Airline stocks offer a way to capture exposure to the mood of the wider stock market. Investors who buy into the sector just before an upturn in global economic activity can make staggering market-beating returns. This is because companies such as British Airways are heavily exposed to fluctuations in demand from corporate clients and the public.

YOUR CAPITAL IS AT RISK

Fuel prices are notoriously volatile, and the COVID-19 pandemic highlighted how much of a rollercoaster ride buying British Airways shares can be. The trick is finding the right time to buy BA shares, and with so much bad news already priced in, that time could be now.

Table of contents

Overview of British Airways

The traditional model for the airline industry has been shaken up in recent years. One notable trend is that of national carriers forming alliances to ensure that they can offer a truly global service. British Airways is part of that trend and forms a key part of oneworld.

British Airways aircraft and staff are part of a larger company, International Consolidated Airlines Group S.A. (IAG), which also includes carriers such as Iberia and Aer Lingus. Between them, the airlines in the group make up one of the world’s largest airline groups. IAG has over 500 aircraft and flies tens to hundreds of millions of passengers to more than 200 destinations each year.

IAG Shares: The Basics

As a result of the international nature of IAG, the firm is incorporated in Spain but listed on two different stock exchanges: the LSE in the UK (LSE: IAG) and the Madrid Stock Exchange (BME: IAG). The shares were first listed when the firm was founded in 2011 when BA and Iberia merged.

The dual-listing makes the stock easier to buy for those investors located in either London or Madrid and means that the firm is a constituent member of the flagship equity indices of both countries, the FTSE 100 and Spanish IBEX 35 index.

The price of shares on the two different exchanges trades in line with each other. The shares are different from each other but represent a claim of ownership on the same underlying asset, IAG.

An additional layer of complexity is added by one listing being in pounds sterling and the other in euros. This makes it easier for investors who hold their wealth in both base currencies to buy the stock, but it means that comparing the two listed stocks involves factoring in foreign exchange rates.

Due to the headwinds facing the firm following the pandemic, IAG hasn’t paid a dividend, although there have been some whispers it could return in the next year or so. However, for now, IAG is focused on reducing its debt pile.

YOUR CAPITAL IS AT RISK

Steps to Buy IAG Shares

It is, of course, possible to use online brokers to short-sell IAG in CFD format. This would mean that you would make a profit if the share price falls and lose money if it goes up. Whether you think that the IAG share price will go up or down, entering into trades is as easy as clicking a button.

Research IAG Shares

No one can be certain about what direction the IAG share price will go, but you can tilt the scales in your favour by being as fully prepared as possible. Good brokers have extensive libraries of video and written materials, which can help you get the best out of your trading.

Some brokers, such as FXTM, also include a service where in-house or third-party software (such as Trading Signals) identifies trading opportunities in the market and shares them with clients.

For those looking to apply fundamental analysis techniques, the IAG financial statements can be accessed online. These offer a chance to dig into the granular details of the firm’s operations and its potential for growth.

Find a Broker

There are a lot of good brokers in the market. Finding one that suits your preference is made easier by the availability of demo accounts, which allow you to test the service by trading virtual funds.

One key point to remember is the need to use a broker regulated by a Tier-1 regulator, such as the Financial Conduct Authority (FCA).

Open and Fund an Account

Once you’ve chosen a broker, there is some online form filling to complete. This is to ensure that the broker complies with ‘client protection’ rules. Working through the contact info can take a few minutes, but it is designed with your interests in mind.

The process of funding your account also takes next to no time to complete. Brokers offer a variety of payment methods. The fastest involve bank transfers or debit/credit card transfers and take no longer than making a payment to complete some online shopping.

Once the funds are confirmed, you are ready to start trading.

Set Order Types

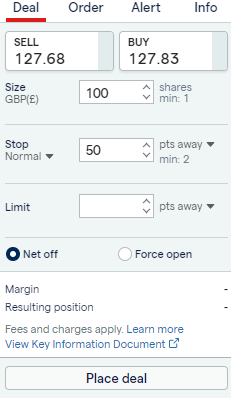

The process of booking a trade is quite simple. The trading platform will offer markets in all sorts of assets, and once you select the one for IAG shares, you’re likely to see a monitor like the one below.

With this broker, IAG, it’s just a case of entering the amount you want to trade; then the direction of the trade, ‘buy’ or ‘sell’; then, if you want to, adjust the order to include a ‘stop-loss’ and/or ‘take profit’ limit on your instruction. These help you manage the risks associated with price moving against you or in a particularly volatile manner.

Select and Buy IAG Shares

As this trade is not using leverage, clicking ‘Place Deal’ will see IAG shares credited to your portfolio. There will be a corresponding deduction from your cash balance. The value of your IAG holding will fluctuate in line with the live market price.

Once you decide to close out the trade, this process will simply be reversed by clicking on the position and clicking ‘Close Position’. At that point, the profit/loss on the trade will be calculated according to how the price has moved in the intervening period.

BEST BROKERS TO BUY IAG SHARES

If you’re ready to buy IAG shares, you’ll need to use a broker that is FCA-regulated, has low trading commissions, and a reliable trading platform. Finding one can be an arduous and daunting task, which is why we’ve hand-picked favourites that tick all of these boxes to help you get started.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, CFDs, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts.

- eToro Top stock trading platform with 0% commission – Read our Review

- Tickmill Regulated by the FCA – Read our Review

- Admirals (Admiral Markets) More than 4500 stocks & ETFs available – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY

Choosing a broker is a personal choice, but if you would like to consider the thoughts of some reviews by expert traders, then that can be done here.

FEES WHEN BUYING IAG STOCK

The entry and exit price level will be your major concern, but other fees also need to be factored in.

The longer the anticipated holding period, the more likely you’re going to find it more cost-effective to hold the position as shares. Shorter-term strategies would more likely benefit from being carried out using CFDs.

A rough estimate is that if you’re holding an equity for more than four to six weeks, the numbers start to favour a buy-and-hold-style share transaction. A report to help you make that decision can be found here.

Your account’s base currency may not be in GBP. If that’s the case, then a purchase of UK-listed IAG, which is priced in GBP, would need to be converted into the base currency. This introduces another frictional cost that you may be able to avoid by doing some research on which broker to use.

YOUR CAPITAL IS AT RISK

Final Thoughts

There are very plausible reasons to buy IAG shares now. The firm’s prospects are largely tied to the chance of a ‘full’ economic recovery, but even without one, IAG looks to be strengthening its position in the sector.

Investors who have already started buying IAG stock at the current low levels have seen the price continue to rise and fall rather than take off, but IAG is one of the airline firms that is best positioned to benefit from an economic upturn.

Despite the challenges of recent years, the management team has demonstrated the ability to make the right calls at the right time. That bodes well for the future and makes IAG shares a top pick for dividend and long-term investors.

Choosing a well-regarded and trusted broker that offers appropriate support is also important. These trading platforms have been reviewed by AskTraders to ensure that they offer the T&Cs and services to help your investing get off to the best possible start.