Shares of airline stock International Consolidated Airlines (LON: IAG) are gaining on Tuesday, climbing over 2.5% to 207.85p…

The move in IAG's share price has come on the back of travel-related updates concerning European travel and a potential opening of UK-US travel.

On Monday, the European Union revealed it aims to take a significant step towards a return to normality with plans to reopen borders.

A proposal by the European Commission has been put forward to allow travellers to enter the region if they have been fully inoculated against the coronavirus.

Time to revive 🇪🇺 tourism industry & for cross-border friendships to rekindle – safely.

We propose to welcome again vaccinated visitors & those from countries with a good health situation.

But if variants emerge we have to act fast: we propose an EU emergency brake mechanism.

— Ursula von der Leyen (@vonderleyen) May 3, 2021

“The Commission proposes to allow entry to the EU for non-essential reasons not only for all persons coming from countries with a good epidemiological situation but also all people who have received the last recommended dose of an EU-authorised vaccine,” the European Commission stated.

It was also reported yesterday that a coalition of US and European travel, airline, union, business and airport groups have called for the US-UK travel market to reopen as soon as safely possible.

A report by Reuters stated that a letter to US President Joe Biden and UK Prime Minister Boris Johnson said that the leaders planned meeting in early June would be a prime opportunity to jointly announce the full reopening of US-UK air travel for citizens in both countries.

The US currently has a travel ban in place for non-US citizens who have been present in China, Iran, the European Schengen area, the UK, the Republic of Ireland, Brazil, South Africa and India during the 14 days preceding their arrival in the US.

“The return of Transatlantic flying would not only have a significantly positive impact on our respective economies but will also reunite those who have been separated from their loved ones for over a year,” the letter said.

With the US previously insisting that there would be no federal vaccinations database or requirement to obtain a vaccination credential, it remains to be seen whether vaccination passports would be implemented.

However, it does seem that the easing of travel restrictions is nearing. With the UK set to reveal a travel green list for its citizens, there is light at the end of the tunnel for battered travel stocks and that could see IAG's share price move another leg higher.

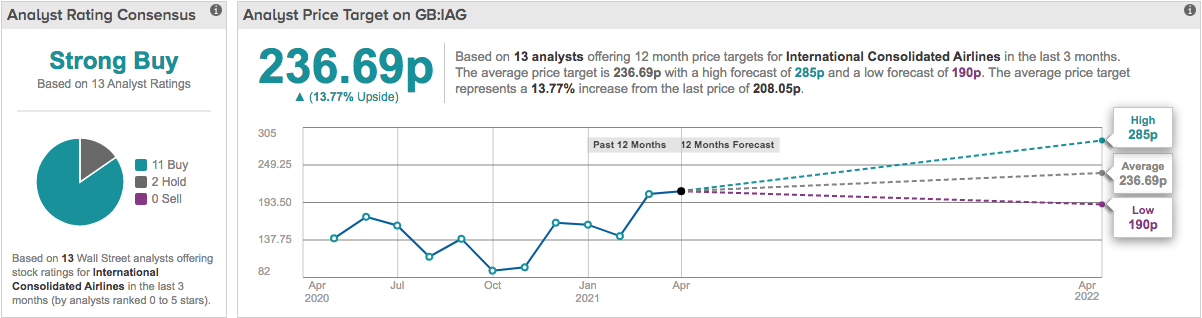

Elsewhere, both Credit Suisse and JPMorgan released positive notes on IAG on Tuesday. JPMorgan analyst David Perry upgraded the stock to overweight, saying that they “expect 2021 to remain very challenging, but the prospects for 2022 onwards look promising as global air travel starts to normalise.”

Credit Suisse stated that the hope of a US-UK travel deal and the joint letter from the 49 industry groups and unions on both sides of the Atlantic has seen them revisit IAG's recover prospects.

“Domestic market recoveries (e.g. in the US, China and Australia) illustrate leisure demand is strong and we think were IAG to outline a credible path to full margin/earnings/FCF recovery, any short term share price momentum on UK-US restrictions lifting could be the first step towards full share price recovery over time,” stated CS.

Should You Invest in IAG Shares?

One of the most frequently asked questions we receive is, “what stocks are best to buy right now?” It's a wide-ranging question, but one that we have answered… Our AskTraders stock analysts regularly review the market and compile a list of which companies you should be adding to your portfolio, including short and longer-term positions. Here are the best stocks to buy right now