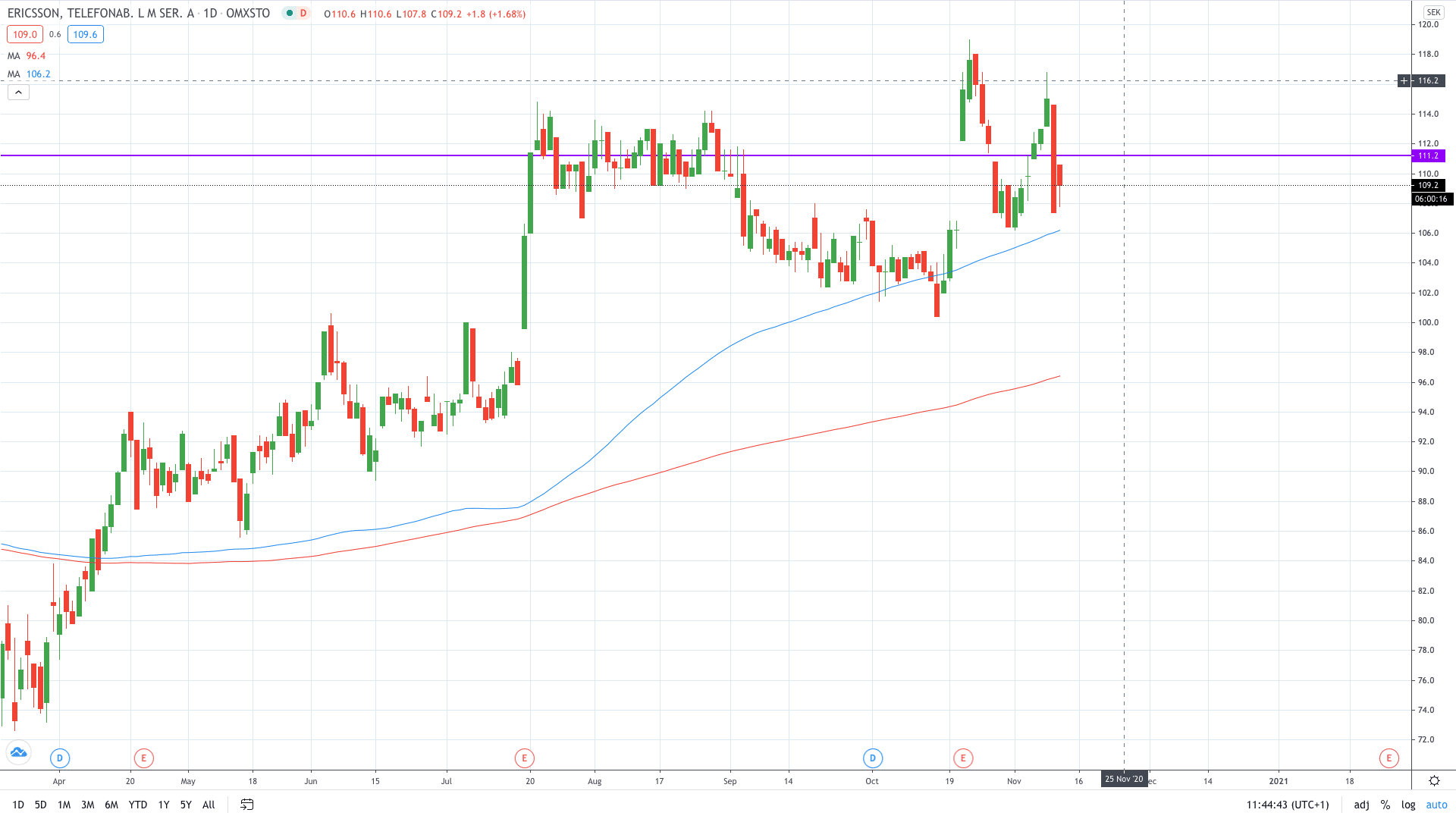

Shares of Ericsson (STO: ERIC) plunged 6.6% on Tuesday to erase vaccine-fueled gains on Monday after the telecom group didn’t change its 2022 operating margin target.

Ericsson left its operating market target at 12%-14%, while the same margin for networks was raised to 16%-18% from prior 15%-17%. The upgraded network margin was offset by lower margin target for digital services business, which now stands at 4%-7% from 10%-12% previously communicated.

“Sometimes we overfocus on 2022. It’s only a milestone to something greater,” CEO Borje Ekholm said.

Ericsson also introduced a new target of long-term free-cash-flow (FCF) of 9% to 12% of sales.

“The new long-term adjusted EBITA and FCF (free cash flow) targets are positive and probably above most analysts’ long-term estimates. Having said that they are seen as distant and thereby vague,” Handelsbanken analyst Daniel Djurberg told Reuters.

Ericsson share price fell 6.6% to post the worst day in 8 months. Last month, shares of Ericsson printed an all-time high at 119.00.

PEOPLE WHO READ THIS ALSO VIEWED:

- BRITISH AIRWAYS: HERE’S WHY IAG SHARE PRICE SOARED TODAY

- Learn more on how to open a demo account

- Learn what is a Pip in trading