Key points:

- The Energy Transfer (ET) stock has risen 7.92% but is facing resistance.

- However, oil stocks have been falling and are now at a crucial support level.

- Therefore, investors should adopt a wait-and-see attitude towards ET and oil.

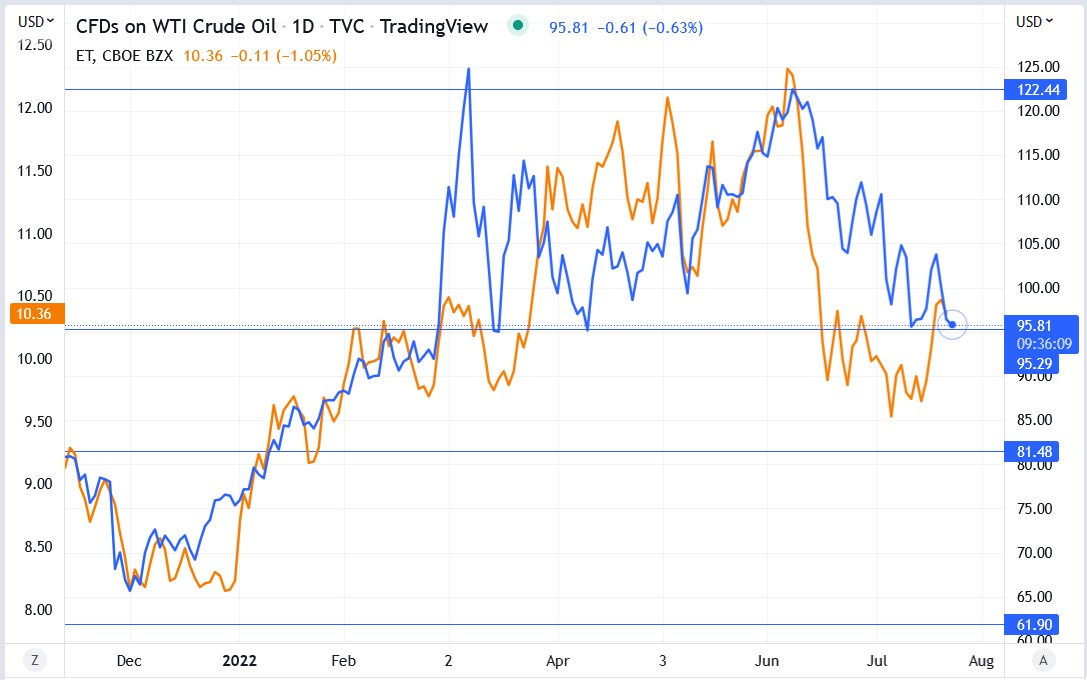

The Energy Transfer LP Unit (NYSE: ET) stock price has risen 7.92% in a week and is trading at a crucial resistance zone below the $10.50 level. On the other hand, crude oil prices have been falling and are trading at a crucial support level of around $95.

The two are at a crucial juncture, with oil prices threatening to break below $95, which has been in place since late February. If oil prices break below this critical support level, there is a good chance that oil prices will fall below $90 and on to $85.

Also read: Oil Trading Guide – How To Trade Oil.

A decline in oil prices is likely to precipitate a drop in the Energy Transfer (ET) stock price, given that the company is a leading midstream player in the US Permian basin, where producers are ramping up production to meet the high demand for oil in the US and globally.

I have mentioned in previous articles that I did not see the price of oil rallying higher and printing new highs despite the start of the busy summer travel season. Instead, I predicted that oil prices would fall or stagnate in the summer due to less-than-expected demand as inflation eats into consumers’ wallets.

ET stock is at a crucial juncture since it has risen as oil prices fell, driven by higher crude oil stockpiles, which rose by 3.5 million barrels last week, according to the Energy Information Administration (EIA).

Given the significance of the current support level, we can only guess which direction crude oil futures prices will take. However, we will probably get a good idea of oil’s future direction next week since, one way or another, we will get a reaction from the support zone, which could break, or prices will bounce higher.

Therefore, now is the time for investors to hold off making any bets on oil prices and companies until we see how crude oil futures will trade starting next week.

*This is not investment advice. Always do your due diligence before making investment decisions.

ET stock price.

The Energy Transfer stock price has surged 7.92% in the past week and is now trading at a resistance zone.