Key points:

- Horizonte is up 1,800% by the usual tickers

- This is really more like a 10% fall

- The explanation is a share consolidation

Horizonte Minerals (LON: HZM) can be described as 1,818% up this morning and many tickers are in fact saying that. Even Horizonte's own page about its own share price seems to be showing that this morning. Actual reality is that Horizonte's share price is down 10% this morning, or close to 10%.

The confusion here is that near all of these reporting systems are automatic and sometimes that careful hand tweaking is necessary. Something that hasn't happened as yet but no doubt will as the webmonkeys get around to it.

The new Horizonte share price of around 140 p should not be compared to the old one of about 7p and change. Because they're not the same shares. We've had a reverse stock split, or as we Brits call it, a consolidation. This was part of the AGM results announced a couple of weeks back:

To approve the share consolidation of 1 new share of £0.20 for every 20 shares of £0.01 each

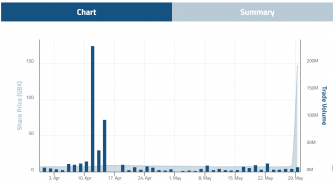

This share price chart is therefore nonsense:

These 5 Investors Say The Market Will Go Down From Here

It's nonsense because it's not adjusting for the fact that there is now only 1 new share for every 20 old ones. These sorts of things do tend to get sorted out and the price comparisons of the old stock will get adjusted to those of the new soon enough. But just in case anyone thought they'd coined it here no, this is not actually a rise in the value of a stake in Horizonte shares. This is in fact a decline in the value of Horizonte shares.

For given a 1 for 20 consolidation there should be a 2,000% rise in the share price. That rise has only been around 1,800%. Therefore that's much closer to a 10% decline in Horizonte's market capitalisation than a 1,800% rise in it.

At which point it's worth asking why it has been done? The answer is that the aim – the hope perhaps – was that it wouldn't work out this way.

As an actual operating business Horizonte Minerals has been doing well. Prospecting for nickel, they seem to have found some and secured the rights to it. They're hitting their milestones at Araguaia and so on. There's a validation of the concept with Glencore's Horizonte stake. This is the way with junior miners often enough, the scrappy independent takes the risk of finding and proving the deposit, when that looks close to being secure and economic then one of the mining giants buys in.

So, why the consolidation? Purely a matter of fashion. There's long been a feeling – and it is no more than that – that “serious” companies have share prices between £1 and £10. Below that range is penny stocks which are somewhat disreputable. So, as Horizonte Minerals matures from being a scrappy, speculative, junior miner into being an actual proper nickel producer let's move that price into the respectability range. Let's get it from 6 and 7 pence up to 140 p. A 1 for 20 consolidation that is.

This should then increase the corporate valuation as people realise that it's no longer a scrappy junior miner etc. As it happens, in this short term, it hasn't worked. But that is the story of what is being tried. The new Horizonte shares are trading 1,800% or so above the price of the old. But they “should” be 2,000% up. So, that's a 10% fall then.