Key points:

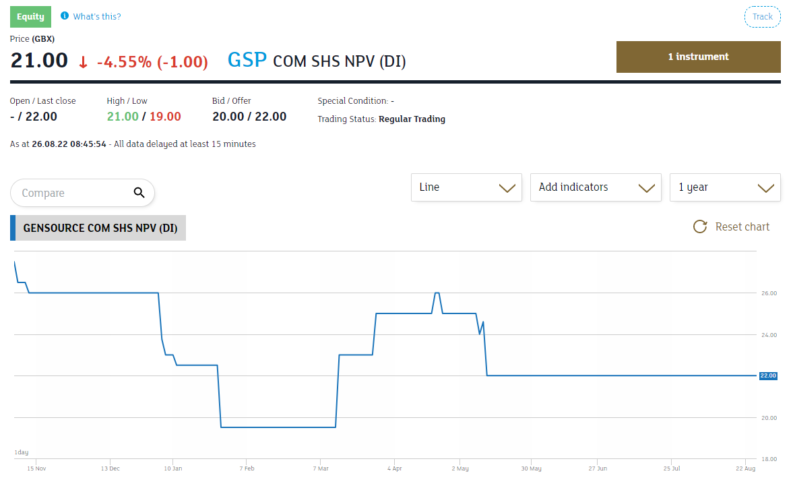

- Gensource Potash is down 5% on management announcement

- The key is being able to raise the equity to open the mine

- The announcement is GSP is still working on it – rather than have solved it

Gensource Potash (LON: GSP) shares are down 5% on the news that there are further delays to their being able to finance the new operations in Saskatchewan. The big question here is gaining access to the capital that will allow them to properly start mining. That's a large amount needed there. Which is something of a problem for a company – like GSP – with an under £100 million market capitalisation. Of course, this is solvable if that is the only problem. But it's one of those things that is not easily solvable at a price most would like.

That is, the problem here is price, not possibility. That assumes that the underlying mine and operation is as it is said it is of course. This is, to some extent, the same problem that Sirius Minerals faced in North Yorkshire. There there were a couple of technical problems but nothing that couldn't be overcome with money and brute force. But even in the absence of those problems a potash mine (polyhalite for Sirius but same difference) because potash is low value then everything has to be done at vast scale to be economic. That requires simply bucket loads of capital.

Capital can be found, of course it can, that's what stock markets are for. But how much you can raise depends upon market capitalisation and price. The lower the market valuation of the company as a whole then the more of that has to be given up in order to gain access to the new capital.

Also Read: The Best Nickel and Nickel Mining Stocks to Buy

The thing for us to understand about potash mining is that it is not – ever – a small scale operation. We do not have small but perfectly formed potash mines around the place. It just does involve moving millions of tonnes of rock. Therefore it's always a large scale operation – and that requires capital.

This is where Gensource finds itself. As their announcement says: “Gensource is actively pursuing the equity capital markets to complete the full project financing package for the Tugaske Project (in conjunction with the previously announced committed debt financing), which will allow the first module at the Tugaske Project to commence construction.” The mine itself seems fine. There's a definite appetite for more potash supply. We'd all also like there to be more supply that wasn't so dependent upon foreign and or odd countries. Potash is vital for ferliser supply and so on – we expect the market to grow in a world getting richer and desiring more food. Gensource seems to have the requisite political support to be able to gain licences and permissions.

The question really comes down to, well, where's that capital going to come from? Sure, precisely because the mine is fine, the tech and market well known, much of the finance can and will be debt. But it's still necessary to underpin that with an injection of equity capital. And raising enough of that on a £100 million market capitalisation just isn't going to be the easiest of tasks – not without significant dilution of current shareholders that is.

Management say they're still working on it – well, great, but prices might well only change significantly when they say they've a solution.