Given the growing popularity of the two platforms, it’s worth digging into the detail to find out which one is best for you.

- What are Nutmeg and Moneyfarm?

- Nutmeg and Moneyfarm – getting started

- Nutmeg vs Moneyfarm – pricing

- Nutmeg vs Moneyfarm – products

- Nutmeg vs Moneyfarm – performance

- Are Nutmeg and Moneyfarm safe?

- Final thoughts

What are Nutmeg and Moneyfarm?

Moneyfarm and Nutmeg are online investment platforms that use algorithmic programs and automated trading to generate a return for their clients. They use cutting-edge technology to make investment decisions, and the user interfaces of both platforms are particularly user-friendly.

Source: Moneyfarm

Both started out in 2011 and have a mandate to bring a fresh approach to investing. Both have a feeling of being a tech start-up. Neither make a profit yet, but both now have more than $1bn of assets under management.

They are regulated by top-level authorities and offer similar products that are pitched towards those looking for medium and long-term returns.

Moneyfarm vs Nutmeg – getting started

Onboarding

Both platforms ask new customers to complete a questionnaire and supply proof of ID. The questions help the platforms satisfy what is required of them as licensed firms. Tier-1 regulators demand that KYC (Know Your Client) protocols are followed, and working through the questions is in the client’s interest.

Source: Nutmeg

Some of the questions are additional extras. The intention is that by establishing their investment objectives and investment credentials, new users are matched up to products that suit them.

Moneyfarm advises that onboarding to its platform typically takes 10 minutes to complete.

Minimum account balance

The minimum initial investment at Moneyfarm is £5,000. If that is out of your range, then it is possible to start with a balance of £1,500 as long as it is accompanied by a regular direct debit designed to top up the account.

Nutmeg supports those with smaller balances. The minimum requirement to open an account can be as little as £100 or £500 depending on the product.

Nutmeg vs Moneyfarm – pricing

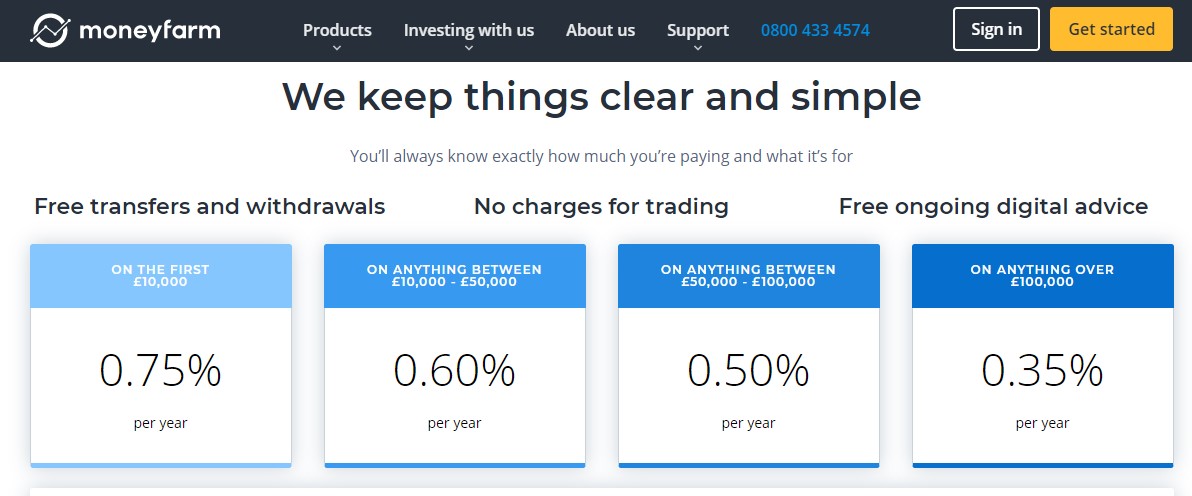

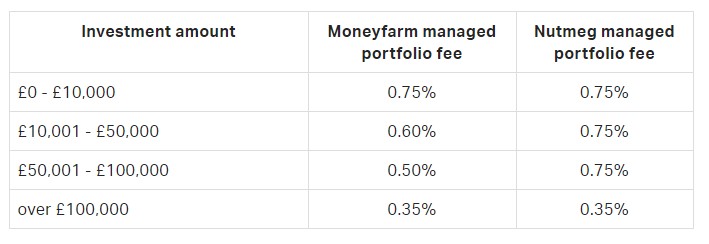

The good news in terms of fees is that Nutmeg and Moneyfarm both provide a simple and transparent pricing schedule. This is to be welcomed, as for too many years, the fees associated with investing, some of them hidden, put people off signing up.

Clients of both firms can also take comfort from the price war that has broken out between the two rivals. Both firms are focusing on developing market share rather than making a profit, which means that in the short term, at least, the investors get to benefit.

Moneyfarm has traditionally been seen as the more cost-effective platform. In 2018, Nutmeg tightened its pricing terms in an effort to compete on costs. Moneyfarm responded in February 2020 by introducing a new pricing structure.

Source: Moneyfarm

Both platforms offer tiered pricing. The larger your account, the lower the charge. It’s also important to check all the fee categories and calculate what your costs will be for your given holding period. The transparent layout of the T&Cs makes your job of checking easier, but you do still need to do it to be absolutely sure.

Source: Nutmeg

Both platforms feel that their pricing gives them a competitive edge. It’s certainly the case that offering clarity on a range of fees helps users get to the bottom of what they will be paying.

Moneyfarm, for example, shares that its fee structure includes:

- No set-up or subscription fees – you can open an account for free in 10 minutes.

- No trading fees – you won’t pay commission or transaction fees.

- No obligations – you won’t be tied in and can leave with no penalties.

Promotions

If you are considering investing with either platform, do run a browser search of promotional offers. It’s highly likely that you might find vouchers that give you ‘12 months fee-free’.

Nutmeg vs Moneyfarm – products

At both firms, your cash will be invested in underlying instruments such as exchange-traded funds (ETFs). These ETFs take real-time prices and can be traded into and out of in real time.

As Nutmeg and Moneyfarm are more about investing than trading, your route into the market will be through one of their investment products. Both firms offer ISA, Pension and General Investment accounts. Nutmeg offers two more account types: Lifetime ISA and Junior ISA.

Once you’ve selected your tax-efficient ‘wrapper’, it’s then simply a case of selecting the type of investment approach you want to follow.

Nutmeg breaks down its investment mandates into four categories:

- Fully Managed

- Smart Alpha

- Socially Responsible

- Fixed Allocation

Moneyfarm offers seven strategies, each one with a different risk-return rating. P1 is low risk, P4 is medium risk, and P7 is high risk.

Once you’ve registered, there are some additional services that you might want to tap into. Nutmeg, for example, offers its clients a product range relating to wills, life insurance and mortgages.

Nutmeg vs Moneyfarm – performance

The bottom line, performance return, is a good benchmark to use to measure the two firms. However, it’s not perfect for two reasons:

- It’s very easy to find yourself comparing ‘oranges and apples’. The two platforms have products that look the same but aren’t quite identical. These differences can make direct comparison difficult. It’s also important to measure the returns of the funds against other industry benchmarks such as the FTSE 100.

- The second factor to consider is time frames. Both Nutmeg and Moneyfarm are new ventures. The downside of being new is that your investment track record runs for years, not decades.

The returns on their funds do suggest that both Nutmeg and Moneyfarm need to be considered as candidates for managing your investments.

Source: Moneyfarm

Source: Nutmeg

The literature on both sites suggests that Nutmeg and Moneyfarm are set up to support individual attitude to risk and provide a healthy return. They don’t overpromise and there is little sense that you’re going ‘all in’.

For both firms, there is an emphasis on performance but also convenience. Nutmeg’s text on how it offers ongoing management states:

“Our team of investment experts will monitor your portfolio for you – so you don’t have to. This means making strategic adjustments to the mix of investments based on news, data and analysis, and rebalancing when necessary, to always ensure you remain aligned to your long-term objective.”

Source: Nutmeg

Are Nutmeg and Moneyfarm safe?

If you’re placing money with a third party, the risk that it disappears completely is much more impactful than the risk that it might be down 3% in value after six months.

Regulators

To reassure customers, both firms are regulated by Tier-1 regulators.

Nutmeg® is a registered trademark of Nutmeg Saving and Investment Limited, authorised and regulated by the Financial Conduct Authority, no. 552016. The firm is registered in England and Wales, with company number 07503666, and has its registered office at 5 New Street Square, London, EC4A 3TW.

Moneyfarm is authorised and regulated by the Financial Conduct Authority as an Investment Advisor and Investment Management Company. Its licence number is 62953.

Source: FSCS

Being regulated means that both firms have to operate in accordance with rules and regulations on things such as order execution, anti-money laundering and KYC. UK clients also come under the umbrella of the Financial Services Compensation Scheme (FSCS), which offers government-backed protection on up to £85,000 of client funds in cases of insolvency.

Reputation

Breaking into a market comes with its challenges, but the two disruptors each now have more than one million clients and more than £1bn of assets under management.

This gives them significant critical mass and the feel of being businesses that are viable concerns. They are also both focusing on attracting new clients, which means that they are very keen to protect their reputation. All this adds up to further reason for investors to trust them.

Backers

Both firms are privately owned. Because they aren’t listed on a stock exchange, there is less transparency regarding their financial situation.

Their start-up status means that both are yet to post an annual profit. Moneyfarm was forecast to do so in 2019 but fell short of breaking even. In the same year, Goldman Sachs bought a stake in Nutmeg, which valued the robo-adviser at £245m.

Neither firm is haemorrhaging cash. Both appear to be playing a long game and prioritising business development and future market share over profits.

The price war and increased regulatory costs haven’t helped either firm. Clients of both firms should make their own opinion on how much weight to give to any potential downside associated with their adventurous business approach.

Final thoughts

Both Nutmeg and Moneyfarm have a lot going for them. They bring a combination of new ideas and tried-and-tested ones.

Moneyfarm probably edges it in terms of costs, while Nutmeg has a wider range of products.

The good news is that both have investment products designed to suit all investor appetites and a very user-friendly platform able to match investors to appropriate strategies.