Key points:

- GreenLight Biosciences is up 114% premarket

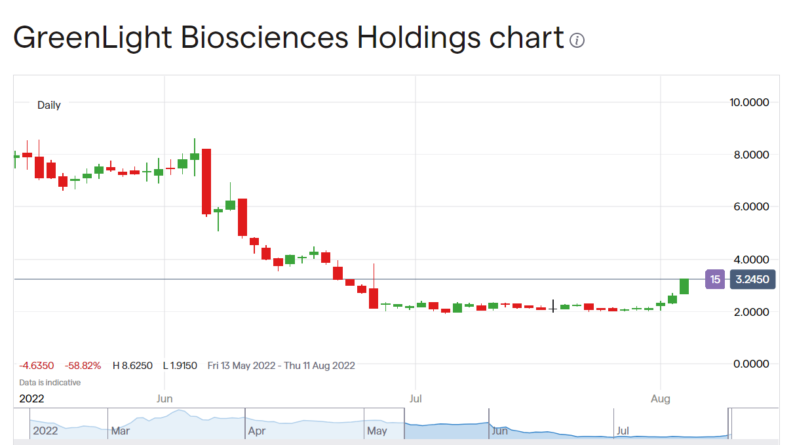

- This doesn't cover the 66% fall since the SPAC IPO

- The cause is the proof that commercial production of the mRNA vaccine seems to be possible

Greenlight Biosciences (NASDAQ: GRNA) stock is up 114% today premarket, following a 25% rise yesterday. Given that Greenlight stock has fallen 66% since the IPO – or SPAC merger, your preference – back a few months this is a welcome change. Of course, this doesn't claw back all of the losses, percentages don't work that way. Today's climb still leaves a substantial loss for those who got in at the original price.

The question is, of course, well, what is it driving this rise in the GRNA stock price? The basic business line is in RNA and mRNA applications for both human and agricultural health. The ag products are for both honeybees and crops and we could imagine there being a growing business there – colony collapse and all that is something that needs to be solved. The human side, well, that links in with the current vaccine rage, mRNA vaccines for covid of course.

It's possible that that, in itself, explains the stock price fall. For back those months at the SPAC time there was much more excitement about mRNA. Clearly and obviously so, given how the vaccines for ‘rona had been developed. Now it might be a little more obvious who the winners and losers are/were. The stock price fall here being that Greenlight was not one of the winners like Moderna.

Also Read: Five Best Pharmaceutical Stocks to Watch in 2022

As to what might be driving the stock price rise now the big news is that the work Greenlight has been doing with Samsung actually seems to be working. The announcement was earlier this week but their joint mRNA virus not only seems to work they've been able to scale up the engineering to commercially sized batches.

This is more important than it might seem. Normally with pharma the difficulty is in first discovering something worth using, then in getting it approved. This is not how those mRNA vaccines have been working out. Several to many people were able to produce something that worked. The regulatory system was of course lenient in passing them as something that does work. The big roadblock was in fact in being able to manufacture at scale. This is why all those bleats about making everything patent free have been so useless. To a reasonable level of detail everyone in the world who was capable of making the mRNA vaccines has been making the mRNA vaccines. It's a significantly difficult industrial and technical task.

Which is the very thing that Greenlight has announced that it is capable of doing.

Now, of course, the big thing is whether anyone wishes to buy another or different covid 19 vaccine. It's possible that they do, given vaccine coverage in some parts of the world. It's also possible they don;t and the answer to that will likely determine the future Greenlight stock price. But the bounce for now seems to be based o the idea that commercial manufacture has been shown to be possible.