Key points:

- Cloudbreak Discovery has issued more shares to fund future acquisitions

- That's fine, that's the point of a natural resources project generator

- But should a small company really pursue bauxite, a notoriously capital intensive mineral?

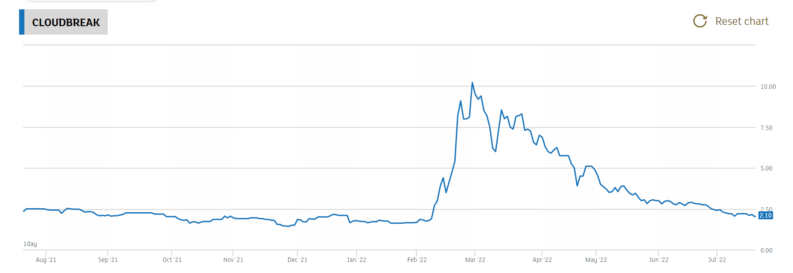

When Cloudbreak Discovery (LON: CDL) first came to public attention around the turn of the year we were most interested in it. As we should have been, the shares went up 500% or so at one point. It's possible to think that CDL might have slightly lost its way since then with the shares back down at 2p. Today sees yet another capital raise to continue to pursue new projects. Raising capital at this 2p plus change price does seem dilutive which might be why interest seems to be waning.

The basic idea could be a good one. The early stage mining and natural resources field is hugely fragmented. Therefore there can be a role of a “natural resources project generator” which is how Cloudbreak Discovery describes itself. Someone in the centre, able to organise professional and legal help, work out fund raising and possibly, even, work the industry the other way around. These are the minerals people should be looking for, let's organise to go look for them. This is, after all, a tactic that has worked more than once in the past under different names – investment banking before that all became trading paper, before that mining houses worked this way.

Organise, be the broker of, projects and take a slice of each of them as payment for having done so. Why not? The thing is, such a strategy does depend upon how good the projects are that are organised. We've tutted over Cloudbreak funding a Namibian oil licence for example. Not a huge amount of value added here perhaps. Sure, finding oil is great, if it is found, but that looks like simple financing of risk rather than value added services.

Also Read: How To Invest In Metal Stocks

We've also worried a bit about Cloudbreak‘s deal with Crescita. There seems to be an option embedded in that. If the shares issued for cash from Crescita fall in the 6 months after issuance then more shares must be issued to make them whole. That could – and at current price levels might well – lead to significant dilution, as we're worried about Cloudbreak before.

But what might worry about the current announcement is this: “acquiring suitable additions including lithium assets and bauxite projects globally,”. Well, lithium is the metal of the day so perhaps. We've more than once muttered that there might be a price crash coming there given how many people are planning to mine more of it. But it's that bauxite that creases brows. It's perhaps the most common mineral on the plant, It's hugely cheap as a result. It's also something dealt with in vast, vast, volumes. It's very much more of a logistics problem than it is a mining one. It's really not a business in which small companies really have any place. Also, given the rise in energy costs producing for the aluminium business doesn't seem all that attractive these days.

Bauxite is simply an odd mineral for a small company to be chasing. Of course, all the same issues mean that a vast success would indeed be vast. But it's not obvious that Cloudbreak Discovery's strategy is all that well thought out. Trading decisions will have to be based on beliefs about all of that, of course.