That volatility doesn’t put everyone off. Some investors are drawn to the chance to make life-changing sums of money in this market. Buying bitcoin is a calculated risk, but hedging against regret the next time price spikes is an easy enough process. However, making a Bitcoin price prediction is more tricky. The process involves considering the factors which drive the price of BTC and developing a clear understanding of whether you are looking to run short-term or long-term strategies.

Short History of Bitcoin

To better understand the future performance of Bitcoin, it is important to look at the cryptocurrency’s history and goals.

On October 31st 2008, Satoshi Nakamoto published the white paper for Bitcoin. Bitcoin is considered the first digital currency and the largest one by market capitalization as of 2022, with a market cap of $385 billion.

Bitcoin was the very first decentralized digital currency that did not require a third party for regulation, such as a bank or a financial intermediary. Instead, Bitcoin was developed as a peer-to-peer network, where each transaction is verified and recorded on a network node on the distributed ledger called blockchain.

Forks and the Blockchain

After Satoshi Nakamoto stepped down from developing the cryptocurrency, the bitcoin community took different views on how to best help bitcoin reach its full potential. From then on, all changes made have resulted in soft and hard forks for Bitcoin. Moments when the bitcoin blockchain takes a new direction designed to improve functionality or add new features are called forks and these can be soft or hard depending on the scale of the change which is made. When there is no agreement in the community as to the changes that a fork will make, a split occurs and the result is a totally new currency. Since 2011, several hard forks of Bitcoin occurred such as Bitcoin Cash, Bitcoin Gold and Bitcoin Private.

Bitcoin’s transactions are all recorded on blockchain, a decentralized, distributed public digital ledger. Blockchain records transactions so that the information cannot be changed retroactively without changing all blocks. Each “block” is verified and each transaction is verified across millions of computers, so that the community agrees on the transaction. This method of transacting eliminates the need for verification by a third party. The whole database on the blockchain is managed through the peer-to-peer network and a distributed timestamping server.

Once the data is verified and secured, the transaction participants can feel more secure regarding potential breaches of privacy, inaccuracy or self-interest among members of the community. When each unit of data is transferred only one time, double-spending, which is typical for digital assets, is eliminated. This is one of the major reasons why blockchain and bitcoin have been so successful thus far.

Each bitcoin has a specific bitcoin address on the blockchain. This is done through private keys, which allow each bitcoin to have a unique address along the chain. The issue with private keys and the address of bitcoin is that if the key is lost, there is no way to reassign ownership since all coins with the lost address are lost as well and cannot be retrieved. To prevent this, many users have backup so as not to lose valuable coins.

Mining

Bitcoins are mined. The process involves miners racing to complete complex equations with the winner being rewarded with new coins. In return, the process of mining keeps the blockchain consistent, complete, and unalterable. The process works by repeatedly grouping newly broadcast transactions into a block, which is then broadcast to the network and verified by recipient nodes. Bitcoin mining is the holding of the record contained so far on the blockchain, while adding the new transactions and making a whole, consistent and verifiable new block on the chain.

After being mined, each new block on the chain must be accepted and verified by the rest of the community. This is done through the Proof-of-Work (PoW) process. The PoW concept is extremely important to bitcoin mining. Since every block must be verified and accepted, it becomes very difficult for a hacker to break the chain.

All transactions and funds that are done through bitcoin are anonymous and stored in bitcoin addresses. While many debate whether this feature is more advantageous or harmful to society, transactions with Bitcoin are transparent and secure, as every transaction is verified and recorded on the blockchain.

The central issue with bitcoin in the past few years has been its high transaction fees and the time taken to create a new block. In a way, bitcoin is a victim of its own success, as the increased use of the coins has exposed capacity issues. It currently takes between one and one and a half hours to process a bitcoin transaction which limits the use of the coin in day-to-day purchases.

Store of Value

Some theorise that Bitcoin is a new form of digital gold, but this argument has yet to be proven. The theory claims that like gold, Bitcoin can be seen as a safe-haven asset. However, historical price data points to the correlation between gold and crypto being relatively low. The flip side of this is that residents of some countries which have experienced rising inflation, political turmoil or civil unrest have turned to Bitcoin. Bitcoin use in Venezuela increased dramatically in 2021 as its citizens struggled to navigate hyperinflation in the economy. It’s now estimated that more than 10% of Venezuelans own bitcoin and Panamanian-based cryptocurrency exchange Cryptobuyer and Venezuelan payments processor Mega Soft have created around 20,000 point-of-sale terminals in the South American nation.

The world’s population and even entire countries have begun to adopt Bitcoin more widely. El Salvador in 2021 took the dramatic step of becoming the first country in the world to recognise bitcoin as legal tender. No other countries have made the same move but that could be largely put down to the subsequent price crash in BTC. If and when prices begin to stabilise it will be possible to carry out a more in-depth analysis of the pros and cons of the move to an entire economy adopting bitcoin use.

Financial Institutions

Banks and financial institutions have had mixed feelings when it comes to Bitcoin. Jamie Dimon, the CEO of J P Morgan has called Bitcoin a “fraud”. Warren Buffet, one of the greatest investors of all times and chairman of Berkshire Hathaway, recently said that Bitcoin is not producing anything and is not backed by anything, so it has no real value.

Yet, the curiosity individual investors feel when bitcoin prices rise extends to major banks and investment houses. Goldman Sachs has been working on developing a cryptocurrency trading desk and multi-asset online brokers also offer markets in cryptocurrencies. This allows retail clients to buy Bitcoin and stocks from the same account. As a result, those interested in buying Bitcoin no longer have to use specialist exchanges or worry about what kind of wallet to use. The increased access to the market opens the door to more people buying Bitcoin and it is now possible to buy fund-style bitcoin instruments such as bitcoin ETFs and Bitcoin indices.

Energy Use

It is impossible to establish if the founders of bitcoin in 2009 factored in the amount of energy the coin would use by 2022. The fact that bitcoin is responsible for approximately 0.32% of total global energy consumption has become a major headache for the coin. The approach to the system being such a drain on resources goes against the move towards a low-energy economy and legacy systems such as Visa. New low-energy altcoins could see their market share increase as a result.

The reaction to the problem has focussed on using renewable energy to run the Bitcoin network and it is estimated that 57% of the energy used for crypto mining currently comes from renewable sources. The extent to which progress on this point could be crucial to the prospects and price of Bitcoin.

The Price of Bitcoin – Past Development and Future Trends

Anyone considering buying Bitcoin is likely to find that the market is heading at some speed in one direction or another. The price of Bitcoin is largely driven by investor sentiment and once momentum builds price can overshoot to the upside or downside.

LESSONS FROM THE PAST FOR THE FUTURE: WILL BITCOIN CRASH AGAIN?

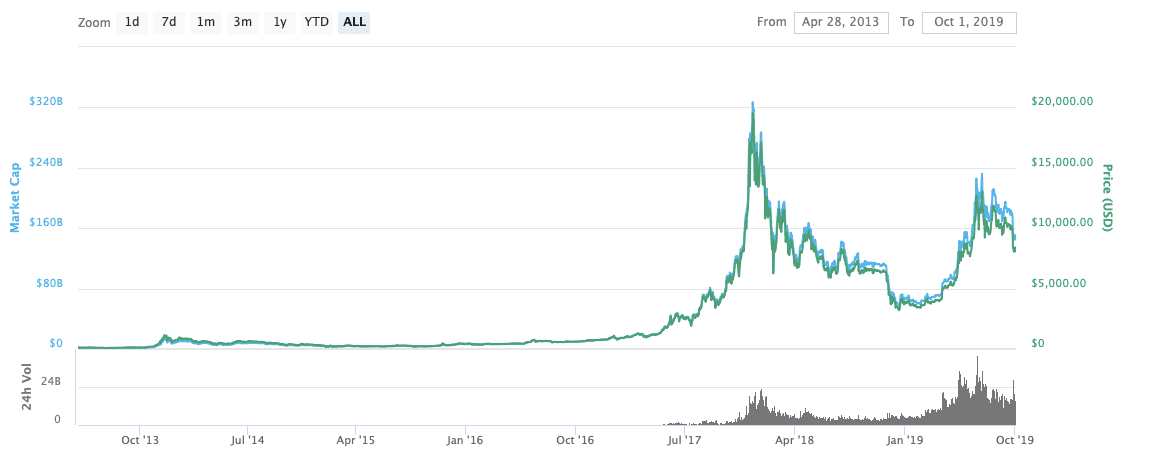

The value of Bitcoin more than halved in 2022, but this isn’t necessarily a sign that the game is over. As an example, in 2011, the price crashed by 93% within a span of five months. Between November 2014 and January 2015, Bitcoin’s value once more dropped by 50%.

The price moves might be typical but an up-to-date Bitcoin prediction will include new variables. One primary concern right now is that regulatory bodies may suffocate Bitcoin’s growing potential. Economic powers such as the United States and China have a vested interest in staying in control of their financial systems and have been reported as developing their own virtual currencies to rival Bitcoin. The announcement made by the China government that it was making bitcoin mining and trading illegal is widely regarded as being the catalyst for a subsequent +50% fall in value. Those updates from governments are by their very nature hard to predict so the only real certainty is that price volatility will remain at high levels.

VALUE OF BITCOIN – 2023 PREDICTIONS

- Some conservative estimates made on industry site digitalcoinprice.com peg the value of bitcoin at $28,915 by the end of January 2023. That piece of research predicts 2023 could be the year when price moves in bitcoin stabilise and makes a December 2023 price prediction of $37,692

- From a technical analysis perspective, the all-time-high of $67,567 which was printed on 8th November 2021 will act as significant resistance should bitcoin reach those levels again. Investors buying in at current levels may want to consider $67,000 as a price target at which they bank some profits.

- A break above $67,567 can be expected to be marked by euphoria returning to the market. CEO of Nexo Antoni Trenchev predicts Bitcoin's price could exceed $100,000 before April 2023.

- Other financial gurus predict Bitcoin could collapse completely.

BITCOIN VS. FIAT CURRENCIES

Satoshi Nakamoto, by creating the special mechanism through which Bitcoin will be entering the market, has created the framework in which value increases over time.

This is among the biggest criticisms of regular currencies with expanding supply and falling value. An investor can think of money as a pie. When more of a currency is issued, more slices are created, though the size of the pie remains the same. As slices are created over time, the size of the slices becomes smaller. As the government prints more money, the value of GBP or other currencies decreases.

This dilemma has become more pressing during 2022. Many are forecasting the global economy is entering a period of high inflation, a slowdown in economic activity, or both. Bitcoin hasn’t navigated a severe recession and so it’s hard to forecast how investors will react. Will it be seen as a safer asset than the fiat currencies central banks can print at will? Or will a recession result in investors selling their positions to cope with a cost of living crisis?

Final Thoughts

As a non-government-backed asset, Bitcoin has become the currency of choice for those looking to escape traditional and limited financial markets and the issues of arbitrary government policies. That genie is firmly out of the bottle but the question is whether that translates into higher prices. If instability strikes the international economy or geo-polity, Bitcoin could turn out to be a very good alternative asset. Bitcoin is durable, portable, scarce and divisible – all the right ingredients for becoming as prized an asset as gold.