverage. These neat tools come with added risks and costs, but they appeal to some.

A more detailed breakdown of how to find out which format is for you can be found here.

1. Research Netflix Shares

The first step to buying BIRK shares is to develop a well-researched strategy. It can be as complex or as simple as you like. You may be looking to trade intra-day using software tools or waiting for an opportunity to enter into a long-term buy-and-hold position.

Good places to start your research include the broker platforms themselves. You’ll find analysts usually break situations down into two general areas.

- Technical analysis — Using historical price data, chart patterns, and powerful software to predict future price moves.

- Fundamental analysis — In-depth analysis of the BIRK business model and the broader equity market. It involves establishing if Birkenstock is mispriced by using reports such as income statements, cash flow reports, and news releases.

2. Find a Broker

When choosing a broker, the crucial aspect is to use one regulated by a tier-1 regulator. An excellent place to start looking is for platforms licensed by the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySec).

3. Open & Fund an Account

Online broker accounts have a similar feel to online banking. As you’d expect, with money being wired from one account to another, some forms must be completed.

Each broker has its own client onboarding process, but most take only minutes to work through. Wiring funds into your account will be almost instantaneous if you deposit funds via bank or credit card. Other payment methods are usually available.

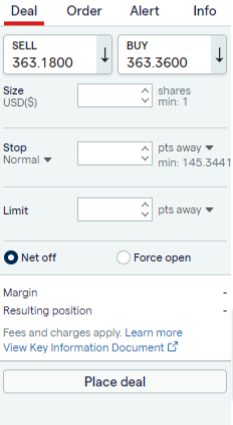

Source: IG

4. Set Order Types

With the admin completed, buying Birkenstock shares is as easy as finding the market on the platform, building a trade instruction, and clicking a button. If you’re trading using CFDs, you’ll be able to ‘buy’ or ‘sell’ BIRK shares. If you are going to hold the underlying shares, then you can only buy and can’t use leverage.

After inputting the ‘amount’ of Birkenstock shares you want to trade, you’re ready to go. Whether you are using a desktop or handheld device, you are one click or one tap away from putting on a trade.

Before you open your trade, you can input automated instructions to close your position at certain price levels. ‘Stop-loss orders’ and take-profit instructions are risk management tools that can be added before or after trade execution.

5. Select and Buy Birkenstock Shares

Even the experts double-check their trading instructions before giving the final order to trade.

Brokers have different names for the button that gives the final order to trade. ‘Open Trade’ or ‘Place Order’ are popular terms. When hit, your cash balance will be debited, and you will hold a position in Birkenstock.

The value of the holding will fluctuate in line with the market price. Monitoring the performance of your BIRK holding is usually possible via the ‘portfolio’ monitor. It will also be possible to close out of your position from this part of the site.

YOUR CAPITAL IS AT RISK

Best Broker to Buy Birkenstock Shares

There is intense competition between brokers, and this feeds through to improved T&Cs for account holders. Each broker offers something slightly different. As demo accounts are free to set up, it is recommended you try a few to find the best one for you.

Broker comparison tables such as the one found here are useful resources.

Finding the right broker is perhaps the most important part of the process. While you can buy Birkenstock shares with most brokers on the market today, not all brokers are created equal.

If you’re ready to buy BIRK shares, you’ll need to use an FCA-regulated broker with low trading commissions and a reliable trading platform. Finding one can be arduous and daunting, so we’ve hand-picked favourites that tick all the boxes to help you get started.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, CFDs, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts.

- eToro Top stock trading platform with 0% commission – Read our Review

- Tickmill Regulated by the FCA – Read our Review

- Admirals (Admiral Markets) More than 4500 stocks & ETFs available – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY

Fees When Buying Birkenstock Shares

Keeping on top of the transaction-based costs and fees associated with trading is vital. Financing charges and commissions can add up over time. They’ll also play a part in determining if you trade using CFDs or Shares.

Most good brokers offer fee tables so that you can run checks and determine what approach is best for you.

| eToro | Plus 500 | Markets.com | |

|---|---|---|---|

| Inactivity Fee | Yes | Yes | Yes |

| Inactivity Fee details | $10 per month. After 12 months | $10 per month. After 3 months | $10 per month. After 3 months |

| FX Conversion | Yes – on non-base currency trades | Yes – on non-base currency trades | Yes – on non-base currency trades |

| Fund withdrawal fees | Yes – $5 | Applied on some payment methods | Yes – $5 -$100 |

| Trading commissions | Included in spread | Included in spread | Included in spread |

| Overnight Financing | Yes, on CFDs | Yes, on CFDs | Yes, on CFDs |

Final Thoughts

Birkenstock shares went like at a time of market uncertainty, which presents somewhat of a risk. However, it could be a popular stock for retail investors, partly due to the consumer-facing nature of the firm and its products.

However, it is important for investors to conduct thorough research on the company before deciding to part with their hard-earned cash. Therefore, it may be prudent to wait for a couple of quarters of results in order to fully understand how the business is progressing and where you think its value should be. It’s important not to rush and consider the various potential risks to your position.

One risk that can be managed relates to your choice of broker. This list of trusted brokers includes firms reviewed by the AskTraders team to ensure they offer the tools and services to get your trading off to the best possible start.