Key points:

- Kibo Energy share surged 23.6% after signing a 10-year PPA.

- The contract is evidence of the demand for Kibo’s sustainable energy tech.

- Kibo shares look pretty attractive at current prices to energy investors.

Kibo Energy PLC (LON: KIBO) share price surged 23.6% after signing a 10-year Power Purchase Agreement (PPA) with an Industrial Business Park Developer in Gauteng, South Africa.

Investors cheered the move, evidenced by the rally in Kibo’s share price, proving that demand for sustainable energy solutions exists following its shift from coal-powered energy projects.

The contract will see Kibo Energy build a 2.7MW power plant that uses specific non-recyclable plastics to produce high-quality syngas via a thermal degradation process. The syngas will then be directed into gas engines to generate electricity and heat energy.

Also, Read 3 Clean Energy Stocks That Offer Promising Growth for 2022.

While the deal generates a base payload of 2.7MW of electricity, Kibo could also sell the heat energy generated to firms operating in the industrial park.

According to the financial models generated, Kibo expects the project to generate ZAR 388 million in earnings before tax and depreciation over the 10-year duration of the contract. In addition, Kibo will receive ZAR 252 million of the revenues generated from the project.

The above figures are based on the minimum 2.7MW electricity payload generated when the project is launched. However, the figure will be much higher if the project is expanded to the maximum output potential of 8MW.

Kibo Energy expects to incur costs worth up to ZAR 180 million in capital expenditure on the project, with the financial close expected to be completed in Q3 2022. The project is expected to start construction in Q4 2022 and be commissioned 11 to 14 months later.

Louis Coetzee, Kibo Energy’s CEO, commented: “Following the Company’s disinvestment from coal, we are excited to have signed our first waste to energy PPA that aligns to our strategy on advancing clean energy in the African market. The project is the first in a pipeline of projects under the Company’s waste-to-energy portfolio, which we are proud to have worked on together with our partners, IGES.”

Adding:

“In the process of getting the PPA ready for signature, the Company has also been doing a large amount of work on procuring funding for the project and has received a higher than expected level of interest from various institutions for the provision of project and debt funding at very competitive commercial terms. With the signed PPA now in hand, the Company finds itself in an excellent position to advance these discussions with a view on finalising appropriate funding arrangements for the project in an expeditious manner.”

The project will generate revenues for Kibo Energy for the next ten years with the possibility of realising significant additional revenues from the sale of heat and other by-products.

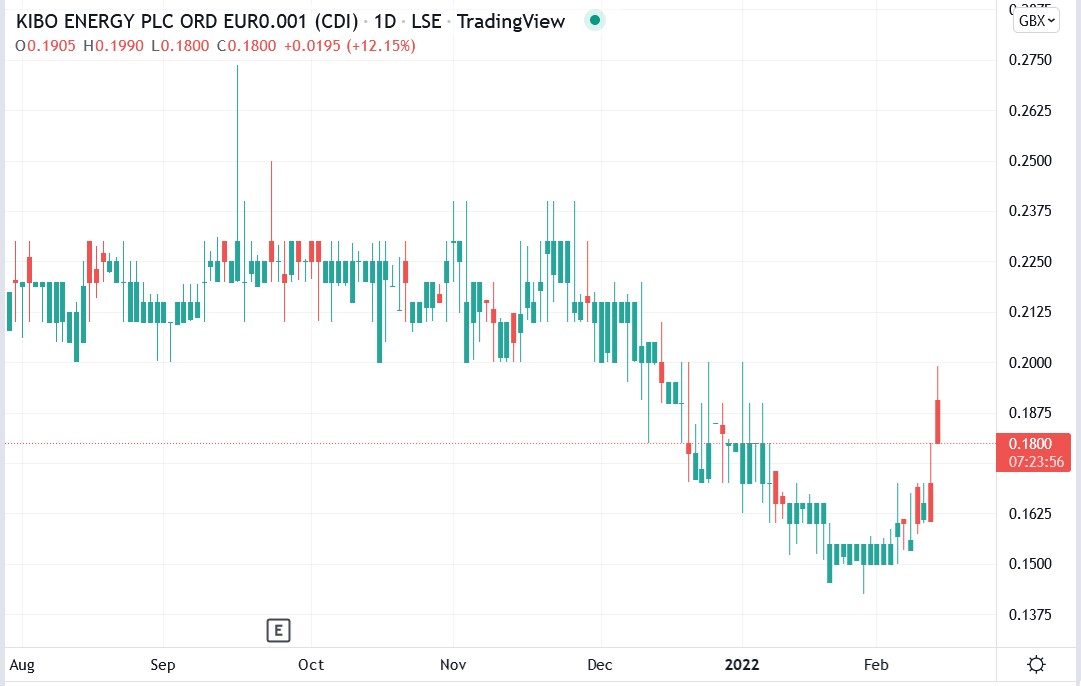

Kibo shares had given up a significant portion of their earlier gains at writing. The shares have risen 5.56% in 2022 but are down 54.7% over the past 12 months, making them quite appealing to energy investors.

*This is not investment advice. Always do your due diligence before making investment decisions.

Kibo Energy share price.

Kibo Energy share price surged 23.6% to trade at 0.1990p, rising from Friday’s closing price of 0.1610p.