Key points:

- The Porsche IPO is slightly up this morning

- Porsche stock is down 7% though

- What is the explanation for this conundrum?

The Porsche (LON: P911) IPO is off to a reasonable enough start this morning, with the shares first offered at the top of the range and now moving, at pixel time, slightly upwards. However, there's going to be an awful lot of confusion among investors as the other Porsche stock is now down some 7% at the same time. This is something that we all need to be aware of – Porsche is not necessarily Porsche. Make absolutely certain of trading the one that you actually want to trade. For, as is obvious here, they won't necessarily move in the same direction.

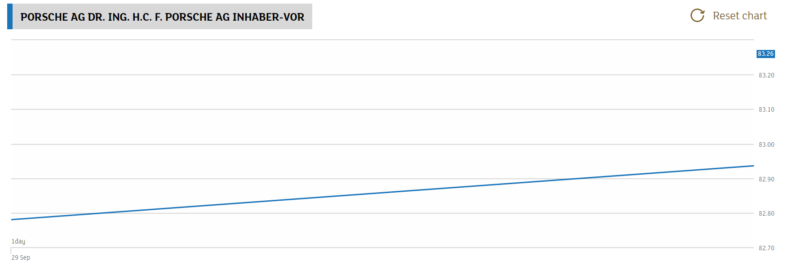

The Porsche IPO is of VW selling a piece of the Porsche company that it – until today – owned. This is intended to raise some €9 billion or so for VW to invest in going electric. As a part of this the Piech-Porsche family is increasing its stake to a blocking more than 25%. This is the new stock that arrives on the market today. It was first priced at €82 and change, at the top of the originally suggested range. It's now up, very modestly, from that IPO price:

However, note very carefully that corporate name. This is the newly floated one: “DR. ING. H.C. F. PORSCHE AG INHABER-VOR”. The need for care here is that there is also the other Porsche:

That is “Porsche Automobil Holding SE – Pfd” and that's a very different company – as we can see from the fact that it's down 7% today while the other Porsche is up that 0.29% or so.

Also Read: The Best Electric Car Stocks To Buy

It's possible to think either way on the Porsche IPO itself. Maybe petrolheads will buy in because, you know, the name and memories and all that. On the other hand, the entire range is to go electric soon enough which is going to be a bit of a downer on a company known for producing excellent petrolhead cars. That transition is coming, it's announced, and no one really does know quite how it's going to work out.

The more important point for us to note as investors though is that we've now got two “Porsche” companies listed and quoted. It's entirely vital that we all grasp the difference between them and make sure that we trade the way we want to in the one we actually want to trade in. That might sound silly to mention but it really is important. There's that recent speculation that AMTD Digital went stonks because people though they were trading the Hong Kong Dollar (the ticker is HFD). Or looking further back there's Zoom: “Zoom Video Communications, a $1 billion startup, filed for its much-anticipated IPO on Friday. Zoom Technologies, a completely unrelated company, saw its shares spike 1,100% in the aftermath.”

Whatever views or desired positions in Porsche now are following the IPO really, do, just make sure that you're trading in the Porsche you mean to be trading in.